Tuesday Mar 10, 2026

Tuesday Mar 10, 2026

Monday, 27 November 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

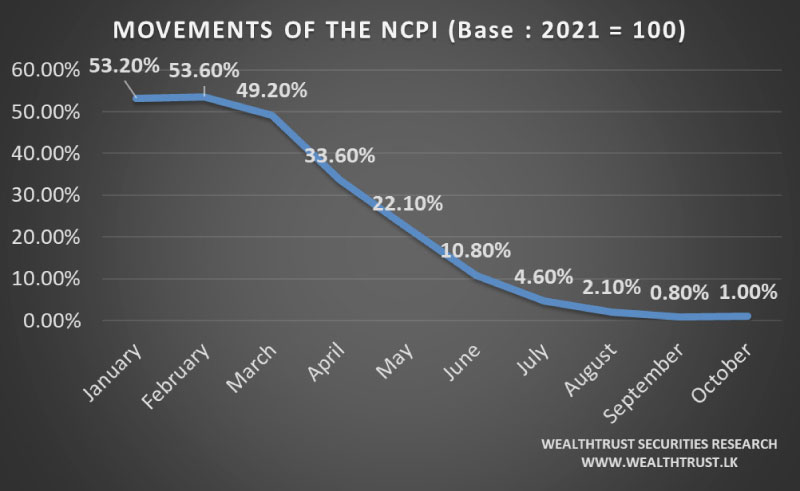

On the inflation front, the National Consumer Price Index (NCPI) (Base: 2021=100) or National inflation for the month of October was recorded at 1.00% on its point to point as against 0.80% recorded in September.

On the inflation front, the National Consumer Price Index (NCPI) (Base: 2021=100) or National inflation for the month of October was recorded at 1.00% on its point to point as against 0.80% recorded in September.

This is the first instance that inflation has accelerated marginally, after steadily and rapidly declining from the peak of 53.60% in February, since the index was rebased at the start of the year 2023.

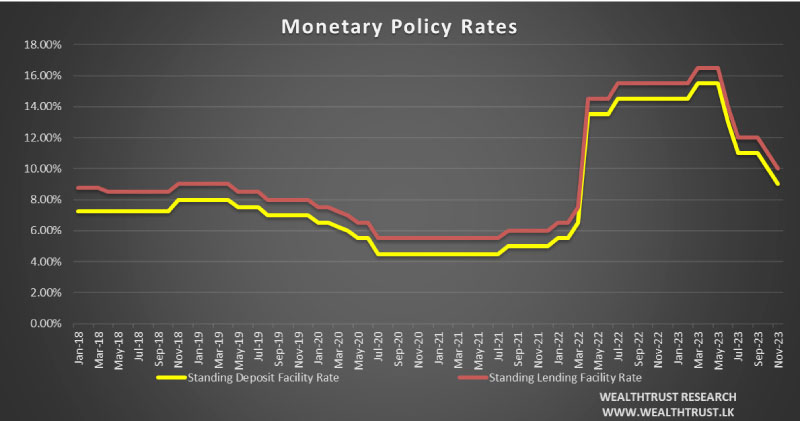

Last Friday 24 November saw, the Central Bank of Sri Lanka’s Monetary Policy Board lower the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 100 basis points each to 9.00% and 10.00%, respectively. The press release stated that the decision, along with monetary policy measures implemented since June 2023, is expected to provide adequate monetary easing to stabilise inflation over the medium term at the targeted level of 5%. Despite some near-term inflation risks from supply-side factors, the CBSL expects no major deviation to the medium-term outlook.

As with previous monetary policy measures, the importance of financial institutions swiftly implementing the rate reduction to normalise market interest rates was reiterated. This announcement was in line with a Bloomberg report that predicted a cut of 100 basis points citing a need to reduce real borrowing costs and support economic growth. The cumulative reduction in policy interest rates since the monetary policy easing began amounts to 650 basis points.

Meanwhile, last week’s Treasury bill auction once again drew a bullish response. The 91-day and 182-day bills continued to see considerable demand, with bids of Rs. 97.39 billion and Rs. 88.00 billion, exceeding the offered amounts of Rs. 55.00 billion and Rs. 60.00 billion. The 91-day bill average dropped by 10 basis points to 15.29%, while the 182-day average remained stable, and the 364-day bill declined by 2 basis points to 12.94%. Total bids were 1.50 times greater than the total offered amount. The entire offered amount of Rs. 145 billion was raised in the 1st phase of the auction.

The secondary bond market during the trading week ending 24 November was seen exhibiting some volatility but remained active all throughout, centring on the shorter end of the yield curve. Commencing the week on Monday with yields creeping up, but ultimately closing down. Tuesday in particular saw aggressive buying interest driving yields down. The trend continued through to Wednesday with yields dipping further. However, upon the announcement of the upcoming bond auctions, selling pressure caused yields to move up, with profit taking on Friday, post rate cut holding yields.

