The Central Bank on Friday announced new measures to further strengthen the resilience of the banking sector, while casting it with added responsibility in supporting the stability of the economy and stimulating growth.

“The banking sector has been resilient, but will need to deal with a few issues,” noted Governor Nivard Cabraal, unveiling the CBSL’s Short Term Road Map spanning six months.

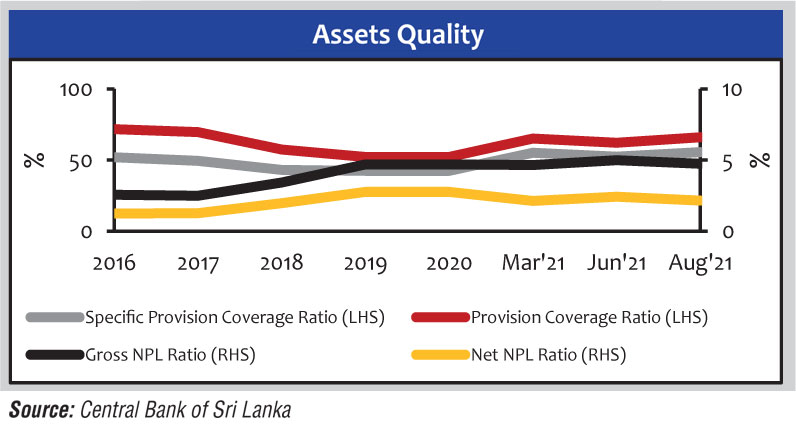

Some of the issues included pressures on foreign currency liquidity condition; prolonged moratoria to the COVID pandemic-affected borrowers and potential drawbacks to the sustainable recovery of the post-pandemic economy; increasing stock of credit to Government and State-owned Enterprises (SoEs) by licensed banks; and emerging threats to operational resilience, including IT and cyber security.

The Governor said that the CBSL expects greater transparency in domestic foreign exchange transactions from the banking sector. Banks are also required to obtain new funds and credit lines from abroad and ensure close cooperation with the Central Bank to ensure export proceeds conversion.

To address some of the issues, as well as ensure stability and growth, Cabraal came up with a ‘to-do list’ for all stakeholders, including the Government, the CBSL and the banks themselves.

To resolve debt and forex issues, CBSL’s ‘to-do list’ requires the entire banking sector, including Non-Bank Financial Institutions (NBFIs), to do the following:

- Mobilise fresh forex funding on competitive terms based on the strength of the bank’s/ financial institution’s own balance sheets. Target set is $ 1.5 billion.

- Closely monitor forex positions while prudently screening forex outflows.

- Facilitate inflows expected with the implementation of the Tax Amnesty through the Finance Act.

- Encourage forex investments in Sri Lanka Government Securities and Sri Lanka Development Bonds.

- Facilitate essential imports, wherever possible.

- Engage with counterparties to dampen undue speculation on the debt situation and enhance their knowledge on the Sri Lankan economy and the financial system.

- Support foreign investors to invest in non-bank sector institutions.

- Support the establishment of equity funds for SMEs.

The ‘to-do list’ in terms of addressing financial sector issues were:

