Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 27 September 2021 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

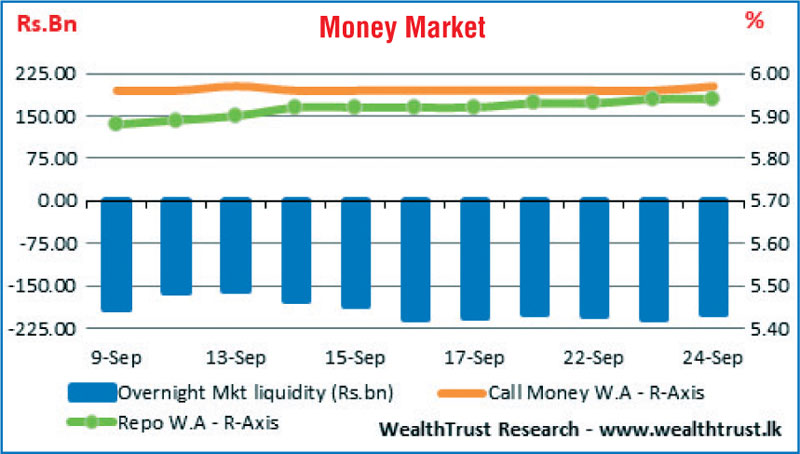

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen conducting an auction on Friday, 24 September to inject permanent liquidity into the system by way of a reverse repo auction for the first time since 11 November 2020. An amount of Rs. 103.5 billion was successfully infused out of an offered amount of Rs. 150 billion for period of 87 days at a weighted average rate of 6.13%, valued 27 September.

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen conducting an auction on Friday, 24 September to inject permanent liquidity into the system by way of a reverse repo auction for the first time since 11 November 2020. An amount of Rs. 103.5 billion was successfully infused out of an offered amount of Rs. 150 billion for period of 87 days at a weighted average rate of 6.13%, valued 27 September.

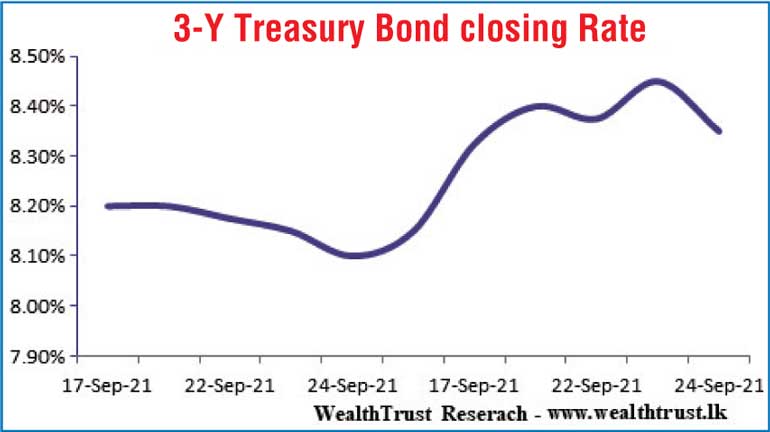

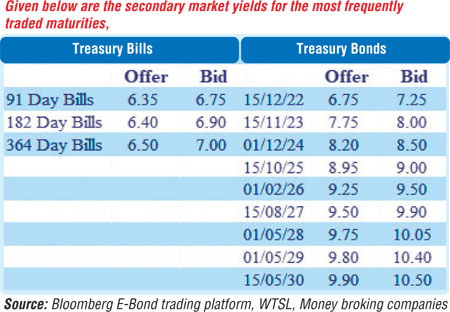

This intern saw sentiment in the secondary bond market turn positive on Friday, following a continued upward momentum during the rest of the shortened trading week ending 24 September. The yields on maturities of 01.10.23, 01.12.24, 01.08.25 and 15.05.30 were seen hitting weekly highs of 8.00%, 8.45%, 9.26% and 10.21% respectively against its previous weeks closing levels of 7.30/90, 8.25/40, 8.50/00 and 9.90/20 driven by the outcome of the weekly Treasury bill auction and the removal of the yield guidance for the upcoming Treasury bond auctions scheduled for 28 September. At the weekly Treasury bills auction, weighted average rates were seen increasing sharply following the removal of the yield guidance for the Treasury bill auctions.

However, buying interest on Friday saw yields dip once again, reversing its upward trend as the maturities of 15.01.23, 15.03.24, and 15.10.25 changed hands at levels of 7.20%, 8.00% and 9.00% respectively.

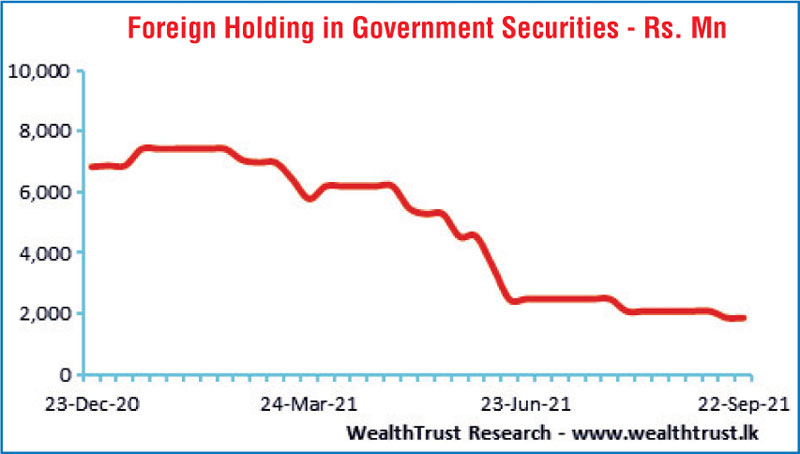

The foreign holding in Rupee bonds remained mostly unchanged at Rs. 1.87 billion for the week ending 22 September 2021 while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 6.16 billion.

In money markets, the net liquidity shortfall decreased to Rs. 200.61 billion against its previous weeks Rs. 206.59 billion while CBSL’s holding of Government Security’s increased to Rs. 1,332.21 billion against its previous weeks of Rs. 1,330.32 billion. The weighted average rates on overnight call money and repo averaged 5.96% and 5.94% respectively for the week.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 202.90 to Rs. 202.92 during the week while the overall market continued to remain inactive.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 20.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money brokingcompanies)