Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 31 January 2024 02:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd.

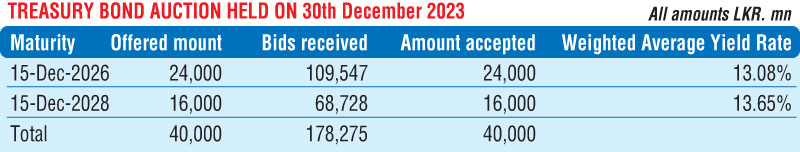

The Treasury bond auctions conducted yesterday recorded a bullish outcome at its first and second phases, with the entire offered amount of Rs. 40 billion on the 2026 and 2028 durations being fully taken up, echoing the declining trend in yields.

The Treasury bond auctions conducted yesterday recorded a bullish outcome at its first and second phases, with the entire offered amount of Rs. 40 billion on the 2026 and 2028 durations being fully taken up, echoing the declining trend in yields.

The total bids received exceeded the total offered amount by a staggering 4.46 times. The 15.12.2026 maturity recorded a weighted average rate of 13.08%, while the 15.03.2028 recorded a weighted average rate of 13.65%. For reference, at the last Treasury bond auction conducted on the 11 January, a 2026 duration was issued at a weighted average of 13.83%, while a 2028 duration was issued at 14.21%.

An issuance window of 20% each of its offered amount for both maturities is open until close of business of the day prior to settlement date (i.e., 4.00 pm on 31.01.2024) at its respective Weighted Average Yield Rates (WAYRs).

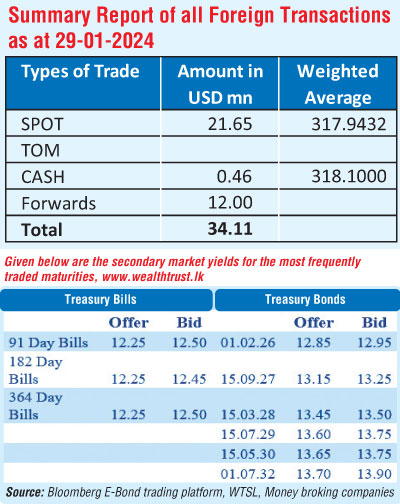

The secondary bond market witnessed two-way quotes edging down with sustained and aggressive buying interest seen throughout the day. Trading continued to be predominantly on the 2026 and 2028 durations. The 2026 durations (01.02.26, 15.05.26, 01.08.26 and 15.12.26) traded down from intraday day highs of 13.25% down to 12.90%, on the back of large volumes. Similarly, the 2028 durations (15.01.28, 15.03.28, 01.07.28 and 15.12.28) were seen trading within the ranges of 13.70% to 13.50%, also with sizeable volumes been transacted. Another, notable development was the drop in yields of the medium tenor 15.05.30 maturity, which dipped from a high of 13.85% to 13.60%. Trades were also observed on the maturities of the three 27s (15.01.27, 01.05.27 and 15.09.27) within the range of 13.50% to 13%.

In secondary market bills, April and June maturities were seen changing hands within the ranges of 12.25% and 12.60% to 12.45% respectively.

The weekly Treasury bill auction due today, will have in total an amount of Rs. 160 billion on offer, which will consist of Rs. 40 billion on the 91-day maturity, Rs. 70 billion on the 182-day maturity and a further Rs. 50 billion on the 364-day maturity. This reflects an increase of Rs. 30 billion on the offered amount on a week-on-week basis.

For context, at last week’s Treasury bill auction, the weighted averages yields dropped across the board. The 91-day maturity reduced by a drastic 56 basis points to 13.35%, which saw its yield drop below the 182-day maturity level for the first time in over a year, while the 182-day maturity dropped by 42 basis points to 13.41%. The 364-day bill also reduced by 14 basis point to 12.78%.

The total secondary market Treasury bond/bill transacted volume for 29 January was Rs. 9.91 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.13% and 9.88% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 35.37 billion and Rs. 34 billion at weighted average rates of 9.16%.

The net liquidity deficit stood at Rs. 37.54 billion yesterday as an amount of Rs. 7.42 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10% against an amount of Rs. 5.25 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 9%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 316.90/317.05 against its previous day’s closing level of Rs. 317.75/317.90.

The total USD/LKR traded volume for 29 January was $ 34.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)