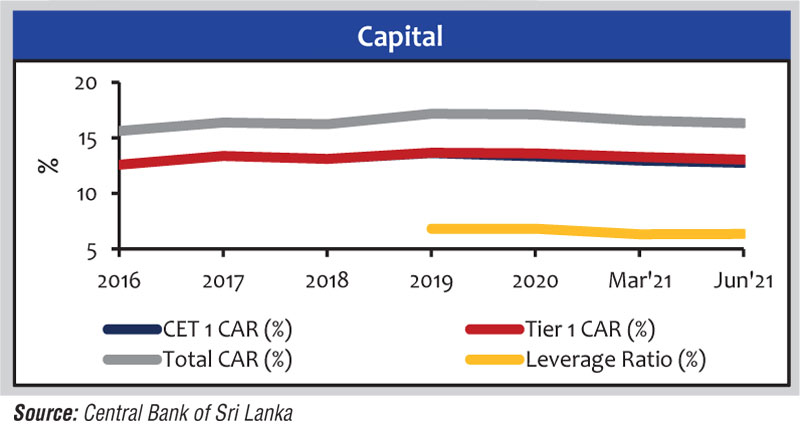

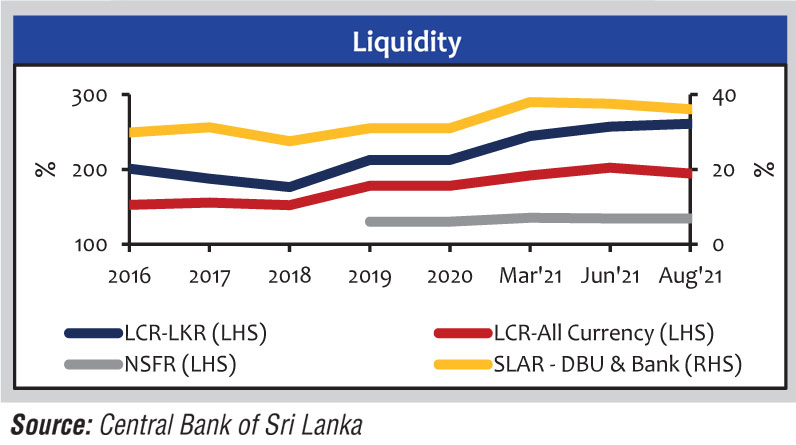

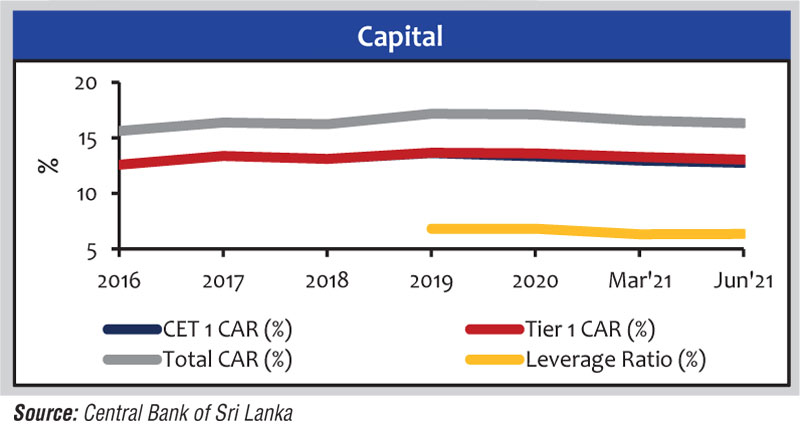

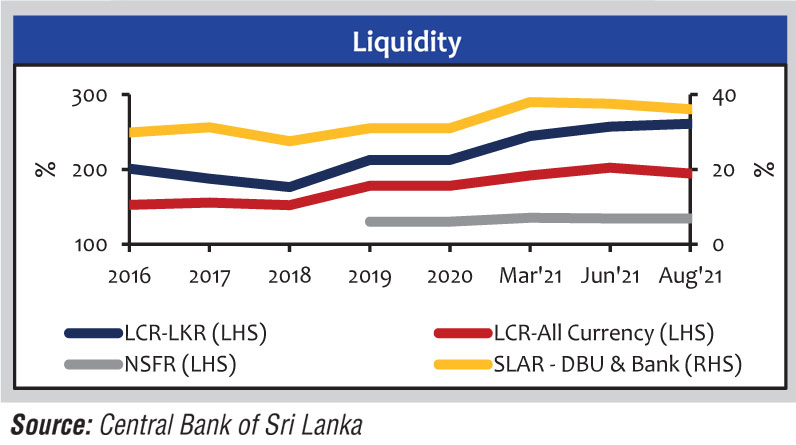

- Maintain adequate levels of capital and liquidity buffers.

- Transact forex transactions in a transparent manner.

- Improve operational risk resilience.

