Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 17 June 2020 00:04 - - {{hitsCtrl.values.hits}}

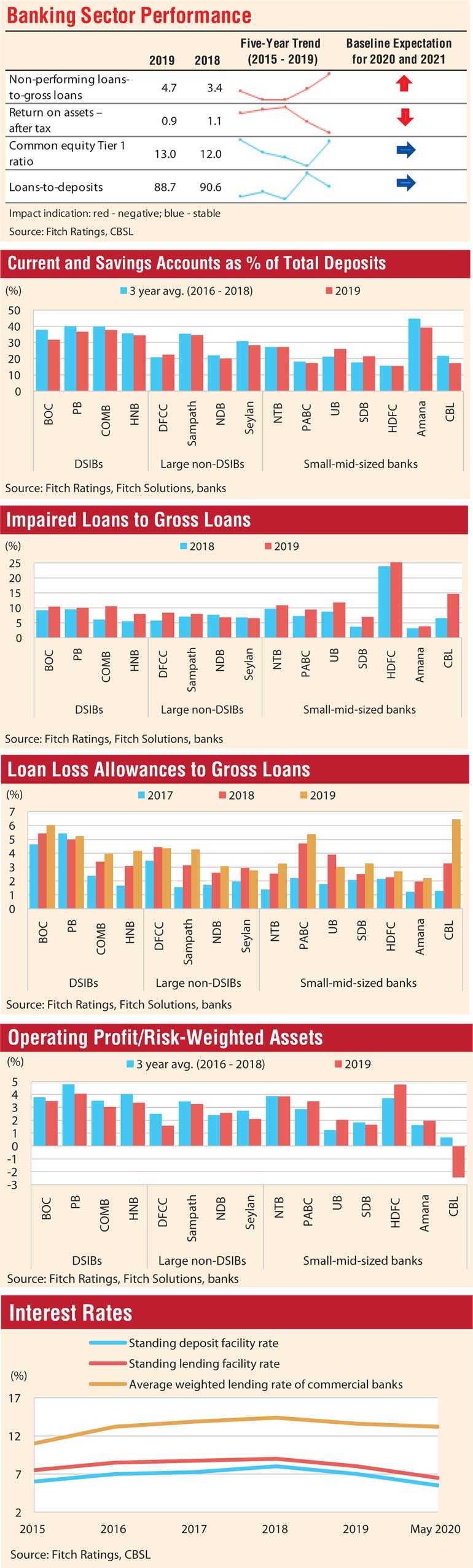

Fitch Ratings says Sri Lankan banks’ operating environment and financial profiles face escalating risks from the economic fallout of the coronavirus.

Fitch Ratings says Sri Lankan banks’ operating environment and financial profiles face escalating risks from the economic fallout of the coronavirus.

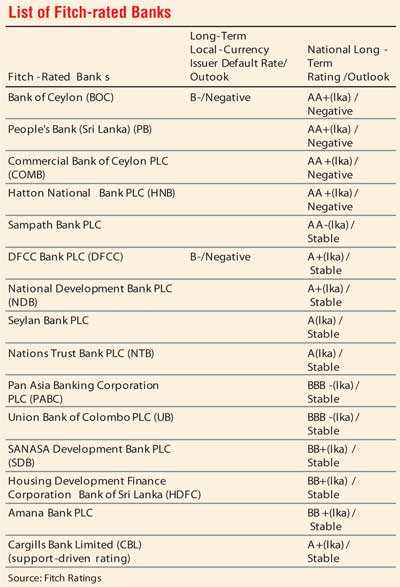

Fitch Ratings now expects Sri Lanka’s real GDP to contract by 1.3% in 2020, worsening from its earlier forecast of a 1.0% contraction published 24 April due to the pandemic.

Deterioration of the economy may worsen if the virus lingers for longer than it expects.

The weakened operating environment will compound the existing threat to the banks’ financial profiles through elevated asset quality and earnings pressure although the sector’s adequate capital buffers should help it withstand the near-term risks.

Heightened asset-quality risks

Fitch Ratings expects asset-quality pressure to manifest from 4Q20 and extend to 2021. The relief measures introduced by the Central Bank of Sri Lanka (CBSL) would delay credit migration for sectors affected by the pandemic in the short term. Nonetheless, Fitch Ratings expects underlying asset quality to deteriorate, as most borrowers will not emerge unscathed from the economic downturn.

Coronavirus exacerbates earnings pressure

Sri Lankan banks’ operating profit will be negatively affected by pressure on interest margins, a reduction in fee-based income and rising loan-impairment charges in 2020 and 2021. Profitability pressure will also stem from the slowdown in loan growth due to low business confidence and consumer sentiment.

