Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 27 January 2020 00:27 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

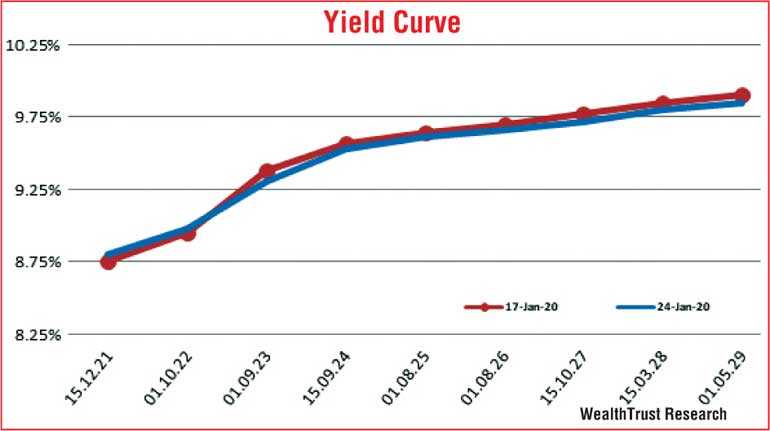

The yields in the secondary bond market varied within a narrow range for a second consecutive week as the market remained at an equilibrium.

The most sought maturities of 01.09.23 and two 2024s (i.e. 15.06.24 and 15.09.24) saw its yields fluctuating within highs of 9.35%, 9.56% each respectively to lows of 9.30% and 9.50% each.

In addition, maturities of 15.07.23, 15.12.23, 01.01.24, 15.03.25 and two 2027s (i.e. 15.06.27 and 15.10.27) changed hands at levels of 9.21%, 9.35%, 9.40% to 9.45%, 9.55% to 9.57% and 9.70% to 9.77% respectively.

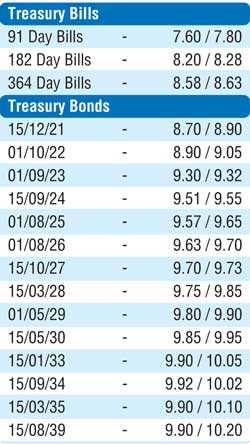

However, weighted average yields at the weekly Treasury bill auction reflected an upward trend for a third consecutive week with 91day, 182 day and 364 day maturities increasing by 05, 02 and 03 basis points respectively against their respective previous weighted averages.

This intern saw secondary bill maturities of March 2020, October 2020 and January 2021 trading at levels of 7.35% to 7.55%, 8.43% to 8.55% and 8.55% to 8.62% respectively while shorter bond maturities of 01.05.20 and 2021s (i.e. 01.03.21, 01.05.21, 01.08.21 and 15.12.21) changed hands at levels of 7.65% to 7.80% and 8.65% to 8.85% respectively.

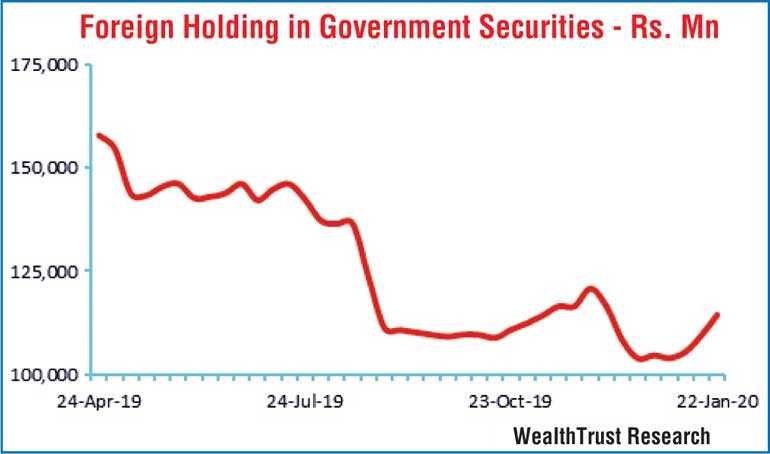

Foreign buying in rupee bonds continued for a third consecutive week to the tune of Rs.4.95 billion for the week ending 22 January 2020.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 11.54 billion.

