Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 31 August 2021 01:23 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

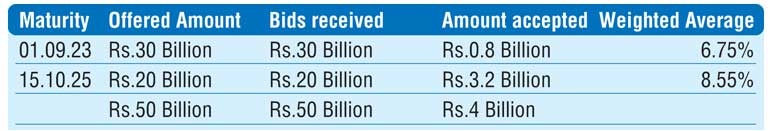

The total accepted amount at yesterday’s Treasury bonds auction decreased sharply to a low of 8% of its total offered amount as only an amount of Rs. 4 billion was successfully taken up against its offered amount of Rs. 50 billion. The weighted average rates on the auctioned maturities of 01.09.23 and 15.10.25 were registered at its stipulated cut-off rate of 6.75% and 8.55% respectively, while the second phase of the auction was opened on both maturities.

At the start of the fresh trading week, the secondary bond market was at a complete standstill yesterday.

The total secondary market Treasury bond/bill transacted volume for 27 August was Rs. 1.54 billion.

In money markets, net liquidity turned negative once again to record a deficit of Rs. 0.48 billion yesterday with an amount of Rs. 112.10 billion being withdrawn from Central Banks SLFR of 6% against an amount of Rs. 102.12 billion deposited at Central Banks SLDR of 5%. The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka drained out an amount of Rs. 9.5 billion by way of an overnight repo auction at a weighted average rate of 5.71%, while the weighted average rates on overnight call money and repo was registered at 5.78% and 5.77% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 27 August was $ 27.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)