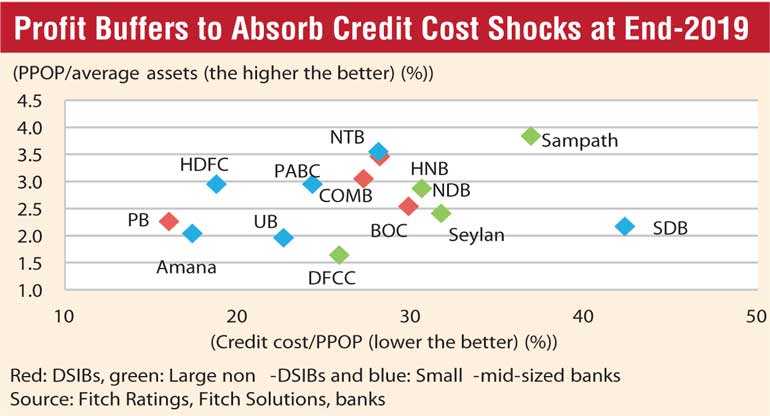

Fitch Ratings expects Fitch-rated banks’ core earnings metric of operating profit/risk-weighted assets to fall to 2.7% by end-2020 from the current low of 3.1% at end-2019. However, most of the banks have sufficient pre-impairment profit (PPOP) buffers to absorb increased credit costs without incurring losses.

Capital is vulnerable to severe shocks

Sri Lankan banks have built up capital buffers over the past few years in response to regulatory requirements, which should help them withstand the near-to-medium term pressure.

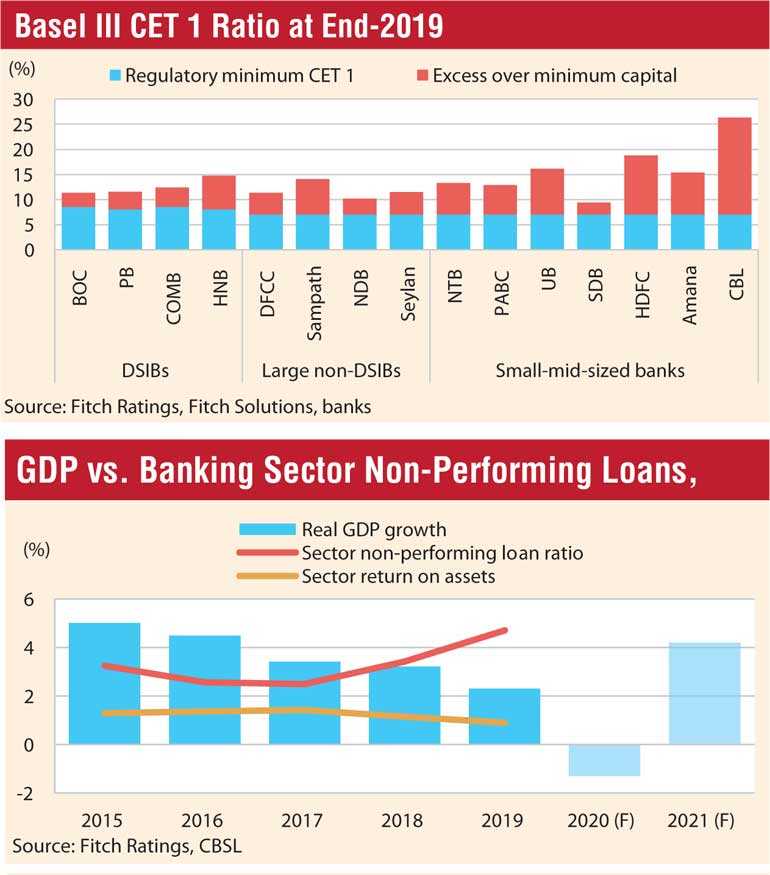

Fitch-rated banks’ average common equity Tier 1 (CET1) capital ratio improved to 12.6% by end-2019 from 11.7% at end-2018.

Nonetheless, capital impairment risks are high in the event the pandemic’s impact is significantly worse than Fitch Ratings expects.

Access to foreign currency challenging

Refinancing foreign-currency (FC) liabilities will be a challenge for Sri Lankan banks due to the sovereign’s weak credit profile, a slowdown in FC worker remittance inflows and worsening global funding conditions. FC liabilities accounted for 23.0% of total sector funding as of end-2019.

Fitch Ratings believes there is less near-term pressure on local-currency liquidity due to the support measures taken by the CBSL, such as a reduction in regulatory liquidity-coverage ratios.

