Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 2 May 2023 01:52 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

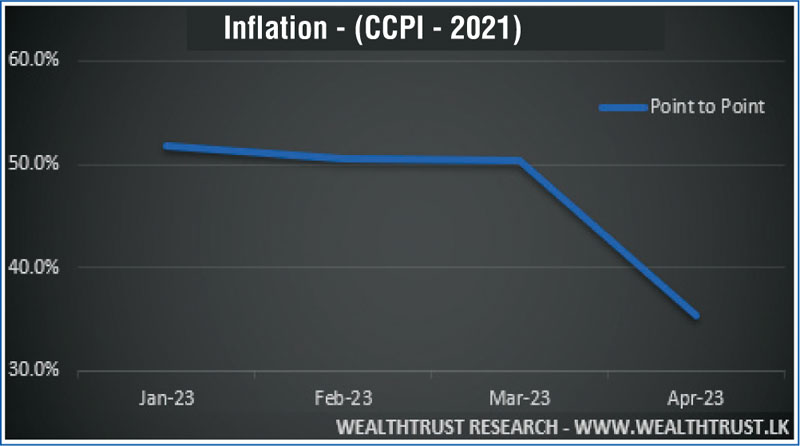

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of April decreased sharply to a 12-month low of 35.3% on its point to point against its previous month’s figure of 50.3%.

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of April decreased sharply to a 12-month low of 35.3% on its point to point against its previous month’s figure of 50.3%.

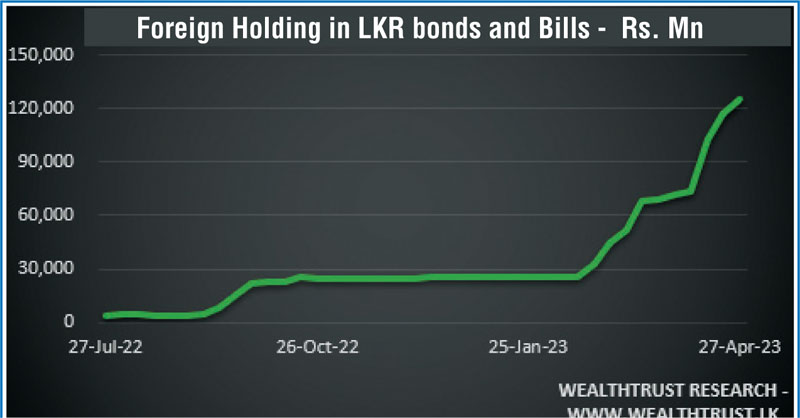

The foreign holding in rupee securities continued its increasing trend, recording an inflow of Rs. 8.52 billion for the week ending 27 April 2023 while its overall holding stood at Rs. 125.13 billion. The accumulated inflow over the past 11 weeks stands at Rs. 99.68 billion.

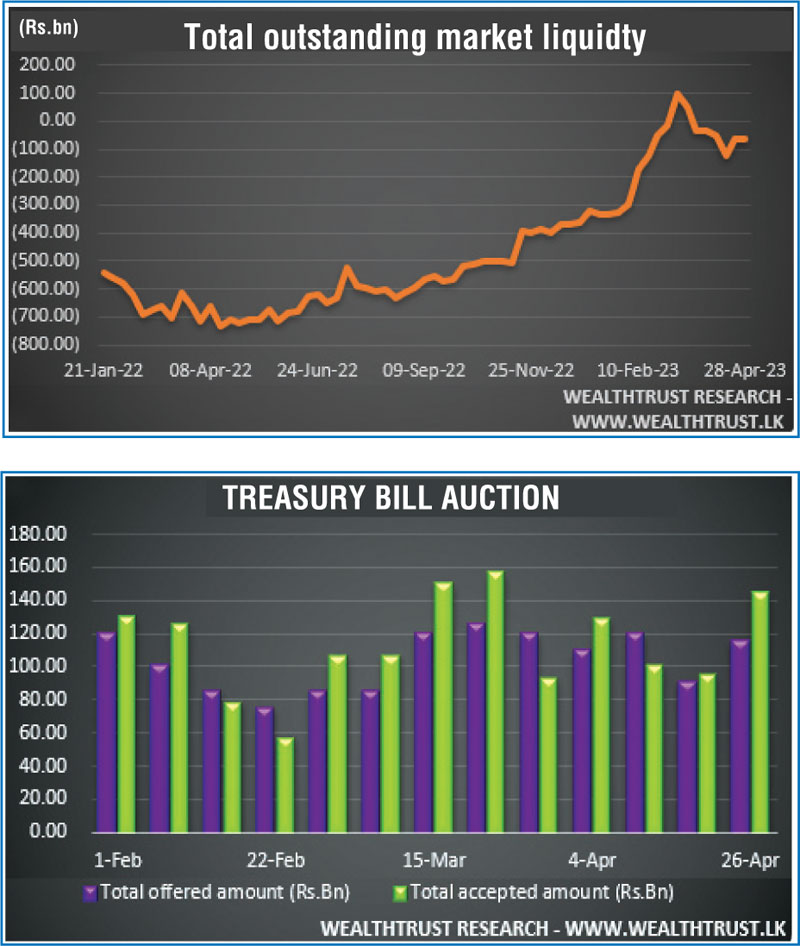

At the weekly Treasury bill auction, the Rs. 115 billion on offer was accepted in successful bids while the additional amount of Rs. 28.75 billion offered through the 2nd phase of the auction was taken up as well. The weighted average rates on all three maturities increased at a condensed pace by 09, 30 and 04 basis points on the 91-day, 182-day and 364-day maturities respectively in comparison to its previous week’s steep increases of 85, 87 and 32 basis points.

In money markets, the total outstanding liquidity shortfall was seen decreasing further for a second consecutive week to Rs. 61.61 billion for the week ending 28 April against its mid-April deficit of Rs. 125.23 billion. Further, the CBSL’s holding of Gov. Security’s decreased further to Rs. 2,590.72 billion against its previous weeks of Rs. 2,616.14 billion.

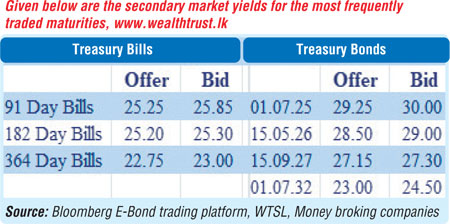

The trading week ending 28 April saw no Treasury bond auctions conducted in lieu of coupon payments due on 1 May. Activity in the secondary bond market continued to centre on the liquid maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) as its yields continued to move higher to weekly highs of 29.50% and 27.60% each respectively from its weeks opening lows of 28.10%, 26.70%, 26.45%, leading to a parallel shift upwards of the overall yield curve for a second consecutive week.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 25.41 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts appreciated marginally during the week to close the week at Rs. 320.90/30 as against its previous week’s closing level of Rs. 321.50/75. The daily USD/LKR average traded volume for the first four days of the week stood at $ 62.57 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)