Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 13 December 2019 00:00 - - {{hitsCtrl.values.hits}}

WASHINGTON (Reuters): The US Federal Reserve on Wednesday held interest rates steady and signalled borrowing costs will not change anytime soon, with moderate economic growth and historically low unemployment expected to persist through the 2020 presidential election.

In its final policy meeting of a tumultuous year, when it was spurred to cut interest rates three times to forestall a slowdown fuelled largely by President Donald Trump’s trade war, the US central bank struck a remarkably sanguine tone, confident the actions it had taken so far are working.

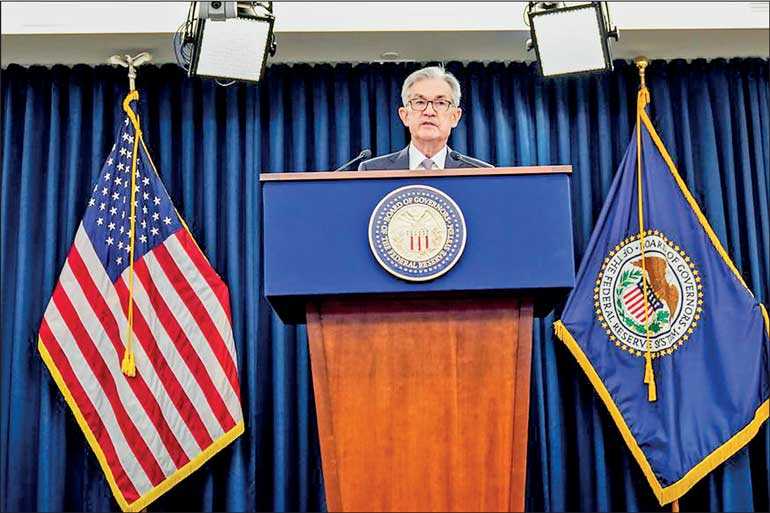

“Our economic outlook remains a favourable one, despite global developments and ongoing risks,” Fed Chair Jerome Powell said in a news conference shortly after the release of the latest policy statement and new quarterly economic projections.

“As the year progressed we adjusted the stance of monetary policy to cushion the economy and provide some insurance ... This shift has helped support the economy and has kept the outlook on track,” he said.

The policy decision left the Fed’s benchmark overnight lending rate in its current target range between 1.50% and 1.75%, three-quarters of a percentage point below where it started the year.

And after broad disagreement earlier over the direction of policy and dissents at its last four rate-setting meetings, the Fed ended the year on the same page. The vote on its latest policy statement was unanimous, and the new economic projections showed 13 of 17 Fed policymakers foresee no change in interest rates until at least 2021.

The other four saw only one rate hike next year.

Notably, no policymakers suggested lower rates would be appropriate in coming months.

Combined, it’s evidence of a central bank in which the most “dovish” members feel the current low level of interest rates will allow job and wage gains to continue, while the most “hawkish” feel inflation will remain contained – a soft landing for both sides after a year in which recession risks rose, the US bond yield curve inverted, and trade policy disrupted markets.

Powell, who at the start of his news conference read a brief tribute to the late Paul Volcker, the Fed’s inflation-fighting former chairman, said the central bank now sees the connection between low unemployment and inflation as “very faint.”

“We don’t have to worry so much about inflation,” Powell said, adding it would take a “persistent” jump in the pace of price increases for him to think it warranted higher interest rates.

While the decision not to cut interest rates further may irk Trump, who has demanded even lower borrowing costs, the Fed’s underlying message that the US economy is in a “good place” bodes well for the Republican incumbent’s reelection.

The only two sitting presidents in the modern era not to have won reelection – Jimmy Carter and George H.W. Bush – both contended with unemployment rates more than twice the level under Trump. The US jobless rate is currently 3.5%.

Still, the Fed noted, global risks warrant monitoring in the midst of an ongoing US-China trade war, as does the possibility of a downshift in public inflation expectations.