Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 7 September 2020 00:32 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

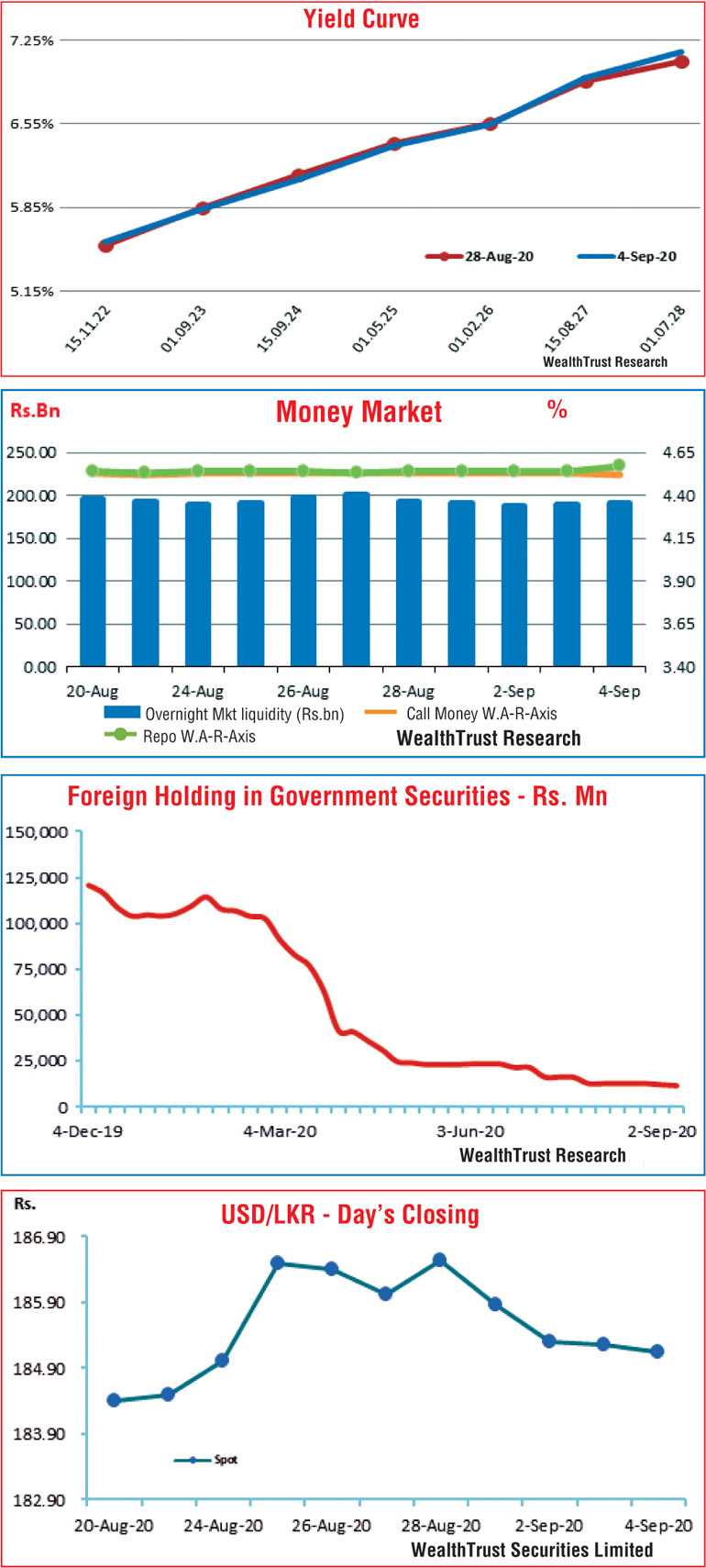

The secondary market bond yields commenced the week ending 4 September 2020 from where it left of the previous week, declining on the back of continued buying interest as sentiment remained bullish. However, selling interest towards the latter part of the week saw yields edge up once again, reversing all of its gain.

The liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 15.01.23, 2024’s (i.e. 15.06.24 and 15.09.24), 01.02.26 and 15.08.27 hit weekly lows of 5.45% each, 5.47%, 6.00% each, 6.44% and 6.77% respectively against its previous weeks closing levels of 5.50/55, 5.54/57, 5.57/62, 6.08/15, 6.10/14, 6.52/57 and 6.90/92. On the upward momentum, yields on the said maturities increased once again to levels of 5.53%, 5.60%, 5.63%, 6.12%, 6.10%, 6.53% and 6.97% respectively to close the week mostly broadly unchanged across the yield curve against its previous week. In addition, maturities of 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21 and 15.12.21) and 2025’s (i.e. 15.03.25 and 01.05.25) also changed hands at levels of 4.60% to 4.75% and 6.35% to 6.38% respectively.

The weekly Treasury bill auction produced a steady outcome once again as the total offered amount of Rs. 40 billion was all but fully subscribed for a third consecutive week.

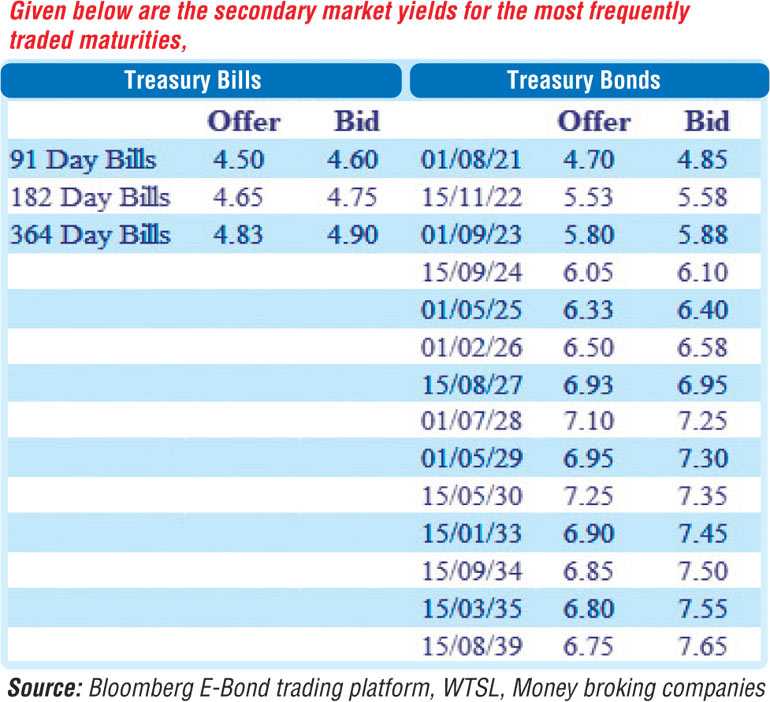

The foreign holding in rupee bonds recorded a decrease of Rs. 0.47 billion for the week ending 2 September 2020 and the daily secondary market Treasury bond/bill transacted volumes for the traded three days of the week averaged Rs. 16.11 billion.

Money market liquidity remains high

In the money market, the weighted average rate of overnight call money and repo’s remained mostly unchanged to average at 4.53% and 4.55% respectively for the week as the overnight surplus liquidity in the system averaged Rs. 189.77 billion for the week.

Rupee appreciates

In the Forex market, the Rupee on spot contacts was seen appreciating to hit intraweek high of Rs. 185.05 against its previous weeks closing level of Rs. 186.45/65 on the back of selling interest by Banks. It closed the week at Rs. 185.10/20.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 83.27 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)