Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 11 September 2023 02:24 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

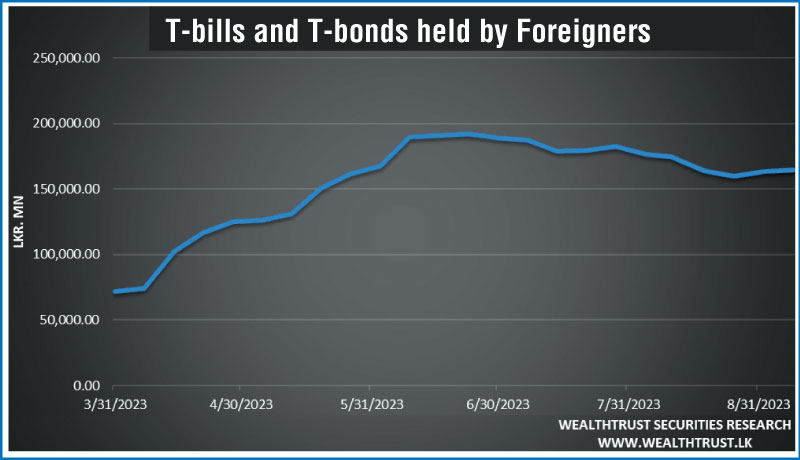

The foreign appetite for Rupee Treasuries continued for a second consecutive week, recording an inflow amounting to Rs. 1.34 billion.

The foreign appetite for Rupee Treasuries continued for a second consecutive week, recording an inflow amounting to Rs. 1.34 billion.

This brings the total T-bills and T-bonds held by foreigners to Rs. 164.54 billion for the week ending 7 September. This is in contrast to four consecutive weeks of outflows up to the week ending 24 August.

Meanwhile, two Treasury bond auctions totalling Rs. 90 billion are scheduled to take place on Tuesday, 12 September.

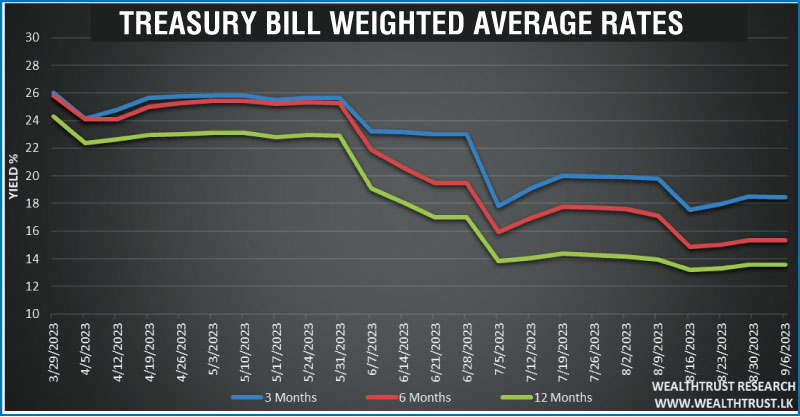

Furthermore, in total an amount of Rs. 169.36 billion (at the 1st and 2nd phase) was raised at the weekly Treasury bill auction as against its total offered amount of Rs. 140.00 billion. Averages remained broadly steady with only the 91-day tenor recording a 2 basis point dip to 18.46% while the 182-day and 364-day maturities remained unchanged at 15.36% and 13.58% respectively.

The week ending 8 September saw some major developments. Firstly, the Sri Lankan parliament passed the amendment to the Inland Revenue act which paves the way for the finalisation of the domestic debt optimisation program. In addition, the Governor of the Central Bank of Sri Lanka made the following comments:

The secondary market bond yields were seen closing the week ending 8 September broadly steady, in comparison to its previous week. Activity remaining somewhat subdued, ahead of next week’s auction and the conclusion of the voluntary Treasury Bond Exchange program for superannuation funds slated for 11.09.23. Trades were predominantly on the previous week’s auction maturities. The quoted yields on the liquid auction maturities of 01.08.26 and 01.07.28 were 15.60/15.70 and 14.65/14.70. This was against its intraweek highs of 15.75% and 14.90% and lows of 15.40% and 14.64% respectively.

However, significant buying interest in secondary market bills was witnessed, centring on October, November, December 2023 maturities along with August 2024 maturities that changed hands at levels of 16.50% to 17.50%, 17.40% to 18.50%,17.50% to 18.50% and 15.50% to 15.60% respectively.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 28.96 billion.

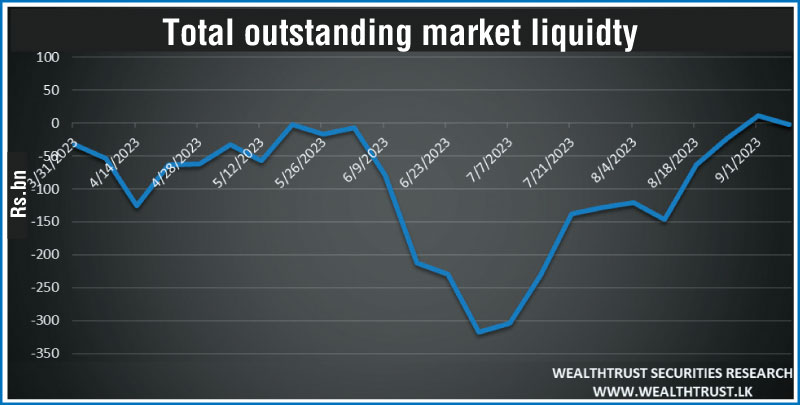

In money markets, the Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term Reverse repo auctions at weighted average yields ranging from 11.52% to 14.11%. The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,556.54 billion against its previous week’s of Rs. 2,604.37 billion.

This week saw the total outstanding liquidity in the money market record a deficit of Rs. 2.22 billion against a surplus of Rs. 10.50 billion for the previous week.

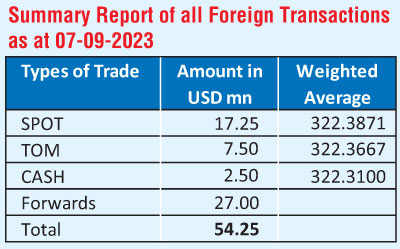

In the forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close the week at Rs. 321.75/322.00 against its previous week’s closing level of Rs. Rs. 319.50/320.00, subsequent to trading at a high of Rs. 320.00 and a low of Rs. 322.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 56.67 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)