Operating environment to weaken further

Fitch revised the Sri Lankan banking sector outlook for 2020 to negative from stable in March to reflect the heightened pressure on the banks’ operating environment stemming from the coronavirus pandemic, which will adversely affect the performance of the banks.

The operating environment was weak prior to the outbreak with slower economic growth of 2.4% by end-2019 in the aftermath of the Easter attack in April 2019 and political turmoil in October 2018 weighing on banks as asset quality deteriorated and profitability fell.

Fitch Ratings also revised its assessment of Sri Lankan banks’ operating environment to ‘b-’/negative, from ‘b’/negative, primarily to reflect the heighted risks of doing business. It expects banks’ financial profiles to come under stress from the increasingly challenging operating environment amid its base-case forecast of a 1.3% contraction in the economy in 2020. Their key credit metrics are likely to be weaker than Fitch Ratings’ previous expectations, notwithstanding regulatory relief on loan classification and provisioning, minimum capital requirements, and income recognition on loans under moratorium.

Fitch Ratings expects GDP growth of 4.2% for Sri Lanka in 2021 on the basis of a gradual recovery in tourism receipts beginning late 2020, although the forecast is subject to an unusually high degree of uncertainty and risks, depending on the evolution of the pandemic within Sri Lanka and globally.

The operating environment assessment is primarily sensitive to Sri Lanka’s sovereign rating (B-/Negative) and heightened risks to the banking sector from the lasting effects of the coronavirus on macroeconomic conditions, including protracted economic contraction. The outlook for the operating environment assessment is maintained at negative to reflect the possibility of further risks should the impact of the economic fallout from the pandemic become more pronounced or linger.

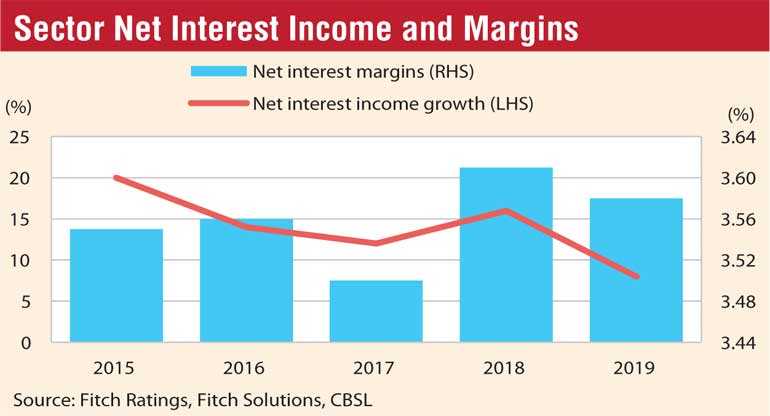

Low interest rates to pressure net interest income

Interest rates in Sri Lanka are likely to remain low through 2020 and 2021 to stimulate the economy. The CBSL has adopted accommodative policies since May 2019, cutting policy rates by a total of 200bp, with 100bp from March 2020, mainly from the measures adopted to combat the impact of the pandemic.

Fitch Ratings believes the rate cuts will to some extent ease repayment pressure for borrowers who are affected by the coronavirus, but the cost-of-funding constraints at banks are likely to make it hard to pass on rate cuts completely, hampering the regulator’s economic growth expectations.

Fitch Ratings expects protracted low interest rates and subdued loan growth to weigh on the sector’s net interest income, leaving the banks vulnerable to a sharp increase in loan-impairment charges in 2020 and 2021. Growth of the sector’s net interest income slowed to 8% by end-2019 from 16% at end-2018, squeezing the banks’ net interest margins (NIM). It expects the average NIMs of Fitch rated banks to fall by around 35bp by end-2021.

Asset-quality deterioration

Sri Lankan banks will face heightened risks to their asset quality due to the pandemic. Fitch Ratings expects asset quality to deteriorate for all the banks in 2020 and 2021, with a more pronounced decline for banks with higher exposure to SMEs and the more affected corporate sectors, such as tourism, apparel and retail.

Nevertheless, Fitch Ratings believes the near-term extent of the deterioration will be masked by the repayment moratoriums and regulatory permission for banks to apply flexibility in impairment recognition for regulatory and financial reporting.

These measures will effectively delay the full recognition of asset quality deterioration in 2020, which Fitch Ratings thinks will become more apparent in 2021 as the relief measures unwind. Fitch Ratings expects Fitch rated banks’ impaired loans/gross loans (SLFRS 9 Stage 3) to peak in 2021 at 13.2% after reaching 10.9% by end-2020.

Fitch-rated banks ended 2019 with a sharp deterioration in asset quality, with the impaired loan-to-gross loan ratio spiking to 9.4% by end-2019, from 7.0% at end-2018, reflecting the already weakened operating environment prior to the virus outbreak.