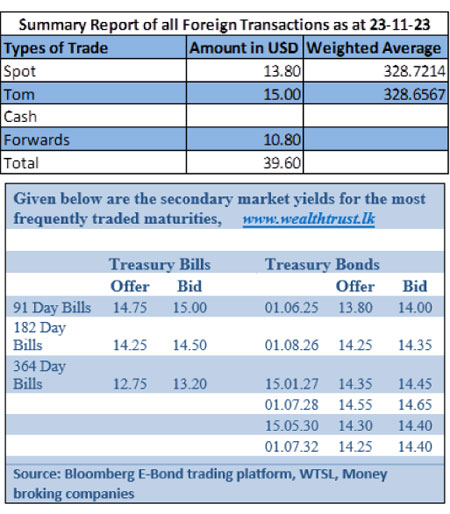

Accordingly, the maturities of 01.08.24, two 25s (01.06.25 and 01.07.25), three 26s (15.05.26,01.06.26 and 01.08.26), three 27s (15.01.27,01.05.27 and 15.09.27), two 28’s (01.05.28 and 01.07.28) and 15.05.30 were seen changing hands at levels of 14.25%, 14.50% to 14.00%, 14.90% to 14.35%, 14.93% to 14.40%, 14.93% to 14.50% and 14.60% to 14.40% respectively during the week.

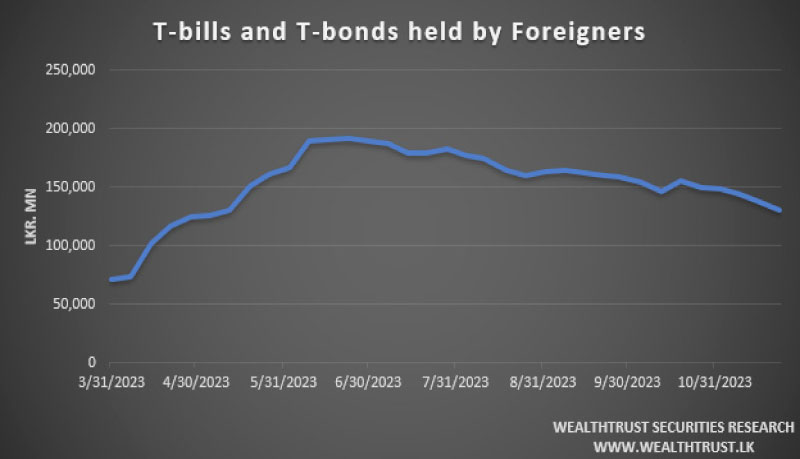

The foreign holding in Rupee bonds and bills continued to decline for a fifth consecutive week, with a net outflow of Rs. 6.93 billion, bringing the total holding to Rs. 130.60 billion as at 23 November.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 26.08 billion.

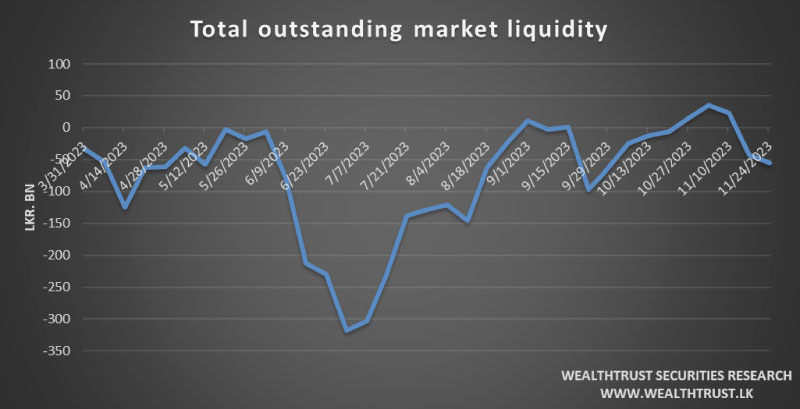

In money markets, the total outstanding liquidity recorded a deficit of Rs. 55.23 billion by the week ending 24 November from its previous week’s deficit of Rs. 43 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 30-day Reverse repo auctions at weighted average yields ranging from 9.44% to 11.59%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,779.35 billion, against its previous week’s level of Rs. 2,799.35 billion.

In the forex market, the USD/LKR rate on spot contracts was seen trading sideways, however dipping during the week to close at Rs. 328.70/328.80. This is as against its previous week’s closing level of Rs. 327.90/328.10. Subsequent to trading at a high of Rs. 327.90 and a low of Rs. 328.90.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 43.33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)