Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 4 March 2020 01:25 - - {{hitsCtrl.values.hits}}

- Unexpected 50 bps reduction in Jan. expected to keep rates unchanged

- More time needed to feel impact of previous cut

- Higher inflation, continued foreign outflows and possible rate cut by US Fed also incentives to maintain rates

First Capital Research yesterday said the Central Bank would not change its policy stance this week as it reduced rates by 50 basis points in January and together with the stimulus given  by the Government, as well as higher inflation, was likely to convince the Monetary Board to hold rates.

by the Government, as well as higher inflation, was likely to convince the Monetary Board to hold rates.

Contrary to First Capital Research expectations at the last policy meeting held in January 2020, the Central Bank reduced its policy rates by 50 bps to support the continued reduction in market lending rates, thereby facilitating the envisaged recovery in economic activity.

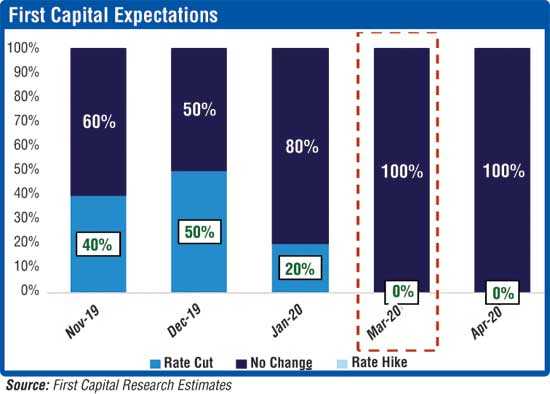

“Considering the recent major fiscal and monetary policy changes and expected pick-up in private credit, First Capital Research believes that the current monetary policy stance is appropriate, and credit growth is likely to accelerate towards 2H2020 with the current low level of market lending rates without requiring further adjustment in policy rates. Accordingly, we assign a 100% probability for no change in policy rates in the upcoming policy announcement,” the report said.

Private sector credit recorded an increase of Rs. 57.9 billion in December 2019, illustrating a positive credit growth for the fifth consecutive month in 2019, with year-to-date growth at 4.5%, closing in on the First Capital credit growth target for 2019.

Going forward, a steady revival of economic activity is envisaged, supported by potentially further improved political stability after the General Election on 25 April 2020 and the measures taken to stimulate the economy such as heavy tax cuts and lending caps. With the decline in lending rates, credit growth has shown signs of improvement. However, the acceleration is mostly likely to take place towards 2H2020, it added.

The market saw a sudden surge in liquidity levels over the last couple of weeks amounting to Rs. 48 billion by the end of February (after adjusting for term repo and reverse repo auctions conducted by the Central Bank) compared to an outflow of Rs. 8 billion at the beginning of the year, indicating an increase of nearly Rs. 56 billion. The higher liquidity position favours the banking system to accelerate disbursements, thus supporting credit growth in the economy. Improving Year-on-Year credit growth may reduce the strong liquidity position towards 2H2020.

Since the previous rate cut, continued net foreign outflows from the Government securities market were witnessed, resulting in an outflow of Rs. 16.7 billion since 30 January 2020. In recent developments, foreign holding in T-Bill and T-Bonds securities declined below Rs. 100 billion for the first time in 12 years (since 2008) due to continued foreign selling followed by the surprise rate cut in January 2020. With foreign outflows, the Sri Lankan rupee witnessed a depreciation during the month to close at Rs. 181.95, relative to the Rs. 181.34 held on 31 January 2020, although the depreciation in the currency was not higher due to lesser pressure on Balance of Payments due to relatively lower imports.

The 6.2% CCPI recorded in February 2020 is the highest since the 7.1% seen in December 2017 and was mainly led by the increase in food inflation owing to domestic supply side disruptions. In spite of such short-term fluctuations, First Capital Research believes inflation will hover and stabilise between 5% and 6% in 2020, assisted by recovery in supply side factors, thus requiring no changes in monetary policy measures.

In light of subdued global growth due to the outbreak of Covid-19 and considering its impact on the economy, the Federal Reserve indicated that the US was open to a rate cut to act as appropriate to support the economy while analysts predict that the Fed is likely to announce a 50 bps cut at its March 2020 meeting, with fears over a global slowdown intensifying. With another round of monetary easing on the cards, global funds are shifting towards the US adversely impacting emerging and frontier regional markets including Sri Lanka.

First Capital Research expects policy rates to be maintained as additional time is required to realise the impact of previous rate cuts.