Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 3 June 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

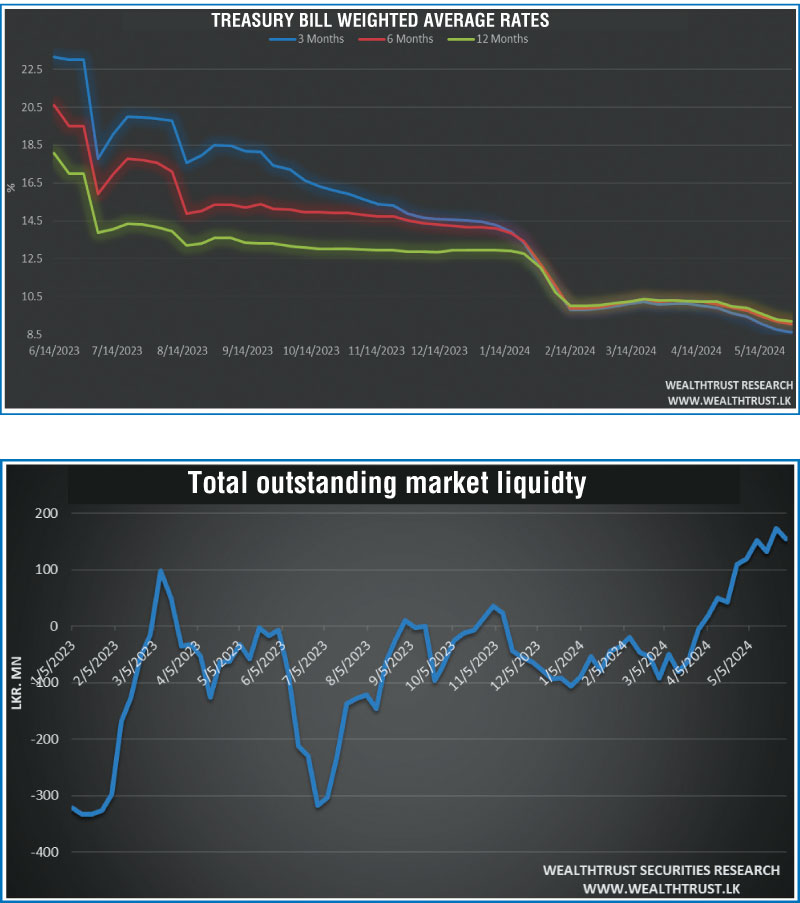

The Monetary Policy Board of the Central Bank of Sri Lanka decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at 8.50% and 9.50%, respectively at the 3rd Monetary Policy review for 2024 held last Tuesday (28 May). As such the CBSL was seen taking a pause on its monetary easing cycle, which has seen a cumulative reduction of 700 basis points since June 2023. As per the official press release, this decision was based on a comprehensive assessment of macroeconomic conditions and risks, aiming to keep inflation at the target level of 5% while supporting economic growth. Despite a slight increase in headline inflation in April 2024, it is expected to stabilise around the target level despite some transitory volatilities. The Board noted the need for further reductions in market lending rates to ease domestic monetary conditions and boost economic recovery. Noting that the cost of funds for financial institutions has continued to decline, providing additional space.

The weekly Treasury bill auction conducted last Wednesday (29 May), recorded a bullish outcome. The weighted average yields declined across all three maturities for an eighth consecutive week, reaching the lowest levels since 2 March 2022. Last week’s decline was also considerably steep, with the 91-day maturity falling by 14 basis points to 8.62%, the 182-day maturity by 13 basis points to 9.04% and the 364-day maturity by 11 basis points to 9.18%. The auction went fully subscribed with the entire offered amount of Rs. 160.00 billion accepted at the 1st phase.

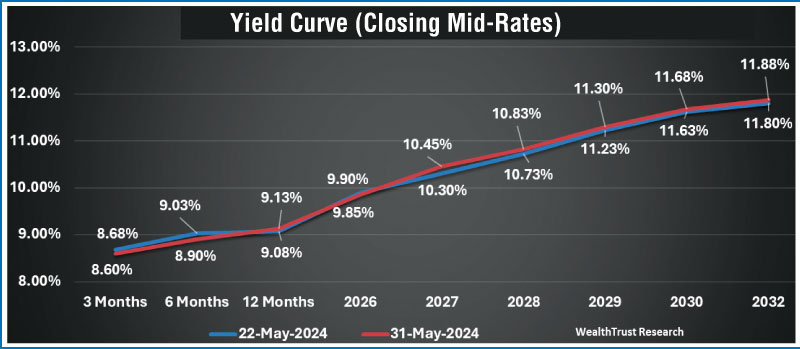

The secondary bond market commenced the trading week ending 31 May 2024 on a subdued note with market participants adopting a wait-and see approach ahead of the Monetary Policy announcement. Post-announcement, where all policy rates were held steady, yields were seen spiking upwards. However, the bullish outcome at last week’s Treasury Bill auction midweek, sparked renewed buying interest that pushed yields back down to recover lost gains. Overall transaction volumes were relatively low, while trading as usual concentrated on the short to medium end of the yield curve with a focus on 2026-2032 tenors.

