Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 19 July 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

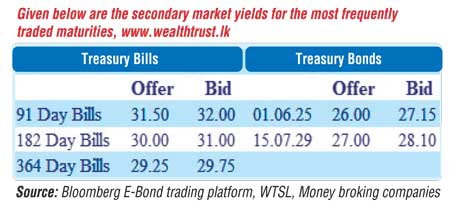

The fresh trading week commenced with the continuation of the positive momentum as yields were seen decreasing further on the back of persistent buying interest, albeit on thin volumes. The yields on the most sorted maturities of 01.06.25 and 15.07.29 were seen hitting intraday lows of 27.15% and 28.10% respectively against its Friday’s closing levels of 27.00/75 and 27.75/25.

The fresh trading week commenced with the continuation of the positive momentum as yields were seen decreasing further on the back of persistent buying interest, albeit on thin volumes. The yields on the most sorted maturities of 01.06.25 and 15.07.29 were seen hitting intraday lows of 27.15% and 28.10% respectively against its Friday’s closing levels of 27.00/75 and 27.75/25.

The total secondary market Treasury bond/bill transacted volume for 15 July 2022 was Rs. 6.88 billion.

In money markets, the net liquidity deficit increased to Rs. 470.80 billion yesterday as an amount of Rs. 313.75 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50% against an amount of Rs. 784.55 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 15.50%. The weighted average rate on REPO stood at 15.50% while no Call money transactions were witnessed.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka conducted auctions for outright sales of Treasury bills for Rs. 5 billion each for periods of 38 days and 45 days. An amount of Rs. 1 billion was accepted from the 38-day maturity at a weighted average rate of 26.70% while all bids received were rejected on the 45-day maturity.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated to Rs. 361.0331 yesterday against its previous day’s closing level of Rs. 361.2400.

The total USD/LKR traded volume for 18 July 2022 was $ 21.40 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)