Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 4 June 2018 00:00 - - {{hitsCtrl.values.hits}}

Fitch Ratings is maintaining a negative banking sector outlook for 2018 as operating conditions are likely to remain challenging.

Sri Lankan banks’ 2017 results were muted amid a difficult operating environment as economic growth slowed to 3% in 2017, the lowest in 16 years.

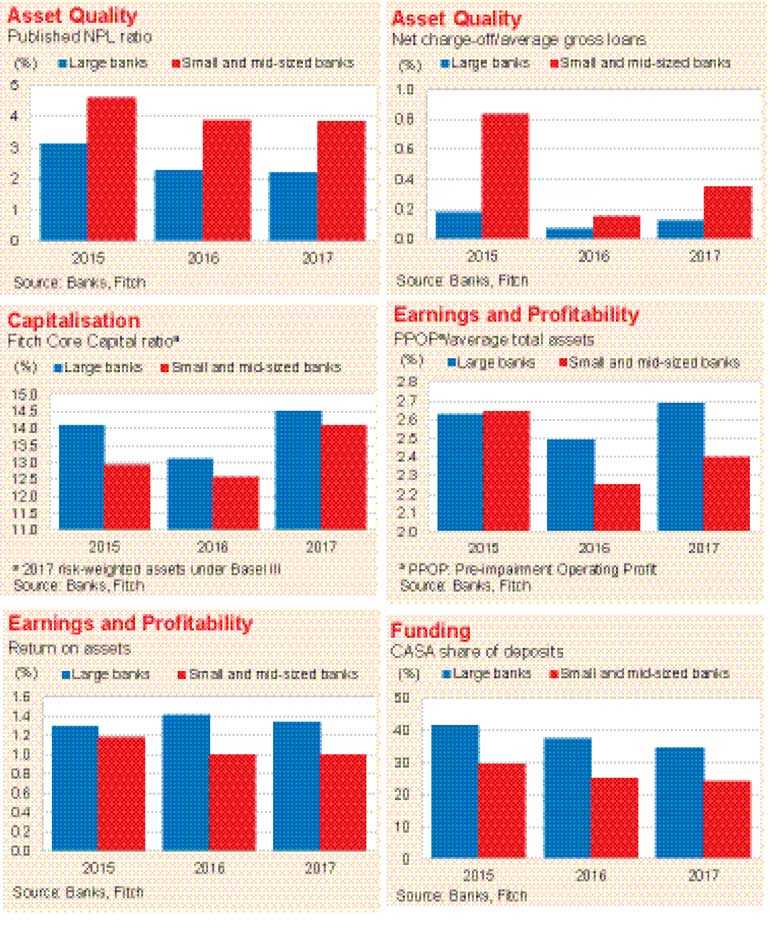

“The lacklustre economic conditions resulted in banks facing moderate asset quality pressure through 2017 and into 1Q18 but we do not expect the sector’s nonperforming loan (NPL) ratio to reach historical highs. Capital requirements for the banks have increased with the implementation of Basel III in July 2017,” said Fitch in a special publication Sri Lanka Banks Results Dashboard.

Following are other highlights of the Dashboard compiled by Fitch Sri Lanka Vice President

Rukshana Thalgodapitiya, CFA and analyst Jeewanthi Malagala, CFA.

Slower Loan Growth: We expect loan growth to moderate further in 2018 due to a reduction in consumption demand. Loan growth slowed in 2017 to 16%, in line with our expectations, from 18% in 2016 (2015: 21%) as tighter monetary policy curbed credit demand.

Weaker Asset Quality: We expect NPLs to rise through 2018 on the back of difficult operating conditions. Sector NPLs rose 13% in 2017, reversing from back-to-back contractions in the last three years and continued to rise in 1Q18 as reflected in the banks’ reported results. Some recoveries and/or write-offs in 4Q17 helped the year-end sector NPL ratio improve marginally to 2.5% before ticking up to 3% at end-1Q18.

Profitability Pressure: We expect pressure on the banks’ profitability to continue in 2018 from increased credit costs with the implementation of SLFRS 9 and weaker asset quality. A new levy proposed in the government’s 2018 budget could also reduce the sector’s profits. Net profit growth was subdued at 10% in 2017 (2016: 25%) due to higher credit costs and the full year impact of the higher financial VAT introduced in November 2016 – both of which resulted in stagnant sector return on assets.

Improved Capital: Fitch believes that the one-time impact of SLFRS 9 on banks’ regulatory capital ratios could be spread out across several years. In 2017, Sri Lankan banks raised Rs. 50 billion in equity and issued Rs. 11 billion of Basel III-compliant subordinated debt ahead of the full implementation of Basel III on 1 January 2019. This included Rs. 10 billion of equity among the large state-licensed commercial banks. Capital raising is likely to continue in 2018, mostly among the large banks, although much of the shortfall was bridged in 2017.

Stable Funding: Loan/deposit ratios are likely to improve in 2018 due to our expectations of a moderation in lending and healthy deposit growth with banks’ balance sheets being fairly liquid. The share of low-cost current and savings accounts (CASA) in the deposit mix continued to decline to 34% (2016: 36%) as term deposits increased due to higher interest rates. Deposits were the main source of funding for banks at 80% at end-2017.