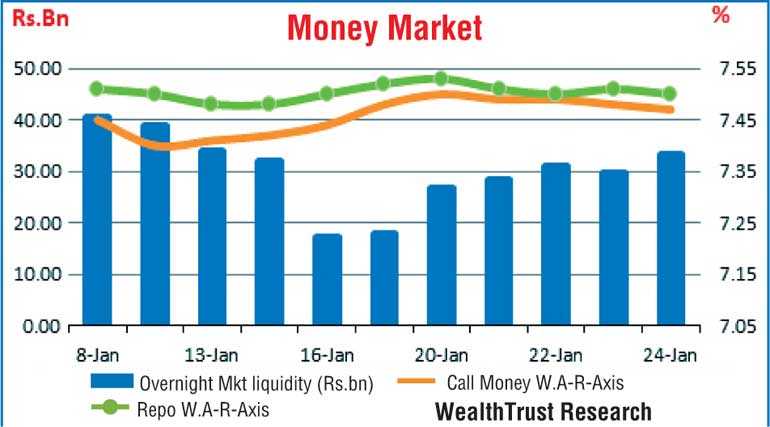

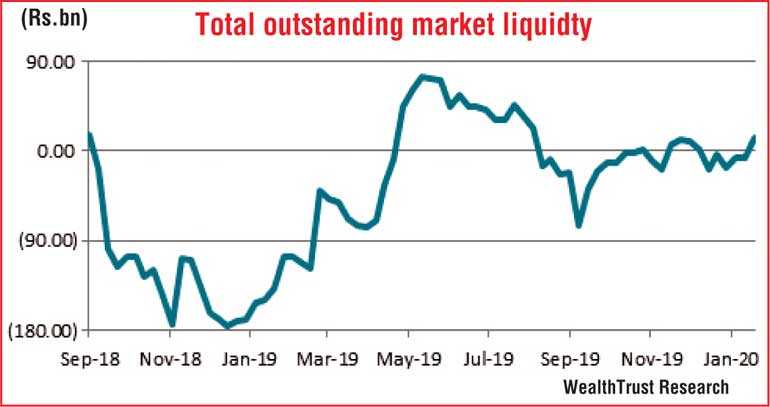

In money markets, the overall liquidity in the system improved considerably to record a surplus of Rs. 13.33 billion against its previous week’s deficit of Rs. 7.23 billion.

The Domestic Operations Department (DOD) of Central Bank injected liquidity during the early part of the week on an overnight basis and term basis (14 days) at weighted average yields ranging from 7.52% to 7.54% while it drained out liquidity during the latter part of the week on an overnight basis at weighted average rate of 7.46%.

The overnight call money and repo rates averaged 7.49% and 7.51% respectively for the week.

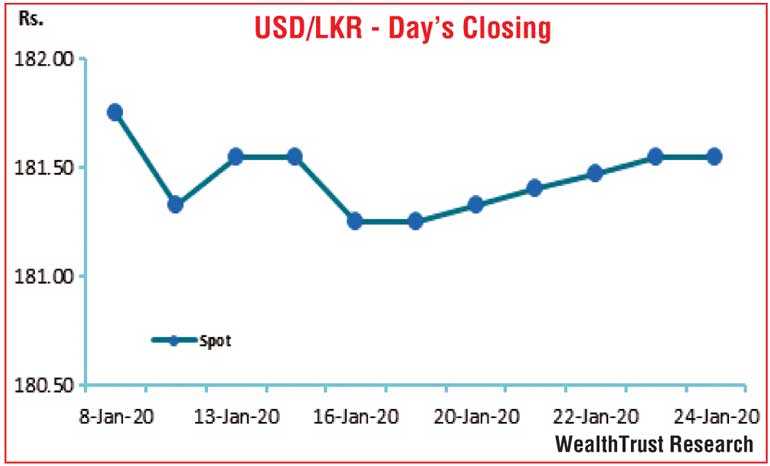

Rupee dips during the week

The rupee on its spot contracts were seen depreciating during the week to close the week at Rs. 181.50/60 against its previous weeks closing of Rs. 181.20/30 subsequent to trading within a high of Rs. 181.30 and a low of Rs. 181.55 during the week. The daily USD/LKR average traded volume for the first four days of the week stood at $ 95.81 million.

Some of the forward dollar rates that prevailed in the market were one month – 182.00/15; three months – 183.95/15 and six months – 184.45/65.