Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 18 March 2020 00:49 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

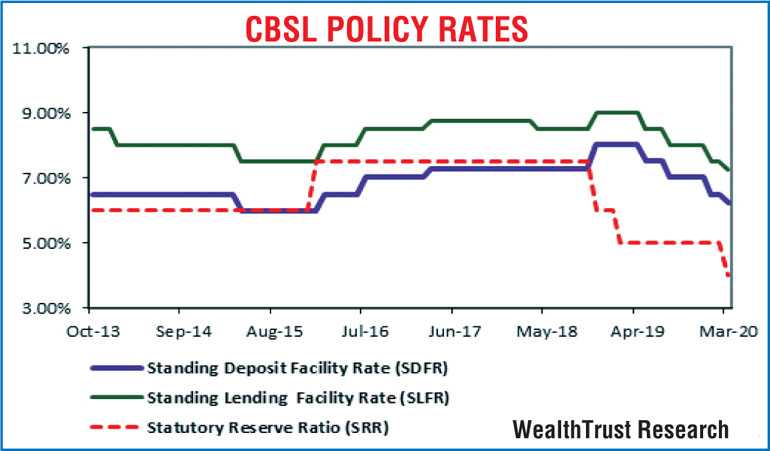

The monetary board of the Central Bank of Sri Lanka, at an urgent meeting held on 16 March, decided to reduce its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) by 25 basis points each to 6.25% and 7.25% respectively. It was further seen reducing the SRR (Statutory Reserve Requirement) applicable for all rupee deposit in Licensed Commercial Banks by 100 basis points as well. This was following a policy cut of 50 basis points on 29 January while the SRR was last reduced on 21 February.

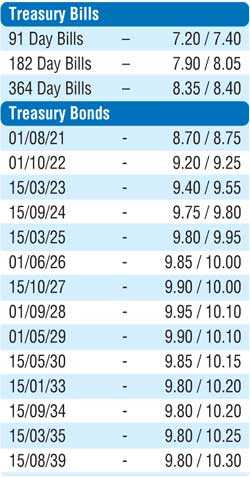

This led to yields on the liquid maturities of 01.10.22 and two 2024s (i.e. 15.06.24 and 15.09.24) dipping to hit intraday lows of 9.20% and 9.75% each respectively in morning hours of trading yesterday against its previous day’s closing levels of 9.35/40, 9.85/92 and 9.87/93. However, overall activity moderated towards the latter part of the day. In addition, trades were witnessed on the maturities of 2021s (i.e. 01.05.21, 01.08.21 and 15.10.21) and 15.07.23 at levels of 8.70% to 9.05% and 9.55% respectively.

This was ahead of today’s weekly Treasury bill auctions, where a total amount of Rs. 29 billion, consist of Rs. 10 billion of the 91 day, Rs. 7 billion of the 182 day and a further Rs. 12 billion of the 364 day maturities will be on offer. At last week’s auction, weighted average yields on the 182 day and 364 day bills increased by 02 basis points each to 8.01% and 8.48% respectively while the weighted average yield on the 91 day bill maturity remained steady at 7.41%.

Meanwhile, in secondary bills, April 2020, May 2020, July 2020, October 2020, December 2020, January 2021 and March 2021 maturities were seen changing hands at levels of 7.40% to 7.50%, 7.60%, 7.37%, 8.05%, 8.22%, 8.28% and 8.39% to 8.40% respectively.

The total secondary market Treasury bond/bill transacted volume for 13 March was Rs. 15.98 billion.

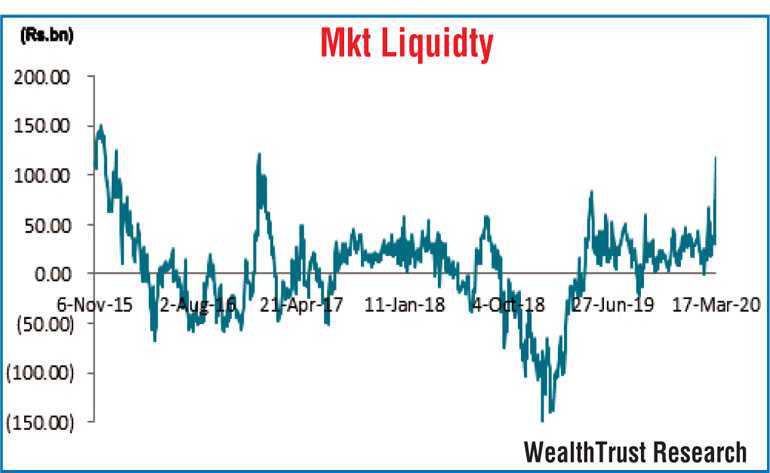

In money markets, the base rate change saw weighted average yields on overnight call money and repo rates decreasing to 6.74% and 6.80% respectively. The SRR change saw the overnight net liquidity surplus in the system increasing to a mammoth volume of Rs. 118.60 billion yesterday, a level last seen in January 2017. The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka drained out an amount of Rs. 66.15 billion at a weighted average of 6.73% by way of an overnight repo auction.

Rupee trades within narrow range

In the Forex market, the USD/LKR rate was traded within the narrow range of Rs. 184.80 to Rs. 185.15 yesterday on the back of an illiquid market.

The total USD/LKR traded volume for 13 March was $ 81.61 million.