Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 11 January 2022 03:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

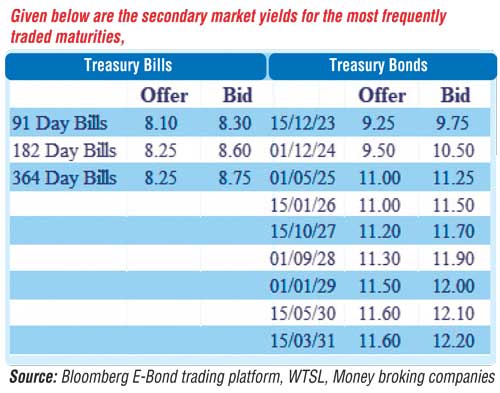

The start of a new trading week saw the dull sentiment in the secondary bond market continuing as only the 01.05.25 maturity changed hands at levels of 11% to 11.05% yesterday. In secondary bills, 8 April 2022 maturity traded at a level of 8.20%.

The start of a new trading week saw the dull sentiment in the secondary bond market continuing as only the 01.05.25 maturity changed hands at levels of 11% to 11.05% yesterday. In secondary bills, 8 April 2022 maturity traded at a level of 8.20%.

At today’s Treasury bond auctions, a total amount of Rs. 50 billion will be on offer consisting of Rs. 12.5 billion each of 15.03.2025 and 15.12.2027 maturities and a further Rs. 25 billion of a new 01.12.2031 maturity. The weighted average yield at the bond auction conducted on 30 December was 12.06% on the maturity of 15.01.2033 while an additional amount of Rs. 2 billion was successfully issued under the Direct Issuance window on the maturity as well. All bids received for the 01.08.2025 and 15.06.2027 maturities were rejected.

The total secondary market Treasury bond/bill transacted volume for 7 January 2022 was Rs. 4.37 billion.

In money markets, the weighted average rates on call money and repo remained mostly unchanged at 5.94% and 6% respectively as an amount of Rs. 467.52 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6%. The net liquidity deficit was registered at Rs. 324.51 billion yesterday with an amount of Rs. 84.51 billion been deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 5%. Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out amounts of Rs. 48.50 billion and Rs. 10 billion by way of overnight and three-day repo auctions at weighted average rates of 5.96% and 5.95% respectively.

USD/LKR

In the Forex market, the overall market remained inactive yesterday.

The total USD/LKR traded volume for 7 January 2022 was $ 31.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)