Sunday Dec 14, 2025

Sunday Dec 14, 2025

Wednesday, 2 December 2020 00:59 - - {{hitsCtrl.values.hits}}

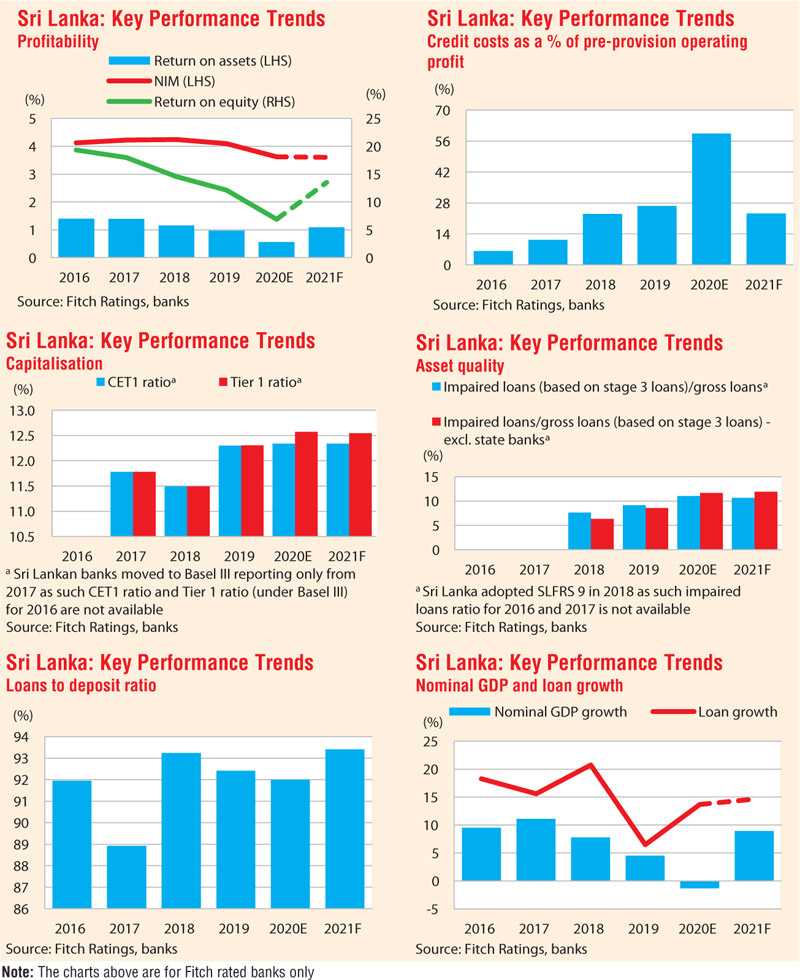

Fitch Ratings warned yesterday that Sri Lanka’s Banking Sector’s downside risks have been elevated, whilst the industry’s credit profile can be impacted further. It said the latest assessment on the Banking Industry was following the sovereign’s weakened credit profile, consequent to Fitch’s downgrade of Sri Lanka’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘CCC’ underscored by relatively sluggish economic activity, external and domestic vulnerabilities and muted private credit growth.

“These factors could in turn impair banks’ credit profiles further – in particular asset quality, profitability and access to foreign-currency funding,” Fitch added in its latest ‘2021 Outlook: Asia-Pacific Emerging Market Banks’. Fitch also said the rating outlook for SL banks is negative.

Following are excerpts from the coverage on Sri Lanka.

Fitch’s Sector Outlook: Stable

Fitch sees the Sri Lankan Banking Sector’s new business and revenue generation prospects in 2021 remaining broadly similar to those in 2020, despite a lingering impact from the pandemic. However, downside risks are elevated due to the sovereign’s weakened credit profile as reflected in Sri Lanka’s ‘CCC’ IDR, underscored by relatively sluggish economic activity, external and domestic vulnerabilities and muted private credit growth. These factors could in turn impair banks’ credit profiles further – in particular asset quality, profitability and access to foreign-currency funding.

Rating Outlook: Negative

Our negative rating outlook is anchored to our negative outlook on the operating environment, which is a high influencing factor for banks’ VRs. However, the banks’ ratings remain under pressure on account of the sovereign’s weakened credit profile.

What to Watch

Economic Recovery; Government Fiscal Position

Sri Lanka’s economic growth prospects will depend largely on how the pandemic progresses both in the country and globally, and also the potential spillover effects of the sovereign’s heightened external debt repayment challenges on the domestic economy. We expect real GDP to contract by 6.7% in 2020 versus our earlier estimate of 3.7%, before rising to 4.9% in 2021, from a lower base.

State demand for credit on the back of the sovereign’s weak fiscal position could be supportive of loan growth for the sector, particularly for State Banks, and partly offset weak private-sector sentiment and demand. Albeit, it would increase these banks’ concentration risk to the fiscally weak State Sector.

Asset Quality to remain weak

Fitch expects underlying asset-quality stress to continue into 2021 as regulatory relief measures – which have delayed the recognition of the build-up – taper off. We estimate loans under moratorium accounted for at least 26% of the Fitch-rated banks’ loans at end-June 2020, with restructured loans rising even prior to the onset of the pandemic, reflecting the potential pressure on banks’ impaired loans.

Any possible pick-up in loan growth can have a sobering impact on the impaired-loan ratio, which will have to be seen against the pace and quality of economic recovery that we expect.

Profitability Hinges on Loan Growth, Credit Costs

Any improvement in profitability in 2021 is likely to stem from a pick-up in loan growth and a softer rise in credit costs, as banks build up loan-loss buffers further this year – credit costs/average gross loans for Fitch-rated banks rose to 1.6% in 1H20, from 1% in 2019. We see credit costs exceeding 20% of pre-provision operating profit in 2021, down from 60% in 2020, but a sharper than expected deterioration in loan quality could keep profitability muted for a longer time frame, if economic recovery fails to take place on expected lines.