- Set up Revival Units to assist customers tide-over pandemic-related difficulties.

- Widen regional expansion and attract more offshore business.

- Explore new opportunities in the Colombo Port City.

- Consider financing models to support equity participation in businesses under moratorium or non-performing categories with a view to reviving such businesses.

Government responsibilities

The onus on the Government to ensure further strengthening resilience of the banking sector as per the ‘to-do list’ were:

- Support the efforts to strengthen the financial sector through the introduction of appropriate tax reforms to facilitate non-banking sector consolidation.

- Reduce dependence on State-owned banks to fulfil financial requirements.

- Encourage State-owned Enterprises (SoEs) to diversify their borrowing sources.

- Stop funding of certain losses in SOEs by State banks.

- Reduce dependence on State banks to finance petroleum bills.

CBSL responsibilities

The CBSL Short Term Road Map also enshrined responsibilities on itself and its ‘to-do list’ items were:

- Unwind moratoria gradually and devise long-term plans to support businesses affected by the pandemic-related lockdown.

- Provide liquidity support of up to Rs. 15 billion to finance interest accrued in loans that have been given the moratorium, so that FIs could deal with the moratorium effect in a sustainable manner.

- Put in place an Emergency Lending Facility Fram-ework.

- Immediately suspend Parate Execution and for-ced repossession of leased assets up to 31.03.2022 for pandemic-affected borrowers.

- Cancel all penalties imposed by FIs during the moratorium period.

- Implement consolidation plan for FIs to create FIs with better economies of scale.

- Implement a comprehensive plan to deal with the six failed finance companies and actively pursue the revival of those that could be revived with new investment.

- Ensure that all FIs develop ‘post-COVID’ Revival Units.

- Stop multi-exchange rates taking place in the market.

- Review governance and share ownership rules.

CBSL supervision in new normal

In terms of supervising banks in the ‘new normal’ the following are the initiatives:

- Establish ‘monitoring groups’ combining on-site and off-site surveillance teams.

- Implement a forward-looking approach to the potential long-term impact of the crisis on licensed banks’ balance sheets and business models, and on the market’s structures and practices.

- Prioritise supervisory activities considering Systemically Important Banks (SIBs) and nature of supervisory concerns.

- Shift to virtual platforms for meetings/discussions with senior officials of banks, enabling uninterrupted communication.

- Explore avenues for SupTech and Artificial Intelligence to improve data analysis and risk-based supervision, workflow management, and customer inquiry management.

- Consider macroeconomic challenges and spill over effects to the banking sector.

- Implement flexible measures in terms of Capital, Liquidity, Moratoria and Reporting, and facilitate the timely unwinding of such relaxations.

To strengthen and safeguard integrity of the financial system:

- Complete the National Risk Assessment (NRA) in order to identify ML/TF risk profile of the country and prepare the country’s AML/CFT framework for next five years (2022-2027).

- Update national AML/CFT strategy in accordance with the results of NRA and strengthen risk-based AML/CFT supervision.

- Increase awareness among relevant stakeholders in order to develop an investor friendly environment within the country.

- Improve the country’s overall AML/CFT compliance with relevant international standards.

For the improvement of the Payments and Settlements platform:

- Publish the National Digital Payments RoadMap 2022-2024 developed by the National Payments Council (NPC).

- Provide policy signals and operational targets for Sri Lanka’s Payments Industry with a view to increasing the adoption of digital payment methods.

- Aim at creating a ‘less-cash’ society.

- Increase digital financial inclusion and use digitalisation as a means to encourage the informal sector to join the formal economy.

- Regulate Money or Value Transfer Services (MVTS).

- Formulate regulatory and governance framework for ‘open’ banking.

- Initiate use of Artificial Intelligence in banking in Sri Lanka.

- Assess the possibility of the introduction of Central Bank Digital Currency in Sri Lanka.

- Initiate a shared KYC solution for eKYC from the Blockchain-based ‘Shared KYC Proof of Concept Project’.

- Continue working towards obtaining PayPal facility.