Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 13 May 2019 00:00 - - {{hitsCtrl.values.hits}}

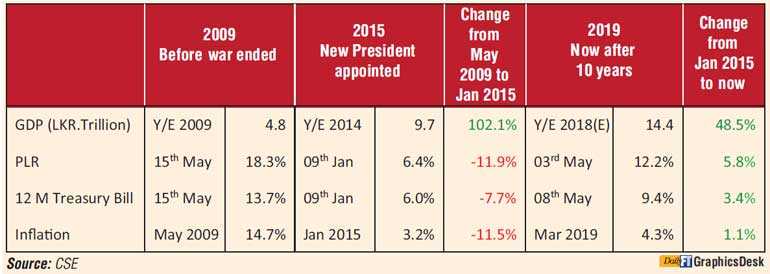

It has been 10 years since the war ended and during this period there has been massive economic development in the country which has improved the economic indicators of which some are shown below.

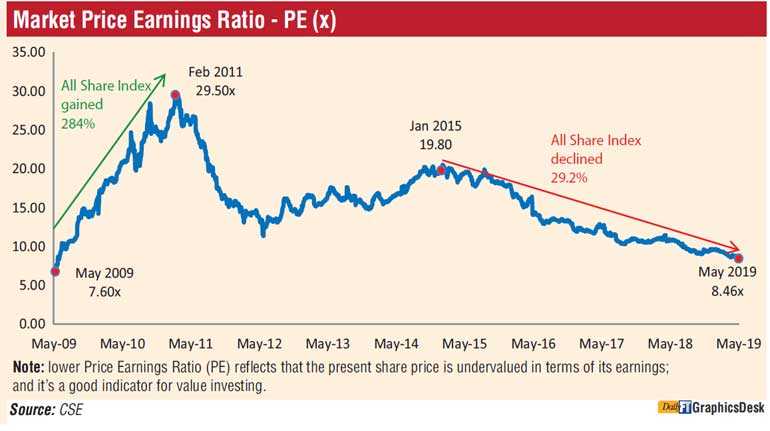

Shares are now trading at valuations lower than what was seen before the end of the war. However since the economic indicators are better than what it was during the war, we firmly believe that the present distress conditions have created an opportunity to accumulate fundamentally strong shares that are presently oversold. As a result of this decline, the dividend yields of selected stocks have exceeded the returns generated from fixed deposits and government securities.

It is important to highlight the fact that investors who were bold enough to accumulate shares at bargaining prices few months before the war ended in 2009, generated extremely high returns; while those who were pessimistic missed a lifetime opportunity.

We believe the present situation replicates a similar opportunity as witnessed in May 2009, since positive changes could happen at least by end of the year in politics, economic policies and national security. This would restore investor sentiment and confidence which would trigger a strong upsurge in share prices similar to which was seen between 15 May 2009 and 9 January 2015.

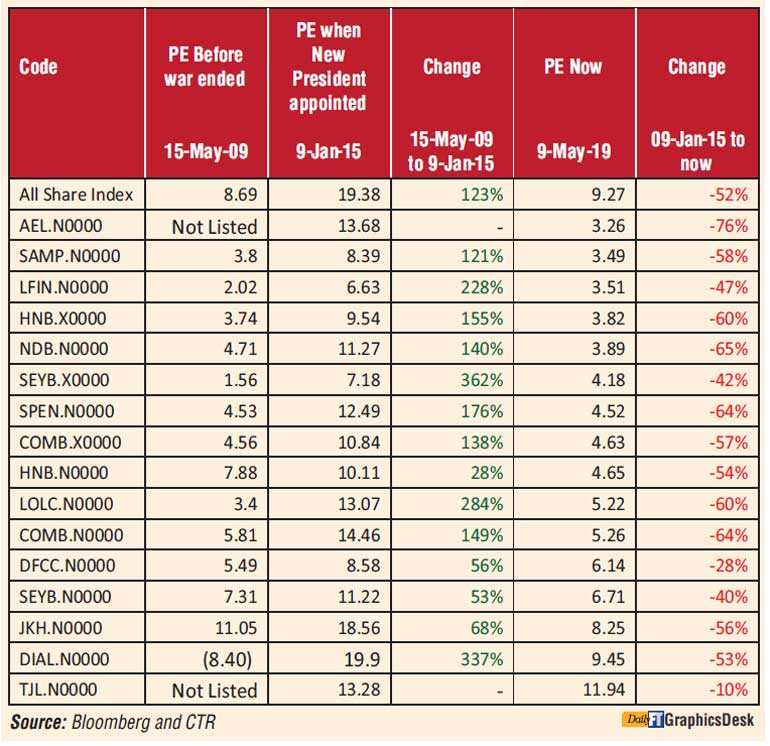

Following are selected stocks that are oversold and could bounce back to generate significant returns.

Change in Price Earnings Ratios (PE) of Overall Market and Selected Stocks

(The information and the opinions contained herein were compiled by Capital TRUST Securities Ltd., and are based on information obtained from reliable sources in good faith. However, such information has not been independently verified and no guarantee, representation or warranty expressed or implied is made by Capital TRUST Securities Ltd. and its related companies as to its accuracy or completeness. This report is not and should not be construed as an offer to sell or a solicitation of an offer to buy any security. Neither Capital TRUST Securities Ltd. nor its related companies, directors and employees can be held liable whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein.)