Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 19 April 2022 01:38 - - {{hitsCtrl.values.hits}}

From left: DFCC Athurugiriya branch Branch Manager Samantha Perera, Vice President Digital Strategy Dinesh Jebamani, Industrialist Association President Rohitha Wijesinghe, Vice President Regional Manager region three Chaminda Gunawardana, Senior Vice President Head of Retail Banking and SME Aasiri Iddamalgoda

In line with its strategy to grow its presence, enhance financial inclusivity, and promote digital transactions, DFCC Bank, the Bank for Everyone, unveiled its 25th offsite ATM/CRM at the Templeburg Industrial Zone in Panagoda, recently.

The offsite access point was officially unveiled and inaugurated amidst a special opening ceremony, which was attended by high-ranking senior management officials from DFCC Bank, along with officials representing Templeburg Industrial Zone and selected customers.

Catering to the 34 companies and over 5,000 employees located within the zone, and the public within a three-kilometre radius of the location, DFCC Bank’s new offsite ATM/CRM aims to enhance customer and public access to convenient digital financial services while reducing the need to travel long distances.

Discussing the new offsite access point, SVP Head of Retail Banking and SME Aasiri Iddamalgoda said: “The Templeburg Industrial Zone is a major complex that houses 34 companies and thousands of employees. We understood that many people face difficulties inconveniently accessing financial services, while also requiring access to cash services. It also came to our attention that productivity was being affected as individuals had to take a short leave to perform their banking activities.

“Thus, as the Bank for Everyone, we saw an opportunity to not just provide convenient access to digital and cash banking services, but also to increase financial inclusivity, in line with our 2030 sustainability goals. Thus, we are very pleased to empower the companies and workers in the zone, along with the public in the area, through our new offsite cash-deposit capable ATM and digital payment kiosk ‘Pay & Go’ at the Templeburg Industrial Zone. We are also supporting businesses through DFCC iConnect, our class-leading comprehensive digital cash management solution, and other SME banking products.”

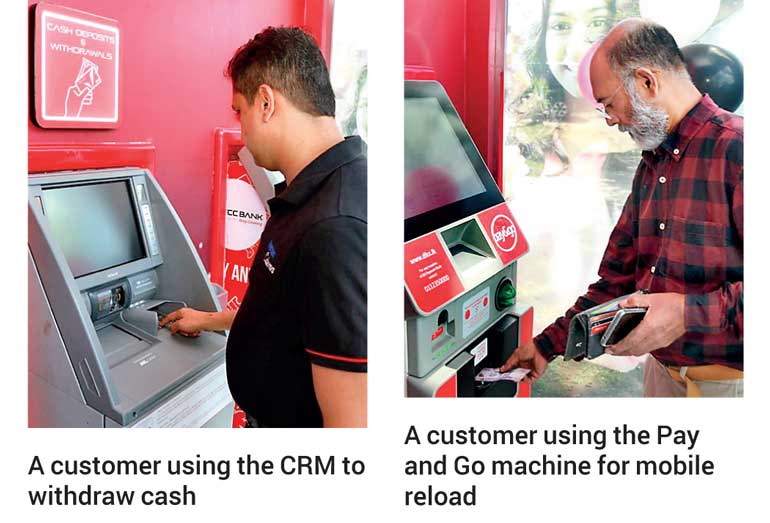

DFCC Bank’s new offsite access point features a state-of-the-art CRM machine that allows customers and the public to make withdrawals from any bank account and cash deposits to DFCC Bank accounts.

Additionally, DFCC Customers can use it to make card and cardless bill payments and transfers to utilities, and payments to DFCC Credit Cards. In addition to the CRM, DFCC Bank has also installed a Pay and Go machine that provides the public with easy access to digital mobile reloads utility bill payments, and institutional payments for insurance, leasing, and more.

The mobile reload facility, which covers all telecom operators, will be a huge convenience for workers, who often face challenges to obtain their reloads, as the nearest reload point is 1km away from the Zone. Workers and others within the Zone can now also easily open one of DFCC Bank’s salary proposition accounts, such as Salary Partner or Salary Plus, to enjoy the many benefits of these accounts, through this access point.

Commenting on the initiative, DFCC Bank VP Digital Strategy Dinesh Jebamani added: “Digital banking and digital inclusivity is pivotal for us at DFCC Bank as it is the future of banking. Today, people expect the bank to come to them, not the other way round. However, some transactions still need to be performed in cash, either due to necessity or preference.

“Thus, our new offsite access point provides a hybrid solution acting as both a cash and digital transaction point, providing next-level convenience, and uninterrupted 24/7 access to financial services for the thousands of workers and area residents. Furthermore, it also provides a fast, quick, and hassle-free way for companies within the Zone to handle their daily cash transactions and utility payments.”