Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 10 January 2023 01:40 - - {{hitsCtrl.values.hits}}

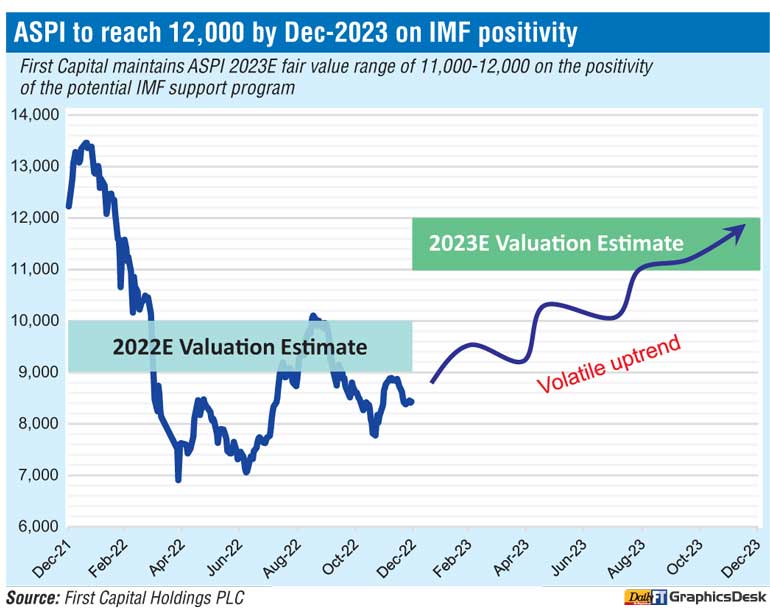

First Capital is recommending a shift to listed equities forecasting the benchmark All Share Price Index (ASPI) to reach 12,000 points in 2023.

In an equity strategy, First Capital said it maintains ASPI 2023 fair value range of 11,000-12,000 on the positivity of the potential IMF support program.

Last year the ASPI dipped by 30.5% to close at 8,489.66 points.

Cautiously bullish, First Capital recommends increasing equity exposure to 65%. In comparison mid-last year it recommended a reduction in equity exposure to 40-50% from 60%.

“With the improving economic indicators and the potential developments, Equity Market warrants a higher exposure to benefit from the potentially stronger returns towards the 2H2023,” First Capital Research said.

It said key indicators support improvement in investor confidence. Among positive factors it cited were Government retains majority securing stability: Strengthening liquidity position; Retention of Tax-Free Environment for Equity; Interest rates trend downwards and potential IMF Board-Level Agreement.

It recalled that with the uncertain environment on all three fronts, Political, Economic and External factors, adopted a stance to be watchful in the market with only about 40%-50% equity exposure.

In line with the expectations, the significant volatility in the market was clearly visible.

“However, more recently we are starting to witness a much clearer policy direction together with tough unpopular reform measures being implemented which is likely to bring in long term positivity. Moreover, with the reforms, Sri Lanka has started to move closer towards Board approval of the IMF program,” First Capital said.

It also noted that high dividend yields offer extra boost to gains whilst interest rates are tipped to head downwards.

Among sectors and stocks it recommends include: