Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 17 June 2022 00:00 - - {{hitsCtrl.values.hits}}

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka conducted auctions for outright sales of Treasury bills totalling Rs. 25 billion for periods ranging 189 to 259 days yesterday. However, only an amount of Rs. 0.50 billion sold down at a weighted average rate of 21.90% for a period of 203 days.

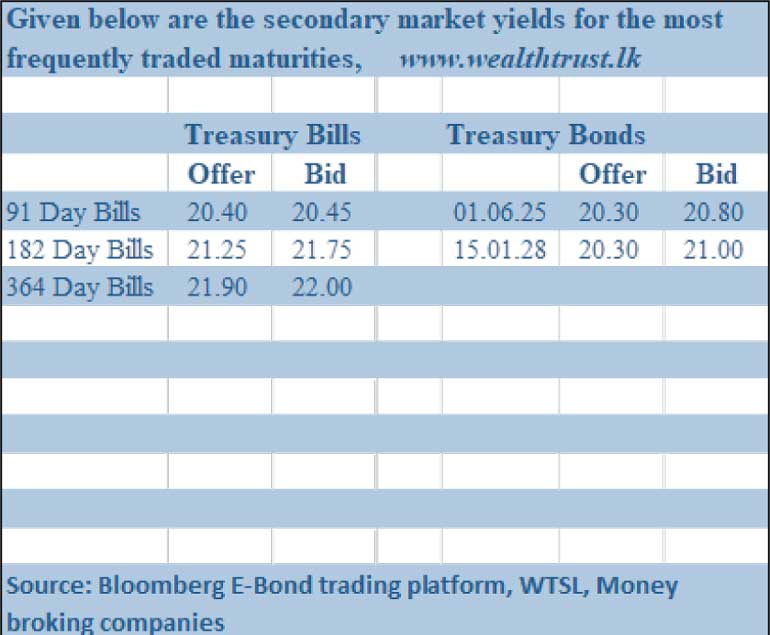

In the secondary bill market, yields were seen increasing yesterday with maturities centring 91 day and 364 days hitting intraday highs of 20.45% and 22.00% respectively against its previous day’s closing levels of 20.25/30 and 21.75/00. Meanwhile activity in the secondary bond market was at a standstill yesterday. The total secondary market Treasury bond/bill transacted volume for 15 June was Rs. 73.74 billion.

In money markets, the net liquidity deficit stood at Rs. 541.97 billion yesterday as an amount of Rs. 204.87 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 746.84 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 359.85 yesterday.

The total USD/LKR traded volume for 15 June was $ 17.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)