Saturday Dec 13, 2025

Saturday Dec 13, 2025

Monday, 20 November 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The two primary auctions conducted during the trading week ending 17 November reflected diverse outcomes as the bond auctions went undersubscribed while the bill auctions were fully subscribed.

The largest ever offered amount in Sri Lanka’s history at a round of bond auctions, went undersubscribed last Monday. Only 29.29% or Rs. 73.22 billion was raised out of the total offered amount of Rs. 250 billion at its 1st and 2nd phases. Of the bonds on offer, demand was seen for the shorter tenure 15.01.27 maturity, which saw its offered amount of Rs. 60 billion raised at a weighted average yield of 15.22%. However, the 15.03.28 maturity, with the highest offered amount of Rs. 110 billion, and the 15.03.31 maturity, with Rs. 80 billion on offer, went significantly undersubscribed, with only Rs. 4.56 billion and Rs. 8.67 billion accepted, at weighted average yields of 14.52% and 13.56%, respectively. This follows the previous round of Treasury bond auctions conducted on 30 October, which saw all bids rejected.

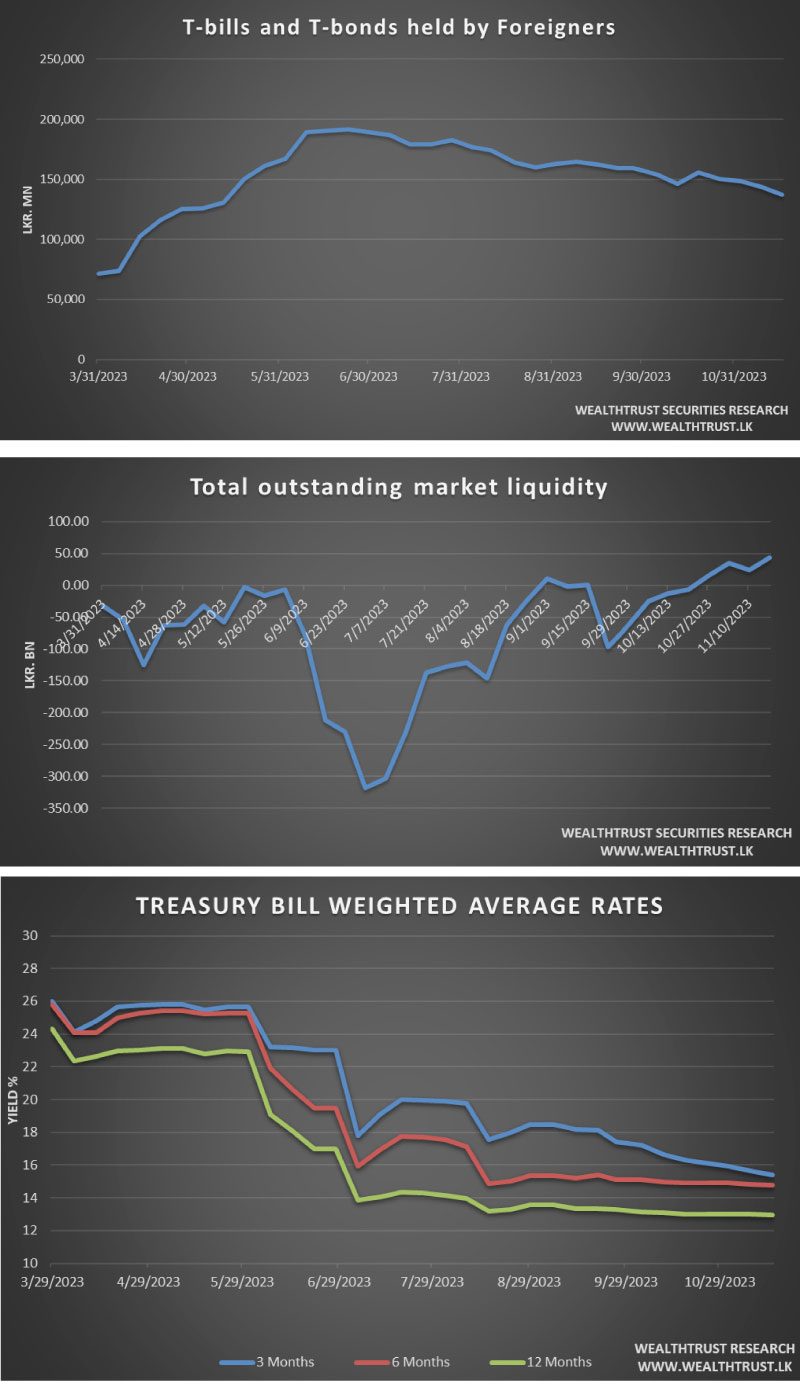

Conversely, last week’s Treasury bill auction, received a bullish response once again as all three weighted average yields decreased across the board for a second consecutive week. The 91-day and 182-day bills saw the most demand, which led to its weighted average yield declining by 25 basis points and 6 basis points respectively to 15.39% and 14.75%. The 364-day bills also declined by 3 basis points to record a weighted average of 12.96%. The total bids received was 1.63 times greater than the total offered amount at the 1st phase. Accordingly, the entire offered amount of Rs. 175 billion was raised at the 1st phase of the auction, while an additional amount of Rs. 30.08 billion was raised at the 2nd phase on the 182-day and 364-day tenures.

Conversely, last week’s Treasury bill auction, received a bullish response once again as all three weighted average yields decreased across the board for a second consecutive week. The 91-day and 182-day bills saw the most demand, which led to its weighted average yield declining by 25 basis points and 6 basis points respectively to 15.39% and 14.75%. The 364-day bills also declined by 3 basis points to record a weighted average of 12.96%. The total bids received was 1.63 times greater than the total offered amount at the 1st phase. Accordingly, the entire offered amount of Rs. 175 billion was raised at the 1st phase of the auction, while an additional amount of Rs. 30.08 billion was raised at the 2nd phase on the 182-day and 364-day tenures.

