Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 9 October 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

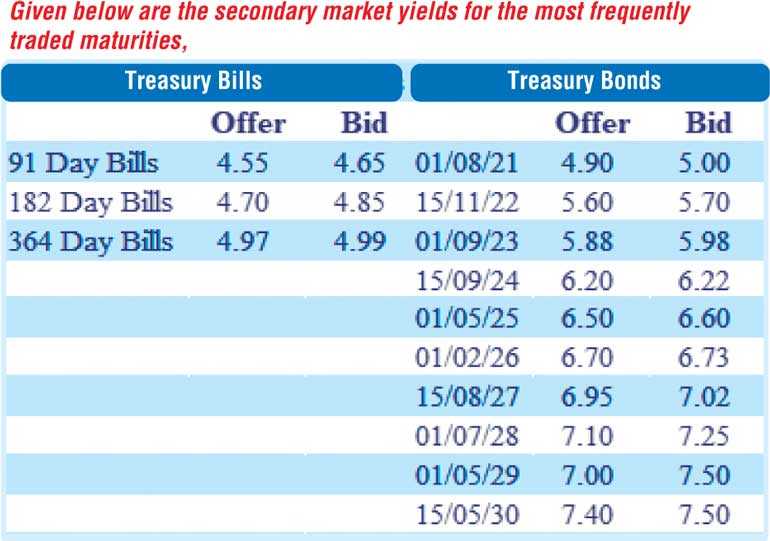

The secondary market bonds were seen trading within in a narrow range yesterday as the liquid maturities of 01.09.23, 2024s (i.e. 15.06.24 and 15.09.24), 01.05.25, 01.02.26, 15.10.27 and 15.05.30 changed hands at levels of 5.96% to 5.99%, 6.22% each, 6.50% to 6.56%, 6.72% to 6.73%, 7.01% to 7.04% and 7.39% to 7.45% respectively.

In secondary bills, 9 April and 23 July 2021 maturities traded at levels of 4.64% and 4.83% respectively.

The total secondary market Treasury bond/bill transacted volumes for 7 October was Rs. 17.75 billion.

In the money market, the overnight call money and Repos registered weighted averages of 4.53% and 4.59% respectively as the DOD (Domestic Operations Department) of Central Bank injected an amount of Rs. 5 billion by way of a seven-day reverse repo auction at a weighted average rate of 4.53%, subsequent to offering Rs. 15 billion. The overnight net liquidity surplus increased to Rs. 166.51 billion yesterday.

LKR appreciates for third consecutive day

In the Forex market, USD/LKR rate on spot contracts was seen appreciating further for a third consecutive day to close the day at Rs. 184.18/22 against its previous day’s closing level of Rs. 184.30/45, subsequent to changing hands within the range of Rs. 184.15 to Rs. 184.25.

The total USD/LKR traded volume for 7 October was $ 91.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)