Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 17 February 2021 00:00 - - {{hitsCtrl.values.hits}}

|

| CA Sri Lanka Tax Committee Former Chairperson Hiranthi Ratnayake |

|

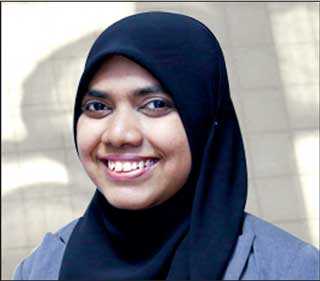

| BDO Partners Tax Services Partner Sarah Afker |

|

| CA Sri Lanka Faculty of Taxation Chairman Sulaiman Nishtar

|

In its standing as the change makers of the country’s professional landscape, the Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka) has been at the forefront in enhancing the knowledge and

competence of finance and non-finance professionals. In fulfilling this important objective, CA Sri Lanka recently organised a public seminar on tax which received a massive response.

The online public seminar titled ‘Awareness on Personal Tax Obligations’ attracted over 725 participants who joined the free seminar conducted early this month.

The seminar was organised amidst increasing concerns expressed by the public in relation to opening income tax files and file returns. The Government announced and implemented significant tax changes from 1 January where the Advance Personal Income Tax (APIT) was introduced in lieu of Pay-As-You-Earn tax (PAYE Tax).

In the past, tax payers who only had employment income were not required to file income tax returns, as PAYE tax was deducted from their income by the employer and remitted to the Inland Revenue Department. However, from January 2020, everyone who is in the tax liable range, are required to register with the Inland Revenue Department and comply with the respective tax obligations.

During the seminar, BDO Partners Partner – Tax Services Sarah Afker made a detailed presentation which covered important aspects in relation to the personal tax obligation components including sources of income, qualifying payments and reliefs, available exemptions, personal tax rates, concessionary rates and how to compute taxable income, and tax payable.

The seminar was further boosted with an expert panel discussion featuring CA Sri Lanka Tax Committee Former Chairperson Hiranthi Ratnayake, CA Sri Lanka Faculty of Taxation Alternate Chairman Denzil Rodrigo, Gajma & Co. Partner N.R. Gajendran, Consultants Consortium Principal Consultant V. Sivagurunathan, and Assent Advisory Partners Managing Partner/Director Athula Ranaweera. CA Sri Lanka Faculty of Taxation Chairman Sulaiman Nishtar moderated the session.

The Tax Faculty was established in 1995 to assist chartered accountants and non-accounting professionals to further their knowledge in taxation. The faculty conducts various courses and programs including seminars and workshops targeting professionals and practitioners to further their knowledge in the subject. The Tax Faculty also organises events hosted by eminent speakers to share knowledge on subjects related to local and international tax matters.