Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 7 March 2023 00:35 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

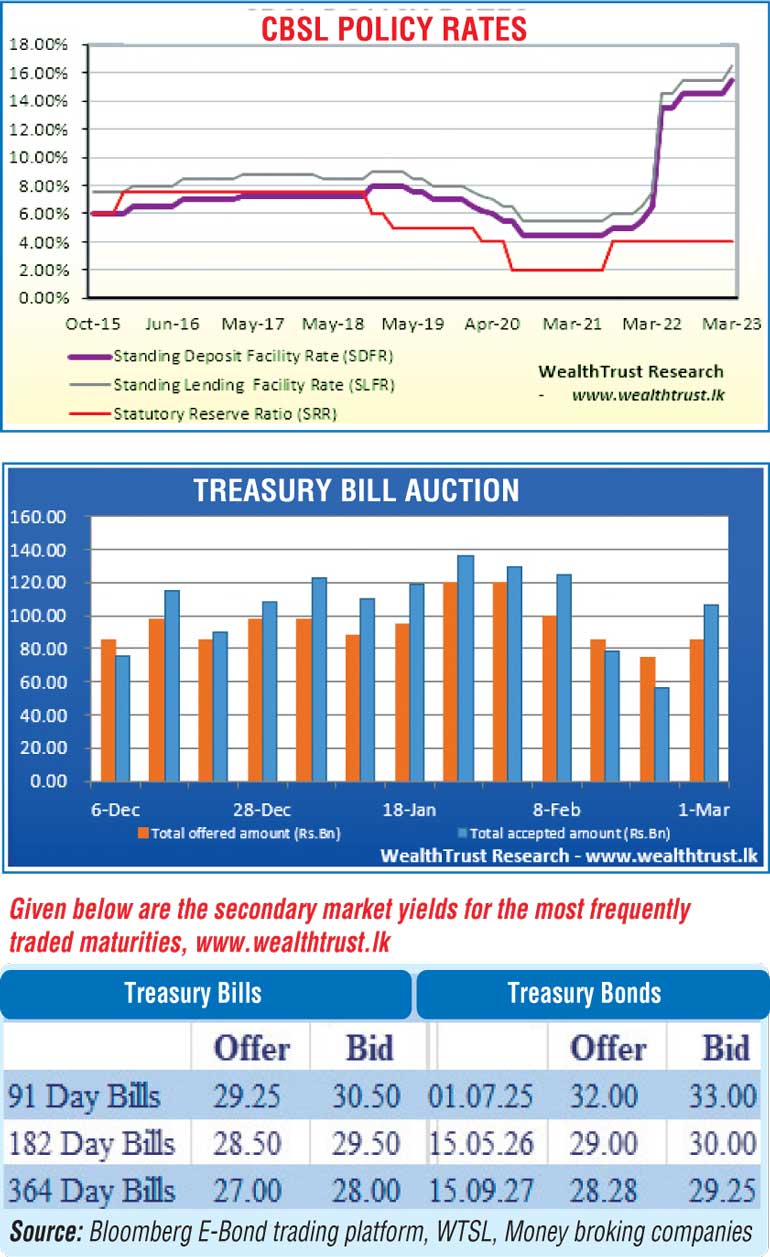

The Central Bank of Sri Lanka resumed its monitory tightening stance by raising its policy rates for the first time in 2023 at its second review meeting announced on Friday 3 March. An increase of 100 basis points saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) advance to 15.50% and 16.50% respectively.

The increase in demand at the weekly Treasury bill auction, increase in money market liquidity, sharp appreciation of the rupee, continued demand for LKR bills by foreign investors coupled with developments on the IMF front with regard to its Extended Fund Facility (EFF) to Sri Lanka reflected positively on the trading sentiment in the secondary market during the week ending 3 March leading to a steep decrease in bond yields, prior to the monetary policy announcement released late on Friday.

At the weekly Treasury bill auction, the total offered amount of Rs. 85 billion was fully subscribed at its first phase of the auction for the first time in three weeks while a further amount of Rs. 21.25 billion was taken at its second phase. Furthermore, the offered amount of Rs. 20 billion on the 4.5 year, 15.09.2027 maturity was fully accepted at its first phase of the T-bond auction at a weighted average rate of 29.37% while a further amount of Rs. 4 billion was taken at its direct issuance Window. However, all bids received for the Rs. 15 billion, two-year maturity of 15.01.2025 were rejected.

In money markets, the total outstanding liquidity deficit was seen decreasing further to a low of Rs. 14.09 billion at the end of the week against its previous week’s deficit of Rs. 53.94 billion.

In the forex market, the middle rate for USD/LKR spot contracts appreciated sharply during the week to Rs. 346.1724 against its previous week’s of Rs. 362.668. The market was reactive after a considerable period of time with spot closing the week at a high of Rs. 336.17 against its week’s opening low of Rs. 362.50.

The foreign holding in rupee bonds increased further by Rs. 12 billion to Rs. 44.47 billion for the week ending 2 March while the Colombo Consumer Price Index – CCPI (Base;2021=100) or inflation for the month of February came in at 50.6% on its point to point as against 51.7% recorded in January.

In the secondary bond market, the yields of the liquid maturities of 15.05.26 and two 2027s (i.e., 01.05.27 and 15.09.27) were seen decreasing to weekly lows of 28.60% and 27.70% respectively against its previous week’s closing levels of 29.50/80 and 29.10/40. In addition, 2025 (i.e., 15.01.25 and 01.07.25) and 15.01.28 maturities dipped to weekly lows of 31.75%, 31.70% and 27.00% respectively as well. However, the two-way quoted were seen increasing and widening following the monetary policy announcement. The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 22.47 billion.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 107.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)