Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 17 July 2023 03:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

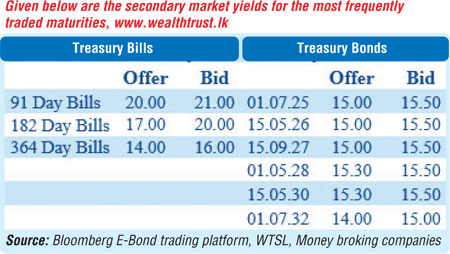

The trading activity in the secondary bond market dried up during the latter part of the week ending 14 July, subsequent to yields fluctuating during the early part of the week. The commencement of Treasury bond auctions after a lapse of around four months led to selling interest which saw yields on the liquid two 2027 maturities (i.e., 01.05.27 and 15.09.27) increasing to weekly highs of 15.00% and 15.50% respectively each before bouncing back to hit weekly lows of 14.40% and 14.50% respectively on the back of renewed buying interest.

The trading activity in the secondary bond market dried up during the latter part of the week ending 14 July, subsequent to yields fluctuating during the early part of the week. The commencement of Treasury bond auctions after a lapse of around four months led to selling interest which saw yields on the liquid two 2027 maturities (i.e., 01.05.27 and 15.09.27) increasing to weekly highs of 15.00% and 15.50% respectively each before bouncing back to hit weekly lows of 14.40% and 14.50% respectively on the back of renewed buying interest.

However, yields were seen increasing and widening once again following the weekly Treasury bill auction results where weighted averages increased for the first time in seven weeks while the auction went undersubscribed.

Nevertheless, the Treasury bond auctions conducted saw its total offered amount of Rs. 100 billion being successfully taken up at its 1st phase of the auction. This intern saw the auction maturities of 01.05.28 and 15.05.30 trading within the range of 15.30% to 15.60% against its weighted average rates of 15.74% and 15.67% respectively.

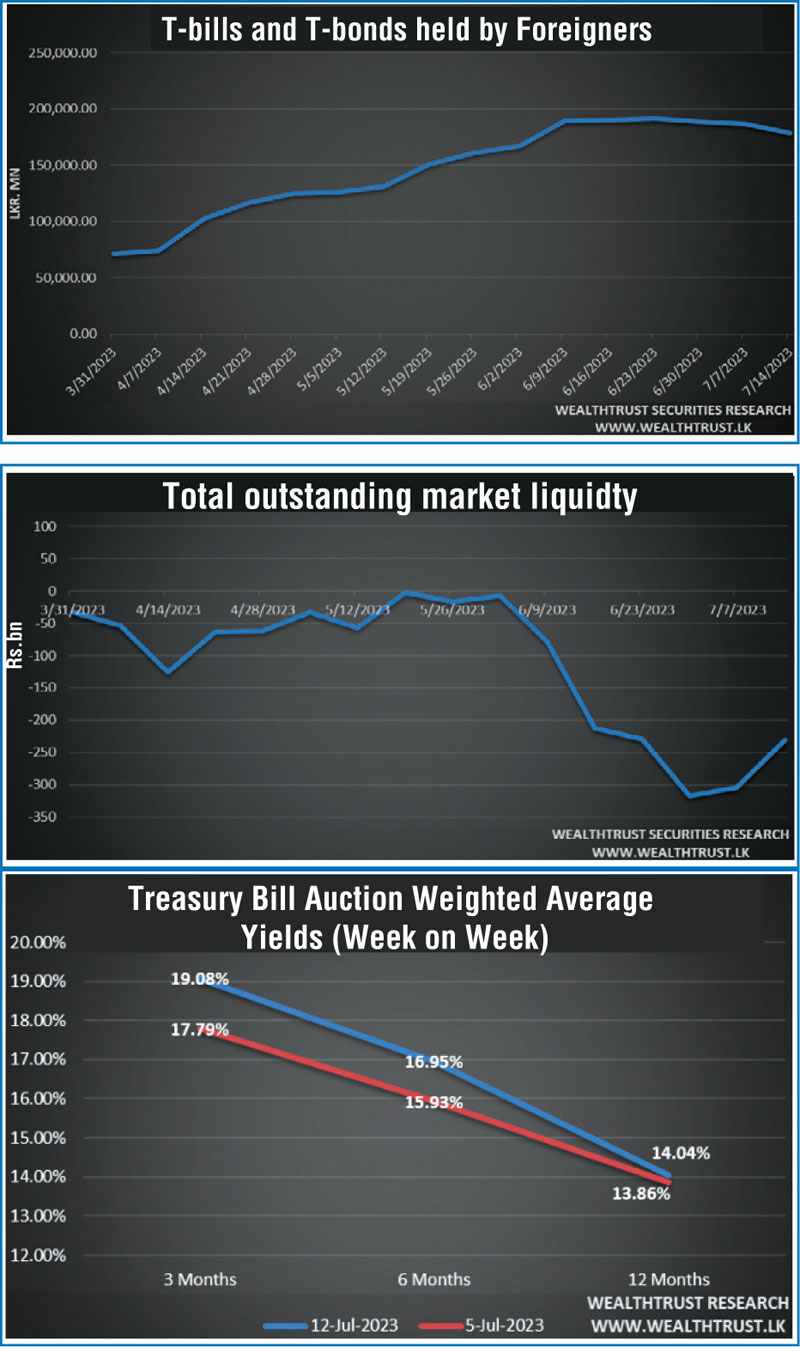

Meanwhile, the foreign outflow for the week ending 12th July 2023 was recorded at Rs. 8.11 billion while totalling Rs.9.96 billion over the past three weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs.42.69 billion.

In money markets, the total outstanding liquidity deficit was recorded at Rs.230.59 billion by the end of the week against its previous week’s deficit of Rs.303.44 billion while the Central Bank of Sri Lanka’s (CBSL) holding of Gov. Security’s registered at Rs.2,539.09 billion against its previous weeks of Rs.2,542.76 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse repo auctions at weighted average yields ranging from 11.58% to 12.00%.

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week at Rs.319.50/321.00 against its previous weeks of Rs.312.00/313.00 subsequent to trading within the range of Rs.312.50 to Rs.319.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at US $ 62.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)