Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 28 June 2018 00:00 - - {{hitsCtrl.values.hits}}

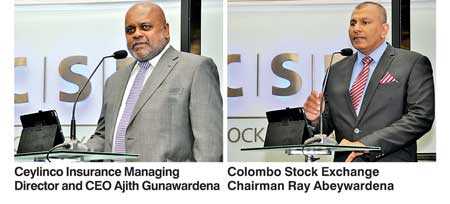

Ceylinco Insurance Managing Director and CEO Ajith Gunawardena, Ceylinco Insurance Chairman Godwin Perera, Ceylinco Life Insurance Managing Director and CEO R. Renganathan, Ceylinco General Insurance Managing Director Patrick Alwis, Ceylinco Life Insurance Deputy Chief Executive Officer Thushara Ranasinghe, Ceylinco General Insurance Head of Finance Nihal Peiris

By Charumini de Silva

Re-entering S&P SL20 Index, Ceylinco Insurance Plc on Tuesday outlined optimistic plans in making some modifications in its product portfolio backed by world’s largest reinsurance companies, while expecting to grow its gross written premiums 15% by end of the year expanding its branch network to rural areas.

“You will see that before the end of this year, there will be many changes to the product portfolios that we have which will be backed by world’s largest reinsurance companies as partners,” Ceylinco Insurance PLC Managing Director and CEO Ajith Gunawardena said at the bell ringing ceremony held at the Colombo Stock Exchange (CSE) to welcome the firm back into Sri Lanka’s 20 largest listed entities, following the mid-year rebalance of the index in June 2018.

Supported by the world’s largest reinsurance companies, he expressed confidence to face any type of calamities in any time of the year.

“We are fully equipped and reinsured around the world. We are backed by the world’s largest reinsurance companies such as Swiss Re, Munich Re, Japanese Re, Chinese Re, you name it; the whole backing is there to meet any type of calamities without any problem, in any time of the year. We can guarantee that any claim can be settled. We are undertakers of claims and that’s our business,” he added.

Despite large international insurance companies entering the local market and creating stiff competition, Gunawardena stressed that they were game to face any challenges.

“I think the difficult periods are over, but the challenges are still ahead. We welcome competition, either locally or from abroad. I think some of the people get scared with foreigners enter into the market, but we are not. There’s a saying that the old broom knows the nooks and corners. We being here, we know the nooks and corners. We are expecting to grow at least about 15 % this year,” he said.

He noted that the firm has always been different and has created one of the leading brands ‘Ceylinco VIP on the Spot’ which has not been offered by other players, but copied often. “We know what our market needs, we cater to that. We are being copied, but that’s perfectly alright. We are confident to continue to drive in these markets.”

Highlighting its expansion plans he stated company expand into areas where they see potential and extend its branch network covering all parts of the island, while opening over 30 new General Insurance branches by the end of the year.

“I think general and life together, we have over 750 branches islandwide at present. General we have close to about 500 branches and life has close upon to 350 branches. With that distribution network and products that we have introduced to the market, none of them are in competition with other products. I think both companies are expanding the way we have seen the markets, where there is opportunity you will see a branch of Ceylinco Insurance,” he quipped.

Noting that they were happy to be back in the S&P Index, Gunawardena said they would like to maintain the position in the top 20 listed entities meeting minimum size, liquidity and financial viability thresholds. Ceylinco Insurance last fell off the index during the annual rebalance in December 2016.

“The CSE has always been supportive and guiding us and with the assistance that they have given, we have managed to reach this position in the S&P. Now that we have come to this position, we would like to maintain it. I think this company managed to overcome all the difficulties thanks to the staff of Ceylinco Insurance and also the valued customers,” he pointed out.

CSE Chairman Ray Abeywardena described Ceylinco Insurance Plc as a phenomenal success story. “Ceylinco Insurance has an amazing track record of how a listed company has grown. We not only recognise the achievements, but we applaud the fact that you all have been one of the companies that have actually benefited by being listed in terms of the growth, in terms of the return to shareholder and in creation of value from being only Rs. 55 million to be a Rs. 33.6 billion market capitalised company,” he pointed out.

Abeywardena said Ceylinco Insurance Plc not only remained resilient and weather the storm, but also grew significantly during that period from 2008 until it became the premier insurance company in the country.

“The strong leadership in steering Ceylinco through what would have been a very troubled or a difficult period and come out victorious and become a leader in your spheres. We wish the company grow to greater heights and the relationship with the CSE grow stronger and stronger as the years go by,” he added.

Pix by Lasantha Kumara