Noteworthy interest was observed on 2026 tenors. Accordingly, the yield on the liquid 15.12.26 tenor was seen dropping to an intraweek low of 9.75% as against an intraweek high of 9.93%. The 01.06.26 and 01.08.26 maturities also experienced fluctuations, hitting intraweek highs of 9.85% and 9.95% respectively, as against intraweek lows of 9.65% and 9.70%. The 15.09.27 maturity saw yields edge up marginally from 10.35% to 10.45%. The popular 2028 tenors, including the 15.03.28 and 01.05.28 maturities, saw yields hitting intraweek lows of 10.70%% compared to intraweek highs of 10.90% each earlier in the week. The 01.07.28 and 15.12.28 maturities also experienced similar trends, with yields hitting intraweek lows of 10.75%, as against highs of 11.00%. Additionally, medium-term tenor 15.05.30 and 15.10.30 maturities were observed trading within ranges of 11.70% to 11.50%, while the 01.10.32 maturity fluctuated between 11.95% and 11.80%.

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of May 2024 was recorded decelerating to 0.90% on a year-on-year basis as against 1.50% recorded in April 2024. This was below both a Bloomberg forecast of 1.30% and a consensus estimate of 2.20% of analysts polled by Bloomberg. The year-on-year deceleration was partly attributable due to a lack of significant base effects, while month-on-month deflation was influenced by a downward adjustment in food prices, LP gas prices, and the reduction in fuel prices.

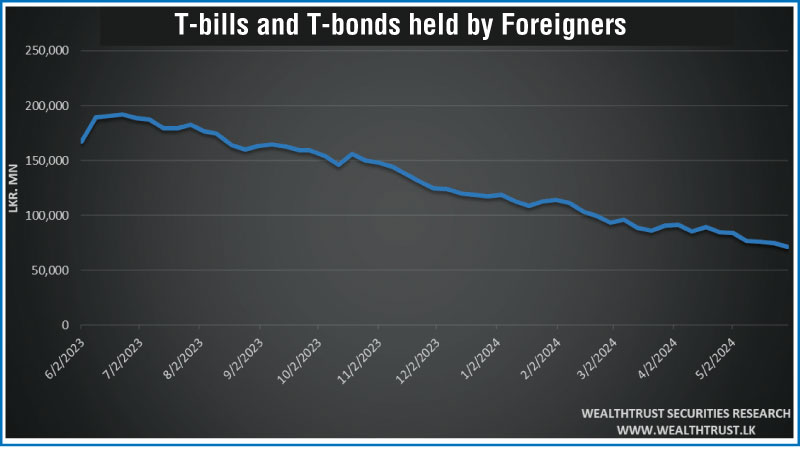

Meanwhile, the foreign holding in rupee Treasuries decreased for a sixth consecutive week, by Rs. 3.03 billion for the week ending 30 May 2024. Accordingly, the overall holding stood at Rs. 71.48 billion. The holdings have dropped a cumulative Rs. 17.79 billion over the past six weeks.

In money markets, the total outstanding liquidity surplus reduced to Rs. 155.63 billion by the week ending 31 May from its previous week’s surplus of Rs. 174.38 billion. The Domestic Operations Department (DOD) of Central Bank abstained from injecting liquidity during the week by way of overnight reverse repo auctions, however it conducted one instance of 7-day term reverse repo at the rate of 8.90%. The weighted average interest rate on call market and repo ranged between 8.65% to 8.66% and 8.72% to 8.82% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,635.62 billion as at 31 May 2024, unchanged from its previous week’s level.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 33.18 billion.

Forex Market

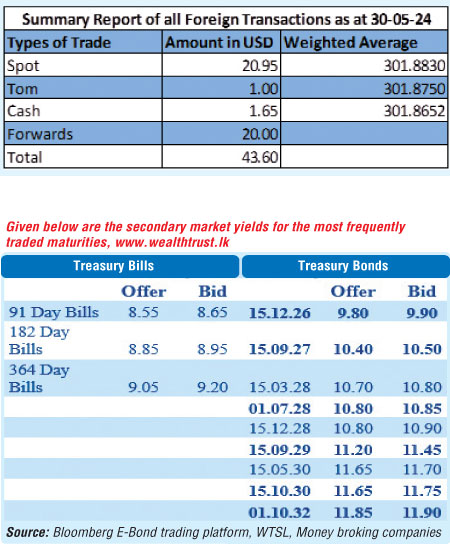

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 301.90/302.00. This is as against its previous week’s closing level of Rs. 300.10/300.30 and subsequent to trading at a high of Rs. 300.30 and a low of Rs. 302.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 37.96 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond

trading platform, Money broking companies)