Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 18 June 2024 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

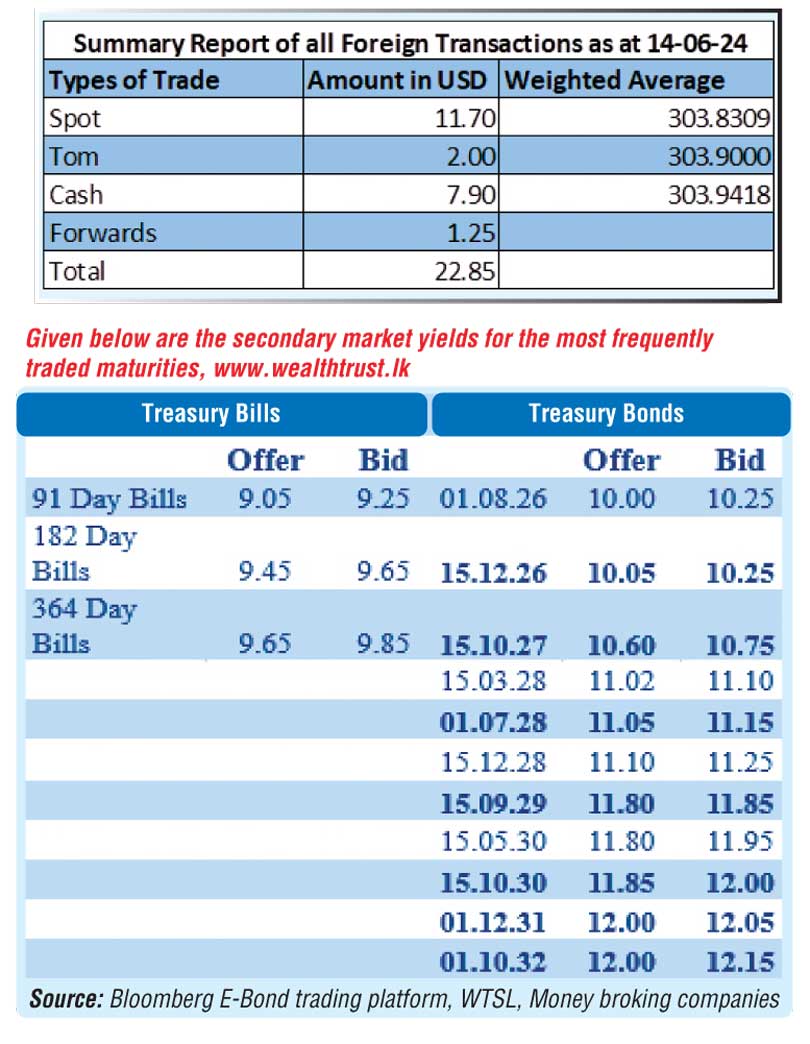

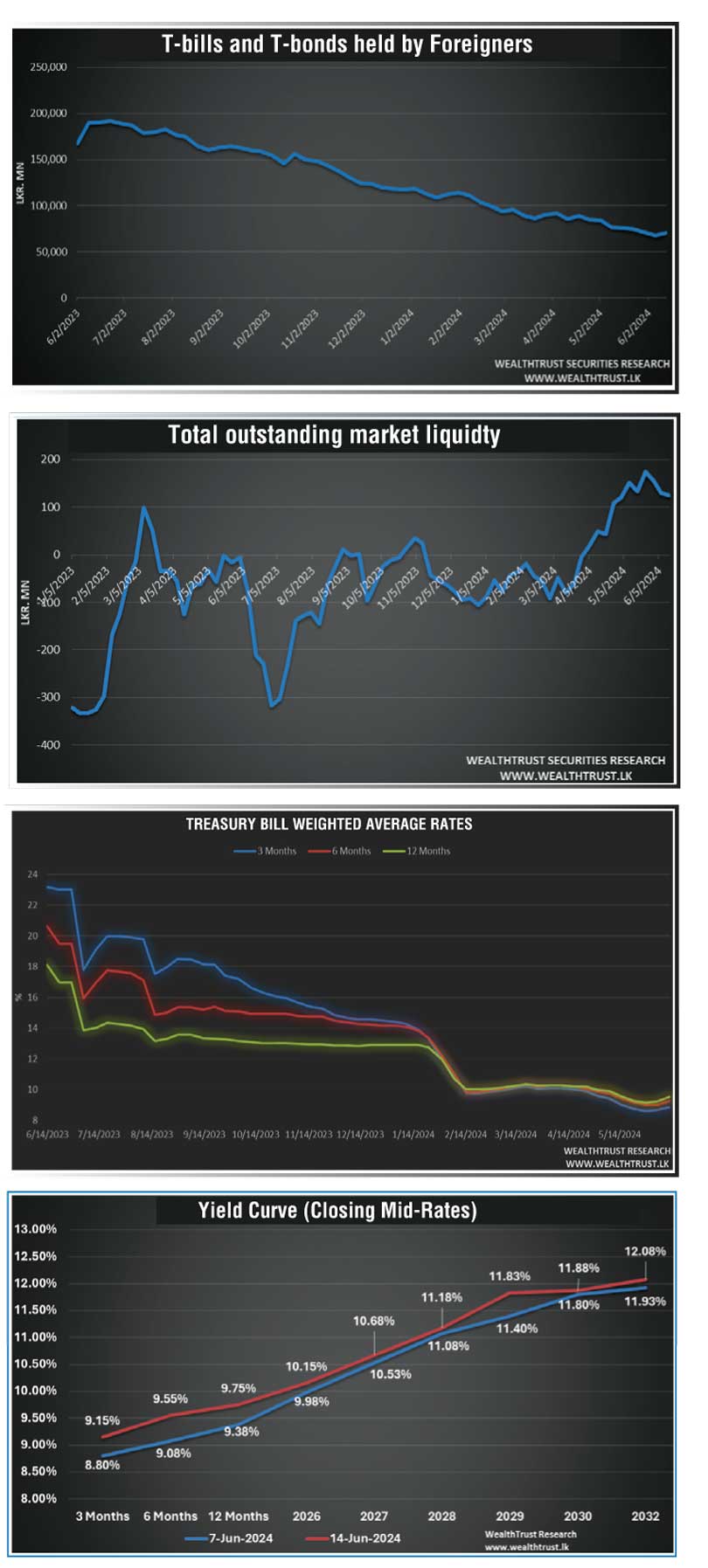

The foreign holding in Rupee Treasuries recorded an increase for the first time in eight weeks with an inflow of Rs. 2.88 billion for the week ending 13 June 2024. As a result, the overall holding was registered at Rs. 70.71 billion.

Meanwhile, the primary Treasury bill and bond auctions conducted during the week produced impressive outcomes as the auctions were fully subscribed while continued demand led to additional amounts been taken up at its phase II and direct issuance window as well.

At the largest Treasury bond auction in Sri Lanka’s history, the entire offered amount of a colossal Rs. 295 billion was raised at the 1st phase, in competitive bidding. The 15.10.27 recorded a weighted average of 10.69% in line with its pre-auction secondary market yield while the 15.09.29 and 01.12.31 recorded weighted averages of 11.78% and 12.03%, above its pre-auction rates of 11.40/60 and 11.85/12.00 respectively. At the weekly Treasury bill auction, the weighted average rates on all three maturities increased to 8.89%, 9.30% and 9.54% respectively on the 91-day, 182-day and 364-day maturities while the total offered amount of Rs. 215 billion was fully subscribed once again.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,615.62 billion as at 14 June 2024, unchanged from the previous week’s level.

The secondary bond market initially started off the week ending 14 June 2024 on a dull note, with market participants adopting a wait-and-see approach ahead of the large back-to-back auctions and the IMF second review of Sri Lanka’s EFF program. Accordingly, yields were seen moving up on the back of moderate activity, ahead of and after the Treasury bill auction. However, upon the release of the news that the IMF Executive Board completed the 2024 Article IV consultation and second review under the 48-month Extended