Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 18 October 2022 00:00 - - {{hitsCtrl.values.hits}}

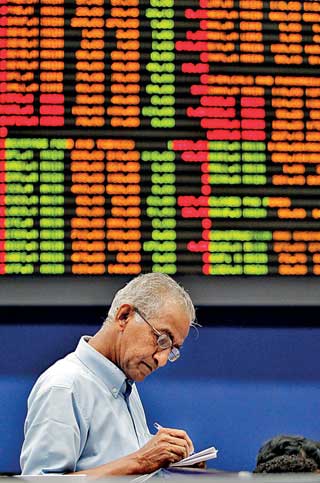

The Colombo stock market opened a fresh week on a negative note with investor interest remaining lacklustre.

The active S&P SL20 declined by 2.2% and the benchmark ASPI dipped by 1.2%. Turnover was Rs. 1.88 billion involving 69.6 million shares.

Asia Securities said the market commenced the week on a negative note with the indices closing sharply lower due to price losses in EXPO (-3.0%), LIOC (-4.8%), LOLC (-6.1%), and LOFC (-5.3%). The ASPI declined 1.2% (-110 points) to close below the 9,000 mark (8,984) while the S&P SL20 Index ended 2.2% lower at 2,721. However, AGST (+10.4%), CICX (+4.1%), and CICN (+2.7%) ended in green amid notable buying interest.

Turnover was led by AGST (Rs. 384 million), CICX (Rs. 221 million), and CICN (Rs. 170 million). Foreigners remained on the buying side, generating a net inflow of Rs. 87 million led by CICN (Rs. 92 million). Selling topped in HNB.N at Rs. 37.4 million.

Overall, 63 stocks ended higher while 127 closed in red.

First Capital said ASPI continued to plunge lower while recording the lowest turnover in one and a half months as investors remain sidelined awaiting direction from the upcoming budget reading for 2023 scheduled for today.

“Though index spiked in the beginning, eventually plummeted steeply as selling pressure mounted on the retail favourites, LOLC and LIOC to close the day on a negative note at 8,984, losing 110 points. On the other hand, as the Government granted permission to import required fertilisers for the Maha season, CIC and AGST rallied with a substantial gain,” First Capital added.

NDB Securities said the high net worth and institutional investor participation was noted in CIC Holdings, Citizens Development Business Finance and Hatton National Bank. Mixed interest was observed in Agstar, CIC Holdings nonvoting and Lanka IOC whilst retail interest was noted in SMB Leasing (voting and nonvoting), Browns Investments and LOLC Finance.

The Materials sector was the top contributor to the market turnover (due to Agstar, CIC Holdings nonvoting and voting) whilst the sector index lost 0.20%. The share price of Agstar increased by Rs. 1.80 (10.40%) to close at Rs. 19.10. The share price of CIC Holdings nonvoting gained Rs. 2.90 (4.05%) to close at Rs. 74.50, while the voting share price moved up by Rs. 2.75 (2.69%) to close at Rs. 105.

The Capital Goods sector was the second highest contributor to the market turnover whilst the sector index decreased by 1.10%. Lanka IOC and Expolanka Holdings were also included amongst the top turnover contributors.

The share price of Lanka IOC recorded a loss of Rs. 11.25 (4.77%) to close at Rs. 224.75. The share price of Expolanka Holdings declined by Rs. 5 (3.02%) to close at Rs. 160.75.