Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 27 January 2025 00:47 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

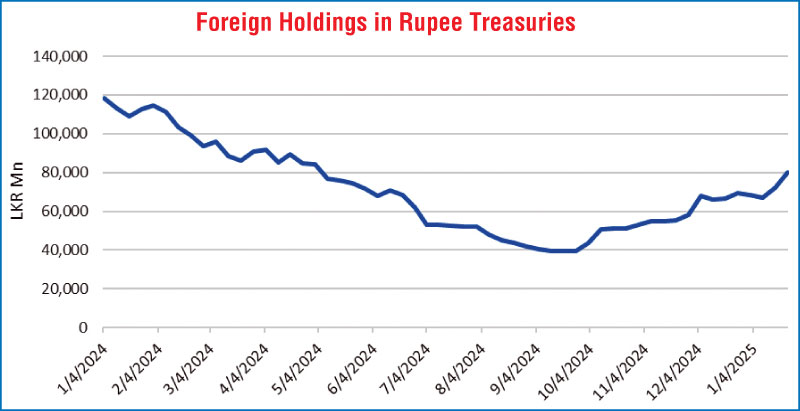

The foreign holding in Sri Lankan Rupee-denominated Treasury securities recorded a sizable increase of Rs.7.77 billion for the week ending 23 January 2025. As a result, total foreign holdings were seen increasing by 11% week-on-week to Rs. 80 billion, reaching the highest level since 9 May last year. This exhibits a robust renaissance in foreign investor appetite for rupee treasuries.

The foreign holding in Sri Lankan Rupee-denominated Treasury securities recorded a sizable increase of Rs.7.77 billion for the week ending 23 January 2025. As a result, total foreign holdings were seen increasing by 11% week-on-week to Rs. 80 billion, reaching the highest level since 9 May last year. This exhibits a robust renaissance in foreign investor appetite for rupee treasuries.

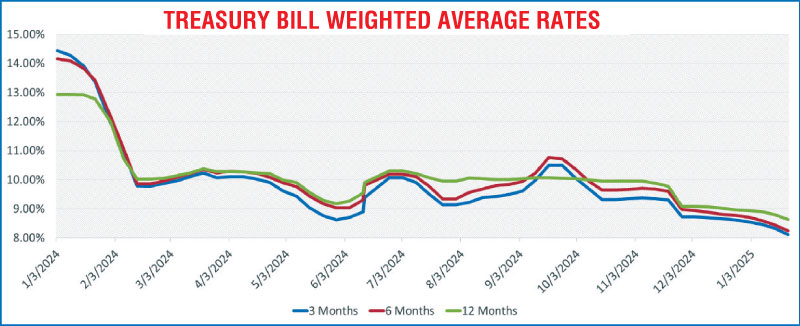

The positive movement was observed even at the weekly Treasury bill auction conducted last Wednesday (22/01/2025), where weighted average rates declined across all three maturities for the seventh consecutive week. As such rates were seen continuing on a downward trajectory, with a reduction in yields observed on at least one tenor over the last 11 weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 21 basis points to 8.12%, the 182-day tenor by 19 basis points to 8.25% and the 364-day tenor by 17 basis point to 8.63%. Total bids received exceeded the offered amount by 2.91 times, and the entire Rs 155.00 billion on offer was successfully raised at the first phase in competitive bidding. This prompted the opening of the second phase across all three tenors, which was also heavily oversubscribed. An additional amount of Rs 15.50 billion, being the maximum offered, out of a total market subscription of a staggering Rs. 189.33 billion was raised at the second phase.

Furthermore, the total outstanding money market liquidity surplus increased to Rs. 124.99 billion as at the week ending 24 January, from Rs. 111.30 billion recorded the previous week.

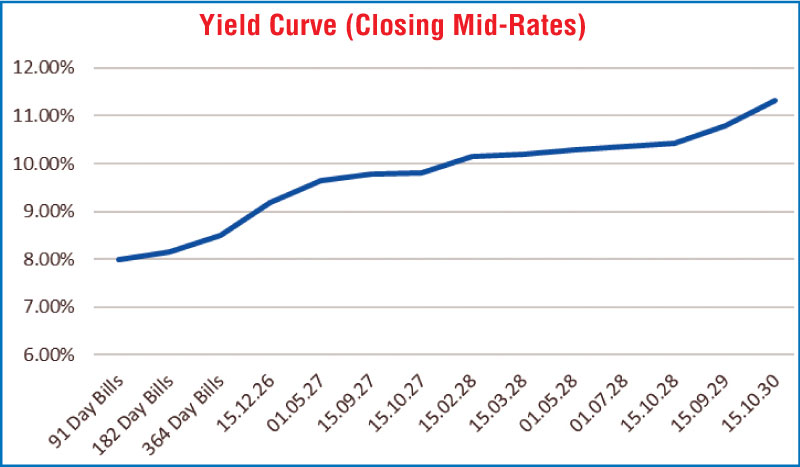

The secondary Bonds market witnessed mixed momentum during the week ending 24 January, with yields fluctuating marginally but remaining largely range-bound by the end of the period. The market started off the week slow with yields initially edging up. However, activity subsequently picked up and saw a recovery midweek, reflecting the bullish outcome at the weekly Treasury bills auction. As a result, by the end of the week, yields closed broadly steady. Overall transaction volumes and activity were seen at healthy levels.

The notable exception continued to be the 2026 tenors that bucked the trend and saw yields consistently decline during the week with the 15.12.26 maturity seen moving down the ranges of intraweek highs to lows of 9.22%-9.15% respectively.

The 15.03.28, 01.05.28 and 15.10.28 maturities were seen trading at the rates of 10.21%-10.15%, 10.33%-10.27% and 10.42% respectively. The 15.09.29 maturity was seen trading within the range of 10.85%-10.75%. The 15.10.30 maturity was seen changing hands at the rates 11.30%-11.37%, as it was seen edging up in relation to the rest of the yield curve.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 21.83 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank injected liquidity during the week by way of a seven-day term reverse repo auction at a weighted average rate of 8.10%. The weighted average interest rates on call money and repo were recorded at 8.00% and 8.02%-8.06% respectively. The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,511.92 billion as at 24 January 2025, unchanged from the previous week’s closing level.

Forex Market

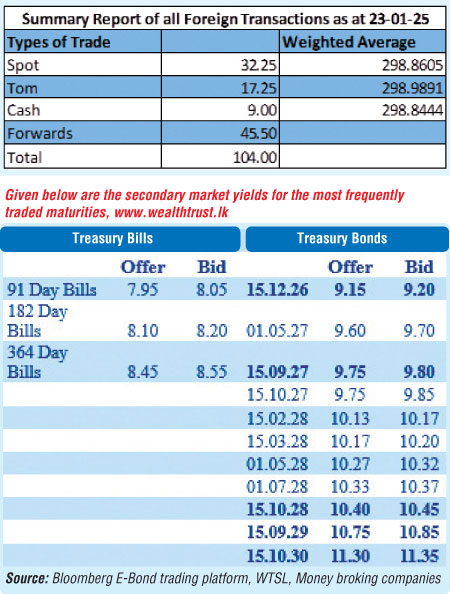

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating, to close the week at Rs.298.15/298.40 as against its previous week’s closing level of Rs. 296.40/296.60 and subsequent to trading at a high of Rs. 296.75 and a low of Rs. 299.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 73.36 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)