Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 17 April 2023 02:37 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

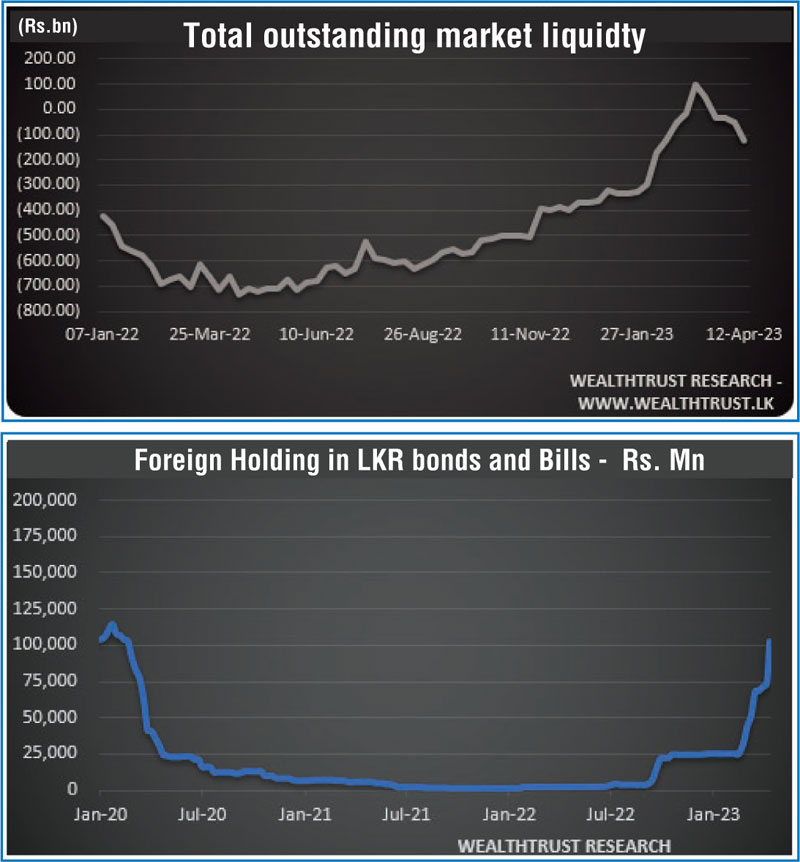

The foreign holding in rupee securities recorded its highest week on week increase in 455 weeks of Rs. 28.52 billion for the week ending 11 April while its overall holding exceeded Rs. 100 billion to stand at Rs. 102.43 billion for the first time since February 2020.

The foreign holding in rupee securities recorded its highest week on week increase in 455 weeks of Rs. 28.52 billion for the week ending 11 April while its overall holding exceeded Rs. 100 billion to stand at Rs. 102.43 billion for the first time since February 2020.

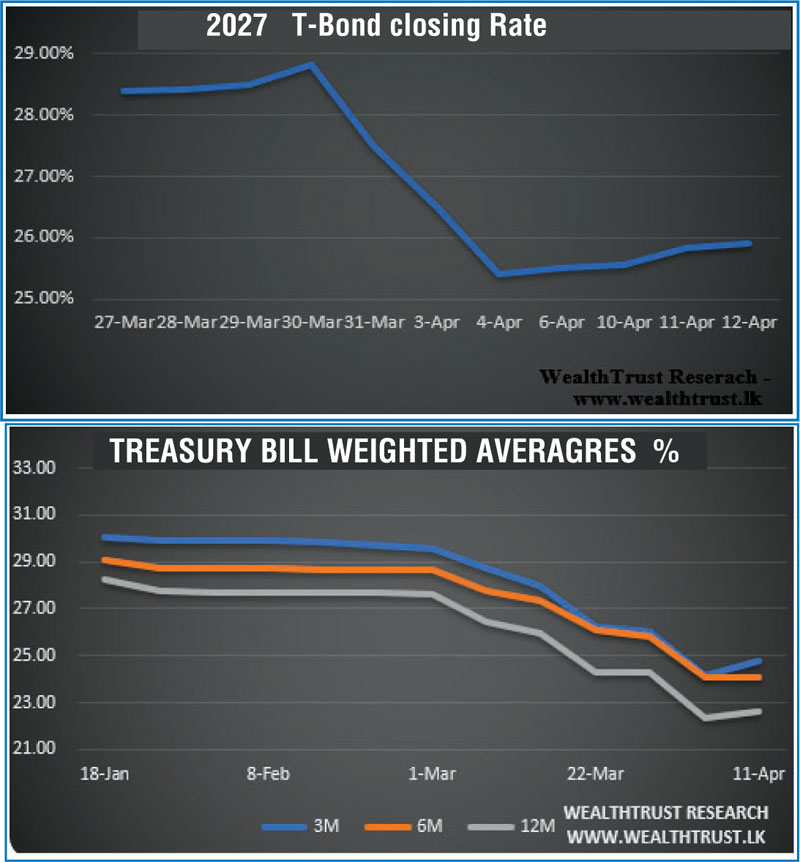

However, Treasury bond yields in the secondary market were seen increasing during the shortened trading week ending 12 April, reversing the downward trend witnessed over the previous week, reflecting an upward shift of the overall yield curve.

This upward tick in bond yields was supported by the outcome at the weekly Treasury bill auction where the weighted average yields of the 91-day and 364-day maturities increased by 68 and 27 basis points respectively to 24.80% and 22.64%. Furthermore, the auction succeeded in accepting only an amount of Rs. 99.98 billion in total at its 01st phase against a total offered amount of Rs. 120 billion.

The most traded bond maturities were the 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) as its yields increased to weekly highs of 27.60%, 25.95% and 26.00% respectively against its previous weeks closing level of 26.75/00 and 25.40/60 each. Furthermore, the 01.05.24 maturity too was seen changing hands within the range of 25.00% to 26.00% as well. However, renewed buying interest at these levels curtailed any further upward movement while yields closed marginally lower from its weekly highs.

The daily secondary market Treasury bond/bill transacted volumes for the first two trading days of the week averaged Rs. 25.17 billion.

In money markets, the Domestic Operations Department (DOD) of Central Bank injected Rs. 141.95 billion in total during the week by way of 07 and 30-day Reverse repo auctions at weighted average yields of 16.50% and 22.07% to 22.28% respectively.

The total outstanding liquidity deficit increased to Rs. 125.23 billion by the end of the week against its previous week’s deficit of Rs. 53.89 billion while CBSL’s holding of Government Security’s increased marginally to Rs. 2,688.95 billion against its previous weeks of Rs. 2,688.71 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contacts was seen appreciating marginally during the week to close the week at Rs. 320.00/320.50 against its previous weeks closing level of Rs. 320.00/321.00 subsequent to fluctuating within a high of Rs. 319.40 and a low of Rs. 320.15 during the week.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 69.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)