The asset quality deterioration resulted in an increase in the provisioning for bad loans with Fitch-rated banks’ ratio of loan loss allowances to gross loans rising to 4.0% by end-2019 from 3.1% in 2018, although it covered only 49% of impaired loans.

Significant pressure on profitability

Fitch Ratings expects profitability pressure to stem mainly from higher loan impairment charges and narrower net interest margins. Most of the Fitch-rated banks already reported declining profitability in 2019 due to high loan-impairment charges. On average, 28.1% of Fitch-rated banks’ PPOP was wiped out by credit costs by end- 2019, compared with the 18.1% three-year average in 2016-2018.

Fitch Ratings expects profitability pressure to intensify for banks with already weak PPOP or banks for which loan-impairment charges already consume more than 30% of PPOP. Nevertheless, the ultimate impact on profitability will depend on the extent to which relief measures can mitigate impairment charges rather than just delay the inevitable.

The reduction in effective taxes of around 13% could ease some of the profitability pressure but it will only be a partial offset.

Adequate capital buffers

Fitch Ratings believes that Fitch-rated banks’ capital buffers are adequate to provide protection against some of the risks. That said, the banks with already thin capital buffers over the minimum regulatory capital would be significantly more vulnerable to capital impairment risks should the economic fallout from the pandemic worsen beyond its base-case expectations. Temporary regulatory restrictions on declaring cash dividends will also help the banks’ capitalisation levels in the near term.

The CBSL’s response to the coronavirus crisis includes allowing banks to draw down against their capital conservation buffer (2.5% of risk-weighted assets) by up to 100bp and 50bp for domestic systemically important banks (DSIB) and non-DSIBs, respectively. This will boost banks’ ability to lend, but Fitch Ratings believes significantly lower capital ratios are credit negative as this comes at a time when weaker margins and higher loan-impairment charges reduce banks’ internal capital generation and buffers amid the heightened operating environment risks.

However, it does not expect banks’ lending activities to gather pace as a result of the relaxation in macro-prudential measures, with subdued loan growth providing some relief to their capital ratios.

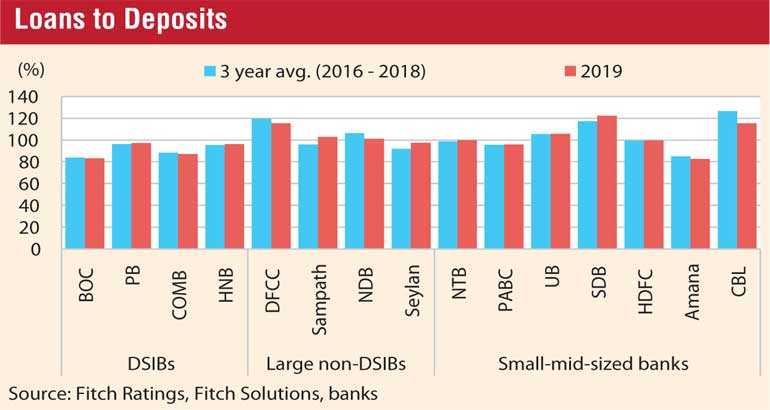

Regulatory measures support liquidity

CBSL’s recently announced measures to provide liquidity to banks will ease any near-term pressure on the banks’ local currency funding and liquidity profiles.

These measures include a reduction in the liquidity-coverage ratio and net stable funding ratio to 90% from 100%, additional funding under a refinancing facility, enabling the banks to provide working capital loans at concessionary interest rates, and permitting banks to consider certain assets as liquid assets in the computation of the statutory liquid-asset ratio. Nonetheless, Fitch Ratings believes the banks’ funding and liquidity profiles could come under pressure if access to foreign-currency funding becomes more challenging in light of the deterioration in the sovereign credit profile.

There is also the potential for some banks, especially small banks, to face some pressure on their funding and liquidity profiles if there is a flight to quality. Large banks, including DSIBs, continue to enjoy a high share of low-cost current and savings accounts (CASA), underpinned by their strong domestic franchise, which accounted for a median 33.0% of total deposits at end-2019. Out of the large banks, this ratio is relatively low for DFCC Bank PLC (B-/Negative) and National Development Bank PLC (NDB, A+(lka)/Negative), reflecting their recent move into commercial-banking franchises after their start as development-financing institutions. The share of CASA for small-to-midsized banks is low at a median 21.5%, reflecting their weaker domestic franchise than that of their large counterparts, although Nations Trust Bank PLC (NTB, A(lka)/Stable) and Amana Bank PLC (BB(lka)/Positive) stand out in this category with 27.2% and 39.2%, respectively.