Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 13 September 2023 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Sri Lanka announced to eligible holders the acceptance of offers by the republic pursuant to the invitation to participate in the bond exchange as part of the domestic debt optimisation program. As per the Ministry of Finance, the percentage of the aggregate outstanding principal amount of eligible bonds for which valid offers have been accepted is approximately 84%.

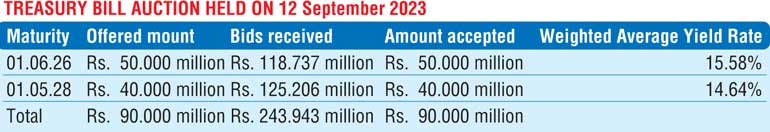

The outcome of the Treasury bond auctions conducted yesterday was a bullish one as its total offered amount of Rs. 90 billion was successfully taken up at the 1st phase of the auction while weighted averages decreased in comparison to the round of bond auctions conducted on 28 August 2023. A further amount of 20% or Rs. 18 billion will be on offer on both maturities (01.06.26 and 01.05.28), through a direct issuance window, until the close of business on Thursday. (i.e., 4.00 p.m. on 14.02.23). Given below are the details of the auction,

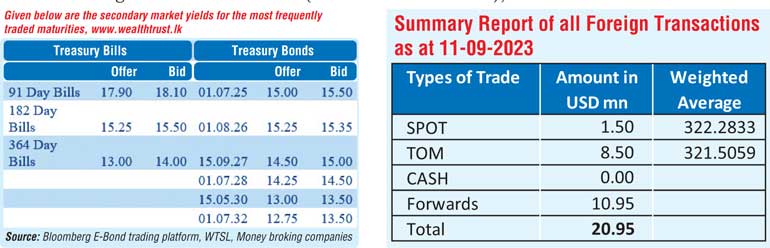

The secondary bond market became active following the auction outcome on the maturities of 01.07.25, 01.08.26, 01.07.28, 15.05.30 as it was seen trading at levels of 15.25%, 15.80% to 15.10%, 14.50 to 14.25% and 13.50% to 13.25% respectively. In secondary market bills, December 2023 maturities traded at levels between 18.00% to 17.80% and March 2024 traded at levels of 15.50% to 15.00%.

The total secondary market Treasury bond/bill transacted volume for 11 September 2023 was Rs. 8.70 billion.

Today’s weekly Treasury bill auction will have in total an amount of Rs. 160 billion on offer which will consist of Rs. 80 billion on the 91-day maturity, Rs. 40 billion on the 182-day maturity and a further Rs. 40 billion on the 364-day maturity. Last week’s treasury bill auction (held on 06.09.23) saw its total offered amount of Rs. 140 billion fully taken up at the 1st phase of the auction while weighted average yields remained broadly steady at 18.46%, 15.36% and 13.58% on the three maturities respectively.

In money markets, the weighted average rates on overnight call money and Repo stood at 11.49% and 11.74% respectively while the net liquidity deficit stood at Rs. 74.64 billion yesterday.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight repo auction for Rs. 45.63 billion at a weighted average rate of 11.44%. In comparison, an amount of Rs. 31.51 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 12.00%. Rs. 2.49 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 11.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 322.45/322.75 against its previous day’s closing level of Rs. 322.25/322.50.

The total USD/LKR traded volume for 11 September was $ 92.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)