Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 14 May 2024 00:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

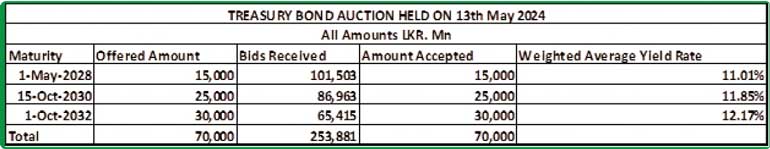

Yesterday’s bond auction recorded a bullish outcome with yields declining sharply and the entire offered amount of Rs. 70 billion being snapped up at the 1st phase. As such a 2nd phase was not conducted. Where the total bids received exceeded the offered amount by a staggering 3.63 times. The short tenor 01.05.28 saw strong demand driving rates down to a weighted average of 11.01%, well below the pre-auction opening two-way quote of 11.15/11.25. Similarly, the 15.10.30 maturity, a new issuance, also saw yields fall to 11.85%. For context, the comparable 2030 tenor of 15.05.30 was issued at a weighted average yield of 12.38% at the immediately previous auction held on the 29th of April and a pre-auction rate of 11.85%/11.95%. The 01.10.32 maturity also experienced a decline in the weighted average yield, issued at the rate of 12.17. This is as against a rate of 12.47%, at the immediately previous auction where the same maturity was last issued. This was also below a pre-auction rate 12.10%/12.20%.

An issuance window for all three maturities is open until close of business of day prior to the settlement date (i.e., 4.00 pm on 14.05.2024) at the Weighted Average Yield Rates (WAYRs) determined for the said ISINs at the auction, up to 10% of the respective amounts offered.

The start of a new trading week saw the positive momentum in the secondary bond market continue as yields dipped considerably. With notable activity and aggressive buying interest that drove yields down drastically.

The popular liquid 15.12.26 maturity experienced a steep decline in yields, falling to an intraday low of 10.15% from an intraday high of 10.45%. Similarly, the other 2026 tenors (i.e. 15.05.26 and 01.08.26) were seen dropping from intraday high of 10.25% to a low of 10.10%. Meanwhile the 2028 tenors (i.e. 15.03.28, 01.05.28, 01.07.28 and 15.12.28) also saw yields plunge to intraday low of 10.90% from an intraday high of 11.25%, on the back of particularly strong demand and robust volumes. Trades were also observed on the medium tenor 15.05.30 maturity, hitting an intraday low of 11.60% from an intraday high of 11.90%, with substantial volumes transacted.

This was augmented by the bullish outcome at the Treasury Bond auction and optimism shared in a Bloomberg Intelligence research report. Which expressed optimism that Sri Lanka will beat the IMF’s 2032 debt-to-GDP ratio of 95% with a figure estimated to be 89%. This is outlined in the report as achievable due to the progress in fiscal reforms, that are working to reduce budget deficits and external and domestic debt

restructuring.

The total secondary market Treasury bond/bill transacted volume for 10 May was Rs. 15.32 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.64% and 8.82% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of a 7-day term reverse repo auction for Rs 18.75 billion respectively at the weighted average rates of 8.72%.

The net liquidity surplus stood at Rs. 165.30 billion yesterday as an amount of Rs. 0.04 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 184.09 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

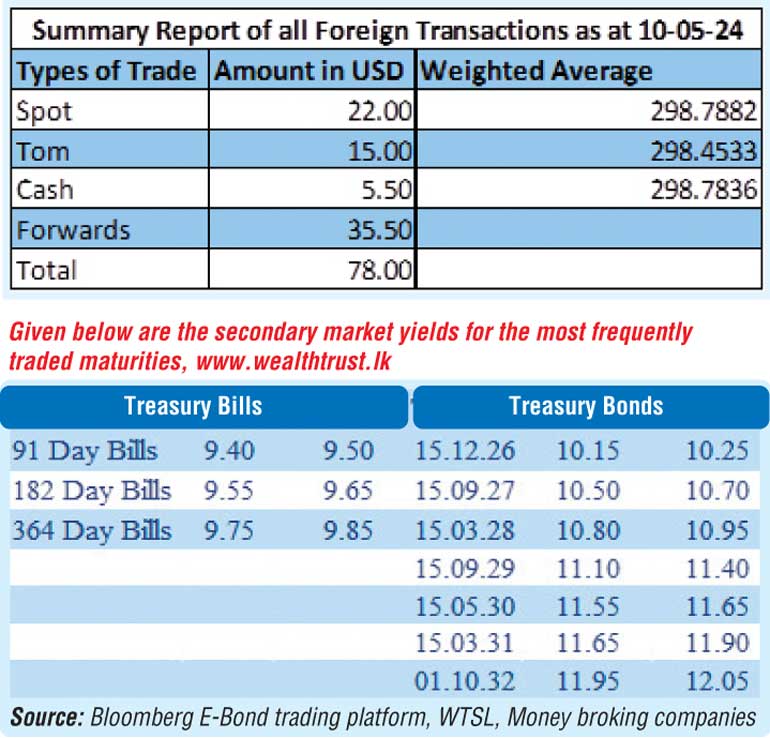

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 300.20/301.00 as against its previous day’s closing level of Rs. 299.00/299.30.

The total USD/LKR traded volume for 10 May was $ 78.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)