Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 16 December 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

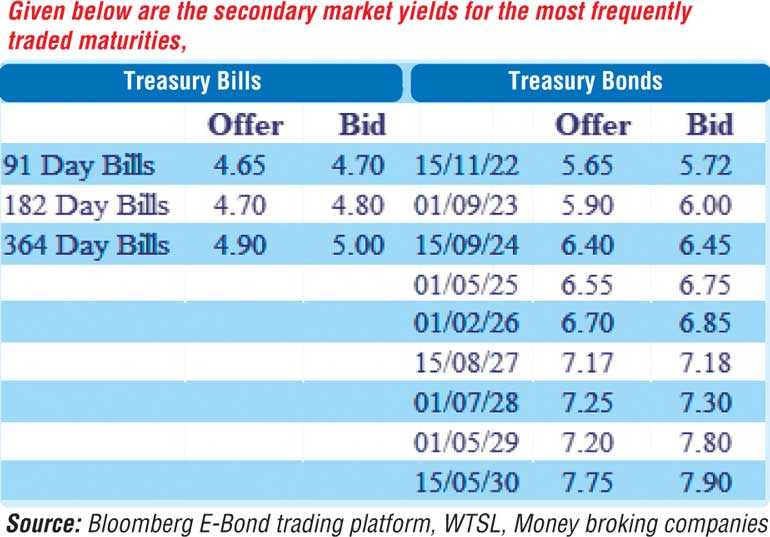

The dull sentiment witnessed in the secondary bond market continued yesterday as well, with most market participants opting to be on the side lines. Limited trades were witnessed consisting of the 01.08.21, 15.12.22, 15.03.24, 15.10.27, 01.07.28 and 15.05.30 maturities, at level of 4.85%, 5.72%, 6.47%, 7.20% to 7.21%, 7.26% to 7.28% and 7.78% respectively.

The dull sentiment witnessed in the secondary bond market continued yesterday as well, with most market participants opting to be on the side lines. Limited trades were witnessed consisting of the 01.08.21, 15.12.22, 15.03.24, 15.10.27, 01.07.28 and 15.05.30 maturities, at level of 4.85%, 5.72%, 6.47%, 7.20% to 7.21%, 7.26% to 7.28% and 7.78% respectively.

Today’s bill auction will have on offer Rs.40 billion, consisting of Rs.12 billion on the 91 day, Rs.9 billion on the 182 day and a further Rs.19 billion on the 364 day maturities. The published stipulated cut off rates for the 91 day and 182 day maturities remain identical to the previous week at 4.67% and 4.78% respectively while the cutoff rate for the 364 day maturity has been increased by 01 basis point to 5.01%.

The total secondary market Treasury bond/bill transacted volumes for 12 December was Rs.6.26 billion.

In the money market, weighted average rates on overnight call money and repos remained mostly unchanged at 4.53% and 4.62% respectively with the overnight surplus liquidity continuing to remain at a high of Rs.237.48 billion.

Activity shifts to spot next contracts

In the Forex market, activity shifted to spot next contracts as it was seen closing the day at levels of Rs. 187.60/00 in comparison to the two week forward closing rates of Rs. 187.50/90 witnessed on the previous day. Spot contracts remained unquoted.

The total USD/LKR traded volume for 14 December was $ 83.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)