Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 18 March 2020 00:56 - - {{hitsCtrl.values.hits}}

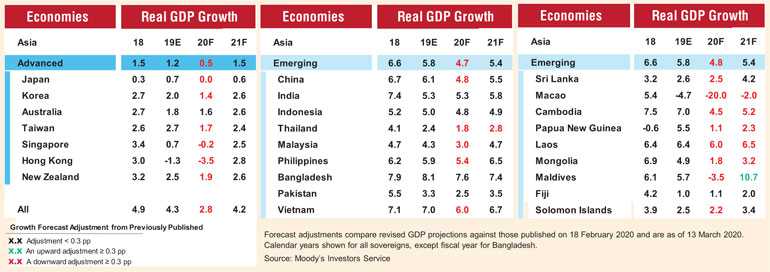

Moody’s Investors Service has revised its forecasts for most APAC economies on coronavirus implications, incorporating ongoing travel restrictions and heightened containment measures, as well as the recent oil price shocks.

“Our baseline scenario assumes declining consumption levels and continuing disruptions to production and supply chains in the first half of 2020, followed by a recovery in the second half of the year,” says Christian de Guzman, a Moody’s Senior Vice President.

“In the short run, this is playing out as both negative supply and demand shocks, and the longer the disruptions last, the greater the risk of a global recession,” adds de Guzman. Rising infection rates would further impede global sentiment, heightening asset price volatility and tightening financing conditions, which could snowball into a deeper economic contraction.

A number of governments have already announced measures to cope with the impact of the coronavirus, and Moody’s expects there will be more fiscal stimulus as the extent of the economic fallout becomes clearer. However, some governments – mainly frontier markets – may be constrained by their high indebtedness and limited access to funding.

Following are some highlights of Moody’s report.

Downward revisions reflect rising global recession risks

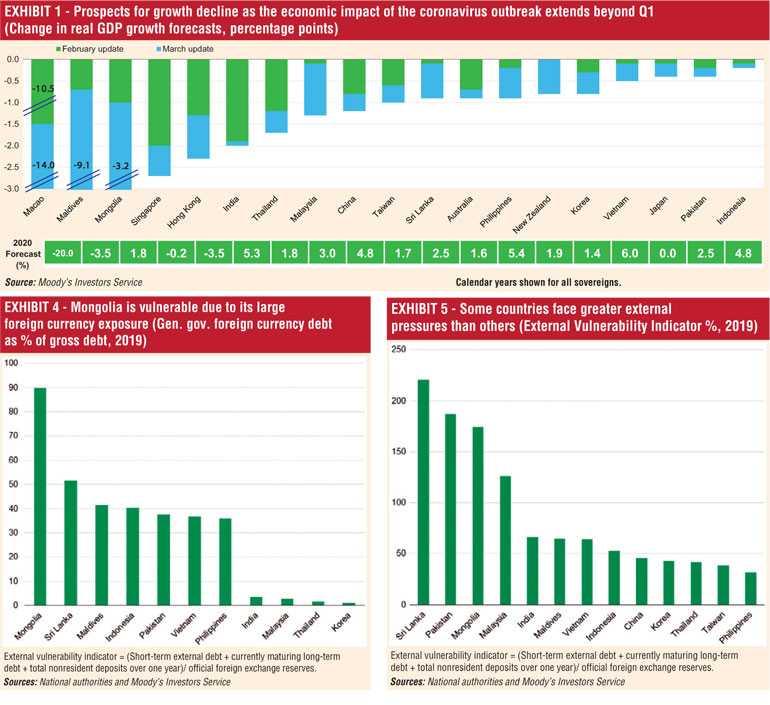

Our new baseline assumes a pullback in consumption and ongoing disruption to production and supply chains in the first half of 2020, followed by a recovery in the second half. In the short run, this is playing out as both negative supply and demand shocks Risks remain firmly to the downside, including from a much weaker European and American economy than currently assumed

Also, rising rates of infection would drive global sentiment even lower, heightening asset price volatility, and tightening financing conditions, which could snowball into deeper economic contraction

Significant global disruption and lower commodity prices embedded in lower forecasts

Our forecast for Chinese real GDP growth at less than 5% assumes that normalisation of economic activity will take time and thatweaker demand in China’s export markets will continue to dampen aggregate demand, even as coronavirus infection rates plateau

We now assume no growth in Japan and Singapore, and deeper contractions in Hong Kong and Macao in 2020 Forecast revisions also incorporate lower commodity prices, ongoing travel restrictions and heightened containment measures

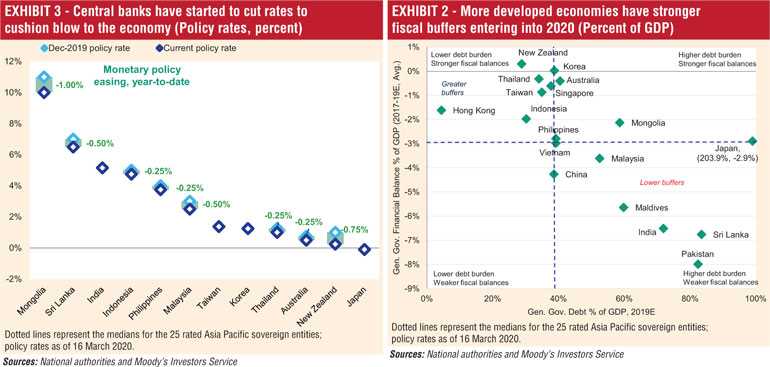

Policy buffers are being tested

A number of governments have announced fiscal stimulus packages or larger-than-expected budgets featuring temporary and targeted measures to deal with the immediate impact of the coronavirus outbreak on households and affected sectors

Further fiscal measures are likely as extent of economic fallout becomes clearer, but some governments—mainly frontier markets—may be constrained by already high indebtedness and constrained access to funding

Central banks and financial regulators have started to ease policy rates or allowed regulatory forbearance, although extent of further easing may be limited by already very low rates in some economies

Global financial volatility heightens liquidity and external vulnerability risks

Tighter funding conditions and exchange rate depreciation could stress sovereigns with high foreign currency exposure, heavy reliance on external market funding or inadequate foreign currency reserve coverage

Among frontier economies, only Sri Lanka faces a maturing international bond in 2020

Lower oil prices will ease pressures on trade and current account deficits for oil-importing countries.