Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 16 May 2024 00:45 - - {{hitsCtrl.values.hits}}

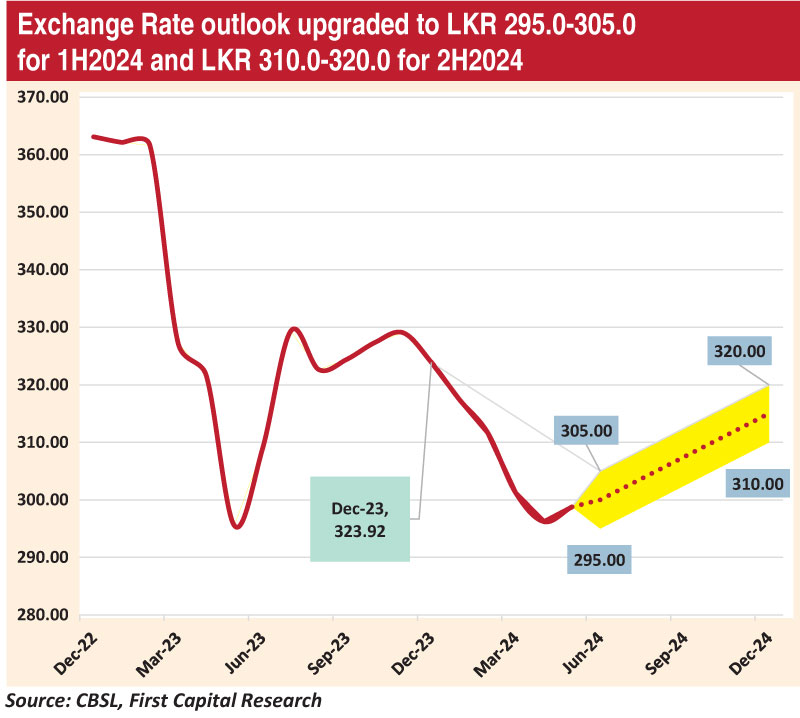

First Capital Research has upgraded its exchange rate outlook for the rupee both in the first half and second half of this year.

It forecasts the US Dollar Exchange Rate to be Rs. 295-305 for 1H2024 and Rs. 310-320 for 2H2024.

First Capital Research (FCR) said in the first half of 2024, the outlook for the LKR has been revised upwards, with potential appreciation pressure. This adjustment stems from the implementation of higher taxes, expected to notably dampen rising consumer demand in the short term amid the escalation in the cost of living.

Consequently, the LKR is projected to appreciate within a range of 295.0-305.0. “Slower consumer demand may lead to a reduction in imports, while the peak tourism season in the 1Q2024 and higher worker remittances could further bolster the LKR. Subsequently, some stabilisation is anticipated as consumer demand improves and tourism income moderates,” it said.

“Conversely, in the second half of the year, depreciation pressure on the LKR may ensue. This is attributed to the restart of loan repayments post EDR, heightened demand for imports amidst improved economic conditions. In light of these factors, the LKR is expected to experience depreciation, targeting a range of 310.0-320.0 for the latter half of 2024,” FCR added.

One of the factors influencing the LKR outlook according to FCR is the sharp strengthening of official reserves which it forecast to grow to $ 6.3 billion by end 2024.

Official reserves of the CBSL saw a sizable uptick of 23.0% in the month of December 2023, following the disbursements received from the IMF (2nd Tranche), World Bank and ADB. Accordingly, the reserves level climbed higher to $ 4.4 billion by the end of 2023 and continued to exhibit robust improvement in the 1H2024 amidst various positive developments as it closed at a 3 ½ -year high of $ 5.4 billion by the end of April 2024.

Moreover, CBSL dollar purchases continued to outdo dollar sales, since Sep-23, while Mar-24 Dollar purchases mounted to a record high of $ 715.0 million while dollar sales were null during the month. This move has resulted in a sharp appreciation of the rupee since the onset of 2024.

However, it is anticipated that reserve accumulation will moderate during the latter part of 2024, as the government is poised to commence loan repayments following the conclusion of the External Debt Restructuring (EDR) process. Additionally, an anticipated uptick in import expenditure in the recovering economy may place further strain on the government’s reserve positions, potentially leading to rupee depreciation.

