Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 19 January 2024 00:04 - - {{hitsCtrl.values.hits}}

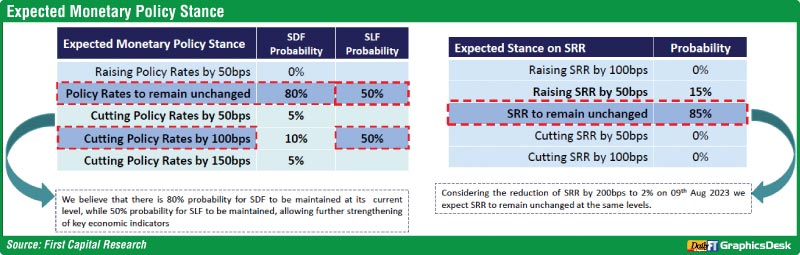

First Capital Research yesterday expressed the belief that there is an 80% possibility for the Central Bank (CBSL) to maintain SDF rate at its current level, allowing further strengthening of key economic indicators.

It made this forecast ahead of the upcoming policy meeting scheduled for next week.

First Capital Research also said there is a 20% probability for CBSL to relax the SDF rate, with a probability of 10% for a rate cut of 100bps, 5% for rate cut of 50bps and another 5% for 150bps rate cut in order to reduce rates and Government security yields at a faster pace to facilitate the strengthening of the Financial sector.

“We believe there is a 50% possibility for CBSL to maintain SLF rate at its current levels, while there is an equal probability of the CBSL adopting a singular monetary policy stance, potentially resulting in a 100bps reduction in the SLF rate. Further, there is 85% possibility to keep SRR unchanged, while considering the risk associated with it there is a 15% possibility for a SRR hike of 50bps,” First Capital Research added.

In contrast to First Capital Research’s prediction, CBSL at its last policy review meeting decided to reduce policy rates, one policy meeting ahead of our expectations adopting a more aggressive monetary easing path. The Central Bank reduced the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 100bps to 9.00% and 10.00%, respectively at the monetary policy review announced on 24 Nov-23.

“However, in line with our expectations CBSL announced a possible halt in monetary easing at the new levels. The decision was reached by the Board after carefully analysing present conditions and anticipated changes in the domestic and global economy, with the aim of achieving and maintaining inflation at the targeted level of 5.0% over the medium term, while enabling the economy to reach and stabilise at the potential level,” First Capital Research said.

Further, it said the Monetary Board viewed that with this reduction of policy interest rates, along with the monetary policy measures carried out since June 2023, sufficient monetary easing has been affected in order to stabilise inflation over the medium term.

Key Arguments considered by CBSL for its policy stance announced on 24 November 2023 were Stable inflation outlook over the medium term and subdued demand pressures; Market interest rates are expected to normalise in the period ahead; Credit to the private sector is expected to increase further in the period ahead, thereby supporting the envisaged rebound of domestic economic activity.

First Capital Research also said at the annual policy statement 2024, the Governor of the CBSL declared a strategic shift, indicating a transition towards a single policy interest rate mechanism, instead of the existing dual policy interest rates to improve the monetary policy transmission and signalling effect of the monetary policy stance.

“As per our view, at the upcoming policy meeting, there is a 50% possibility for CBSL to maintain SLFR rate at its current levels, while there is an equal probability of the CBSL adopting a singular monetary policy stance, potentially resulting in a 100bps reduction in the SLFR rate,” First Capital Research added.