Fund Facility with Sri Lanka, granting immediate access to SDR 254 million (approximately $ 336 million), the market turned bullish with a sizable recovery in yields ahead of the Treasury bond auction. Subsequent to the release of the Treasury bond auction results, trading was observed shifting to the auction maturities with yields edging down on those tenors intraday as well. Trading as usual centred on 2025-2032 tenors.

Prior to the announcement of the IMF news the 15.12.26 maturity was seen hitting an intraweek high of 10.15% as against an intraweek low of 10.05%. The other 2026 tenors followed suit with the 01.08.26 tenor hitting an intraweek high of 10.25% as against a low of 9.95%. Similarly, the 01.05.28 and 01.09.28 maturities were seen hitting intraweek highs of 11.20% and 11.25% respectively. However, after the news broke, 2028 tenors were seen recovering to 11.00% levels. The positive sentiment continued after the release of the bond auction results as well with the 15.09.29 auction bond trading down to an intraweek low of 11.78% as against an intraweek high of 11.90%. Additionally, the 15.10.27 and 01.12.31 maturities were seen changing hands at 10.70% and 12.00% respectively as well. In money markets, the Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repo at the rate of 8.56% to 9.01% while the total outstanding liquidity surplus reduced marginally to Rs. 123.93 billion by the week ending 14 June from its previous week’s surplus of Rs. 130.55 billion. The weighted average interest rate on call money and repo ranged between 8.67% to 8.70% and 8.69% to 8.83% respectively.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 59.17 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs. 304.00/304.15. This is as against its previous week’s closing level of Rs. 302.70/302.80 and subsequent to trading at a high of Rs. 302.90 and a low of Rs. 304.10.

The daily USD/LKR average traded volume for the first four trading days of the week stood at

$ 34.39 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)