FCR also expects tourism earnings to reach $ 3 billion and workers remittances to be $ 6.6 billion by the end of 2024.

In 2023, tourism earnings totalled $ 2.1 billion, accompanied by 1.5 million tourist arrivals, aligning closely with the FCR target. In 2024, the tourism landscape is to witness a resurgence as numerous airlines and cruise tourism operations recommenced activities. Concurrently, extensive promotional campaigns were launched, with a notable shift in traveller preferences from the Maldives to Sri Lanka, aimed at invigorating the tourism sector.

The potential surge in tourism earnings and tourist arrivals carries the capacity to bolster the local currency through heightened demand in exchange transactions. Moreover, it can contribute to a favourable current account balance, thereby attracting foreign investment and strengthening the currency’s value. Additionally, the ongoing growth and investment prospects associated with a developing tourism industry have the potential to spur economic expansion and attract capital inflows, further uphold currency appreciation.

Further, a stable rupee will support inflows as the recovery of the economy and a possible credit rating upgrade (possibly post achieving debt sustainability by Aug-24), will make Sri Lanka an attractive destination for investments.

FCR projections indicate a surge in tourist arrivals in Sri Lanka, surpassing 2.0 million in 2024, alongside a targeted earnings figure of $ 3.0 billion, reflecting a substantial YoY increase of 46.3%. This anticipated growth is poised to augment inflows into the country, potentially mitigating any pressures of currency depreciation.

In 2023, worker remittances were recorded at $ 6.0 billion, which was broadly in line with FCR expectations. Over the past six months, worker remittances have displayed a consistent upward trajectory, with a notable surge leading up to the festive season in April, registering $ 1,536.0 million from Jan-Mar 24. Throughout the six-year span from 2015 to 2020, worker remittances averaged over $ 7.0 billion annually, significantly bolstering foreign exchange liquidity within the country and its banking system.

Various initiatives have been implemented to support migrant workers who remit funds to Sri Lanka through official channels, including the provision of low-interest loans and vehicle import permits, alongside increased duty-free concessions at airports. These efforts aim to incentivise and streamline the remittance process, encouraging continued financial contributions from migrant workers, thereby exerting upward pressure on the currency.

The stability in the rupee will help wipe out spreads between official channels and undiyal, making people opt for official channels to remit money in the future.

If the current positive trajectory in worker remittances persists, FCR anticipates that such inflows could reach $ 6.6 billion in 2024E. This influx of funds has the potential to bolster the country’s foreign exchange reserves, thereby contributing to upward momentum in the exchange rate.

Whilst noting consumer confidence is on the rise as the economy signals recovery, FCR said rupee would face pressure as import restrictions are eased.

“A positive turnaround in GDP is forecasted for 2024, signalling increased consumer demand. As domestic spending rises, there is a likelihood of greater preference for imported goods and services, consequently driving import demand whilst off-peak tourism season may place downward pressure on the Sri Lankan Rupee in the latter half of 2024,” FCR said.

“Since January 2024, the trade deficit has been widening, mirroring the uptick in imports, and this trend is anticipated to continue in the period ahead. As a positive reversal in GDP is forecasted for 2024, we anticipate a resurgence in purchasing power and heightened demand for imports, consequently exerting pressure on the LKR and potentially leading to currency depreciation,” FCR said.

In its report, FCR also noted Heavy debt repayments & easing global monetary conditions are expected to weigh on the Rupee. Sri Lanka has annual repayment obligations of nearly $ 6.0 billion-7.0 billion (may decline to $ 3.0 billion - 4.0 billion, post EDR) in foreign loans until 2029 and may build up its foreign reserve buffer over the coming months which may exert a downward pressure on the exchange rate. It recalled that In May 2023, CBSL relaxed the cash margin deposit requirements on specific imports and also expects the gradual removal of the existing import restrictions in the near future, which can potentially exert downward pressure on the exchange rate.

Although the currency is on an appreciating trend in the midst of improved tourism earnings, higher remittances and inflows. Upon completion of the EDR and a possible credit upgrade, inflows may flow in from multilateral and bilateral countries upholding the appreciation trend. However, trade relaxations and repayments of loans expected from 4Q2024 may partly offset the appreciation of the currency. We expect that the turnaround in the GDP coupled with the relaxation of import restrictions may set the tone for the currency to be on a slower than expected appreciation trend, FCR said.