Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 31 October 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The overall activity levels in the secondary bill and bond markets remained muted while sentiment remained dull as well during the short trading week ending 28 October as most market participants persisted to stay on the sidelines.

The overall activity levels in the secondary bill and bond markets remained muted while sentiment remained dull as well during the short trading week ending 28 October as most market participants persisted to stay on the sidelines.

The two Treasury bond auction conducted on Friday saw only a total amount of Rs. 18.14 billion been accepted in successful bids against a total offered amount of Rs. 30 billion.

The three-year maturity of 01.07.2025 recorded a weighted average rate of 32.63% while the five-year maturity of 15.01.2028 fetched a weighted average rate of 31.78% against its previous day’s closing rates of 32.00/75 and 31.00/75 respectively.

The phase II of the auction was opened for the undersubscribed three-year maturity whereas the direct issuance window of 20% will be on offer on the fully subscribed five-year maturity until close of business of the day prior to settlement (i.e.,4.00 p.m. on 31.10.2022).

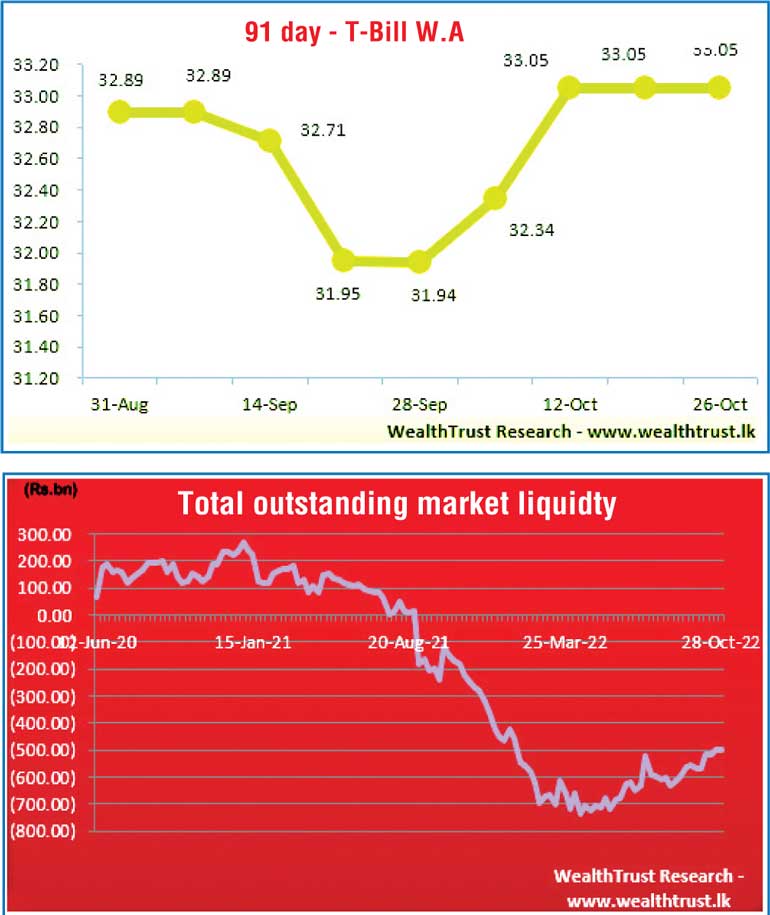

The total accepted amount at the weekly Treasury bill auction increased to 87.06% of the total offered amount while weighted average yields remaining unchanged for a second consecutive week. A further amount of Rs. 4.18 billion was raised at its phase II as well.

In secondary markets, limited trades were seen on the 15.01.28 and 15.07.29 bond maturities at levels of 31.10% each and January-April 2023 bill maturities at levels of 32.00% to 32.60% prior to Friday’s bond auctions while the 01.07.25 maturity was traded at 32.75% following the auction outcome.

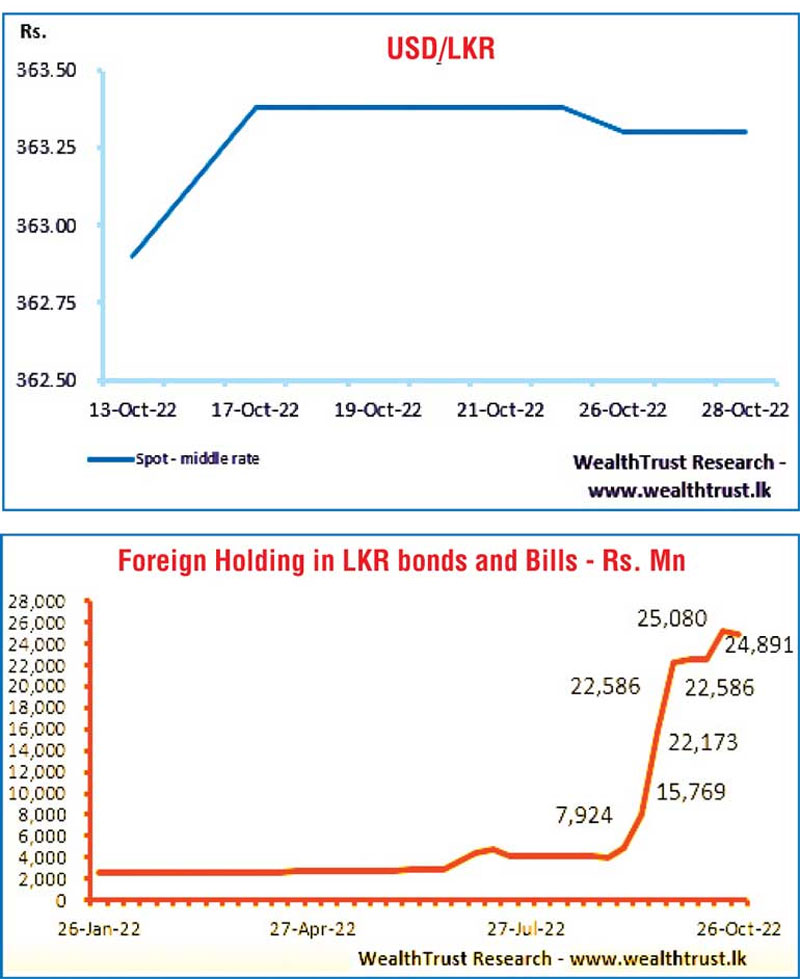

In the meantime, the foreign holding in rupee bonds was seen decreasing during the week ending 26 October 2022 to record a marginal outflow of Rs. 0.18 billion while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 17.63 billion.

In money markets, the weighted average rate on overnight repo was at 15.50% for the week while the total outstanding market liquidity deficit decreased to Rs. 499.22 billion by the end of the week against its previous weeks of Rs. 501.17 billion. The CBSL’s holding of Govt. Security’s stood at Rs. 2,420.59 billion against its previous weeks of Rs. 2,413.29 billion.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected an amount of Rs. 80 billion by way of a 31-day Reverse Repo auction at a weighted average rate of 31.06%.

USD/LKR

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally during the week to close the week at Rs. 363.30 against its previous weeks closing of Rs. 363.38.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 54.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)