Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 28 April 2022 00:00 - - {{hitsCtrl.values.hits}}

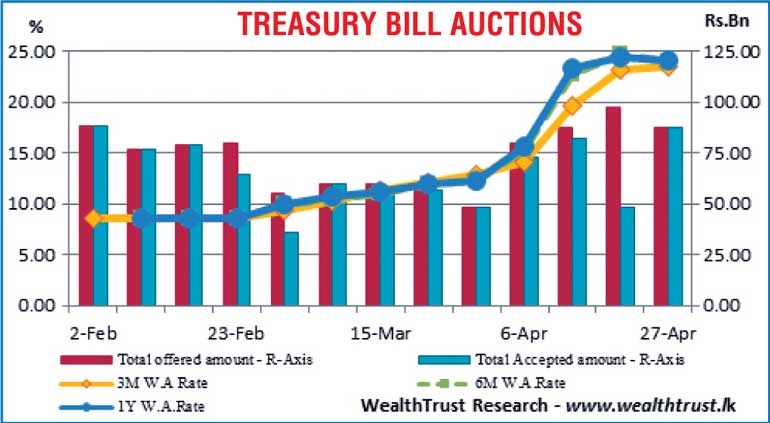

The weighted average rates on the 6 months and 1-year Treasury bills were seen decreasing for the first time in nine weeks at its auctions held yesterday while the auction was fully subscribed for the first time in four weeks as well.

time in four weeks as well.

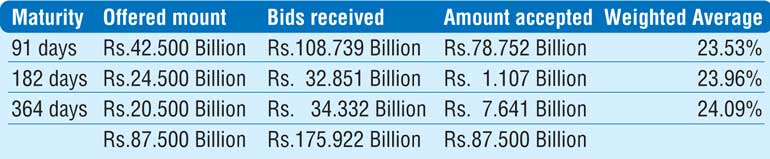

The decrease recorded was 81 and 27 basis points on the 6 months and 1-year maturities respectively to 23.96% and 24.09%. Nevertheless, the weighted average rate on the market favourite 3 month bill increased for a 10th consecutive week, recording a uptick of 32 basis points to 23.53% while it continued to dominate the auction by representing 90.00% of the total accepted volume. The bids to offer ratio was registered at 2.01:1.

This was ahead of the primary Treasury bond auctions due today, the first following the steep monetary policy adjustment of 700 basis points. A total volume of Rs. 35 billion is on offer, consisting of two new maturities of 01.06.2025 and 01.05.2027 for amounts of Rs. 20 billion and Rs. 15 billion respectively.

At the two Treasury bond auctions conducted on 18 April, an amount of Rs. 13.12 billion was taken only on the maturity of 15.12.2027 at a weighted average of 20.21% while all bids on the 15.03.2025 maturity was rejected. The total offered amount in this instance was Rs. 45 billion.

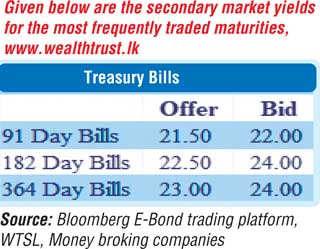

Meanwhile, the secondary bond market was at a standstill yesterday with only the very short end maturity of 15.03.23 changing hands at levels of 25.02% to 25.15%. In the secondary bill market, the latest 91 day bill maturity was traded at a low of 22.00%, post auction.

The total secondary market Treasury bond/bill transacted volume for 26 April 2022 was Rs. 1.8 billion.

In money markets, the net liquidity deficit stood at Rs. 688.29 billion yesterday as an amount of Rs. 162.31 billion was deposited at Central Banks Standard Deposit Facility Rate (SDFR) of 13.50% against an amount of Rs. 850.60 billion withdrawn from Central Banks Standard Lending Facility Rate (SLFR) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 60.00 billion by way of a 22 day Reverse Repo auction at a weighted average rate of 22.1%, valued today.

Forex market

In forex markets, limited trades on the USD/LKR cash contracts was seen traded at a level of Rs. 360.00 yesterday while overall activity remained muted.

The total USD/LKR traded volume for 26 April was $ 24.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)