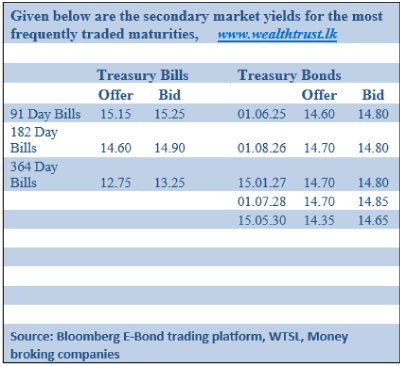

The secondary bond market was sideways during the week, as yields initially dipped at the start of the week following the bond auction outcome on the back of an uptick in activity and volumes, steadied midweek and edged up once again towards the end of the week. Trading revolved around the short end of the yield curve, mainly on the 2026, 2027 and 2028 maturities.

Activity was observed on the maturities of 01.05.24, three 26’s (15.05.26, 01.06.26, 01.08.26), three 27’s (15.01.27, 01.05.27, 15.09.27) and two 28’s (01.05.28 and 01.07.28) during the week, within the ranges of 14.55% to 14.40%, 15.00% to 14.70%, 15.10% to 14.65% and 14.80% to 14.60% respectively.

Activity was observed on the maturities of 01.05.24, three 26’s (15.05.26, 01.06.26, 01.08.26), three 27’s (15.01.27, 01.05.27, 15.09.27) and two 28’s (01.05.28 and 01.07.28) during the week, within the ranges of 14.55% to 14.40%, 15.00% to 14.70%, 15.10% to 14.65% and 14.80% to 14.60% respectively.

This week will see the 8th and final Monetary Policy Announcement for the year 2023 due on 24 November at 7:30 a.m. (this Friday). It is widely anticipated that the CBSL will continue to ease policy rates, as significantly cooled inflation creates space. It was reported that Bloomberg expects a cut of 100 basis points citing a need to reduce real borrowing costs and support economic growth.

The foreign holding in Rupee bonds and bills continued to decline for a fourth consecutive week, with a net outflow of Rs. 6.56 billion, bringing the total holding to Rs. 137.53 billion as at 16 November.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 34.06 billion.

In money markets, the total outstanding liquidity recorded a deficit of Rs. 43.00 billion by the week ending 17 November from its previous week’s surplus of Rs. 23.49 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 28-day Reverse repo auctions at weighted average yields ranging from 10.05% to 12.33%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at 2,799.35 billion, against its previous week’s level of Rs. 2,819.35 billion.

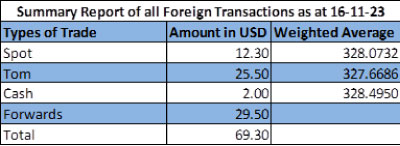

In the forex market, the USD/LKR rate on spot contracts was seen exhibiting some volatility, however recovering during the week to close at Rs. 327.90/328.10. This is as against its previous week’s closing level of Rs. 327.00/327.50. Subsequent to trading at a high of Rs. 326.80 and a low of Rs. 328.80.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 49.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)