Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 13 December 2021 02:05 - - {{hitsCtrl.values.hits}}

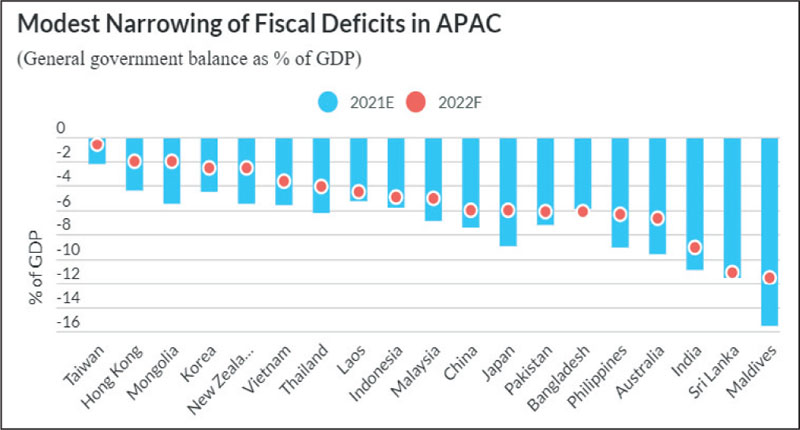

Fitch Ratings projects fiscal deficits to narrow in nearly all APAC sovereigns in 2022, as relief measures unwind and revenue ratios rise with the recovery of domestic demand.

It said the narrowing of deficits would generally be modest, however, as governments exercise caution in withdrawing support in view of fragile recoveries and risks to the outlook.

Consolidation strategies were delayed in APAC emerging markets in 2021, as authorities grappled with further outbreaks of COVID-19. For example, Malaysia (BBB+/Stable) rolled out a series of fiscal support packages in 2021. Indonesia (BBB/Stable) relaxed budget targets for 2021 and 2022, even though the authorities aim to bring the deficit back to within their 3% of GDP ceiling by 2023.

Fitch said consolidation efforts were proceeding more steadily in developed markets, where fiscal relief packages were larger relative to GDP than in emerging markets and where vaccine rollouts were more advanced. “In contrast to most other APAC sovereigns, we expect fiscal and monetary policies in China (A+/Stable) to loosen in 2022, as the authorities seek to cushion the economic impact of other initiatives that are slowing growth. These include measures to contain property-sector financial excesses, a regulatory crackdown on internet-based companies, and the imposition of mobility restrictions in pursuit of ‘zero-COVID’.” “We see the sector outlook for APAC sovereigns in 2022 as improving, but China’s economic slowdown stands among a number of factors that could pose challenges,” Fitch said. Others include the potential for further COVID-19 outbreaks and new variants such as Omicron, and difficult financing conditions associated with US monetary tightening and dollar appreciation. The path of policy normalisation could influence sovereign ratings in APAC, particularly for those on Negative Outlook, such as India (BBB-/Negative), Japan (A/Negative) and the Philippines (BBB/Negative).