Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 28 January 2019 01:47 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

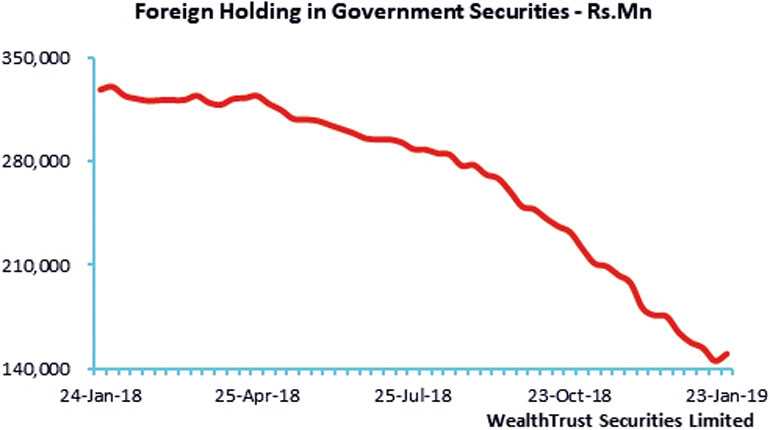

The foreign holding in rupee bonds was seen increasing for the first time in 21 weeks to record an inflow of Rs. 4.7 billion for the week ending 23 January, reversing an outflow of Rs. 132 billion witnessed over the previous 20 weeks.

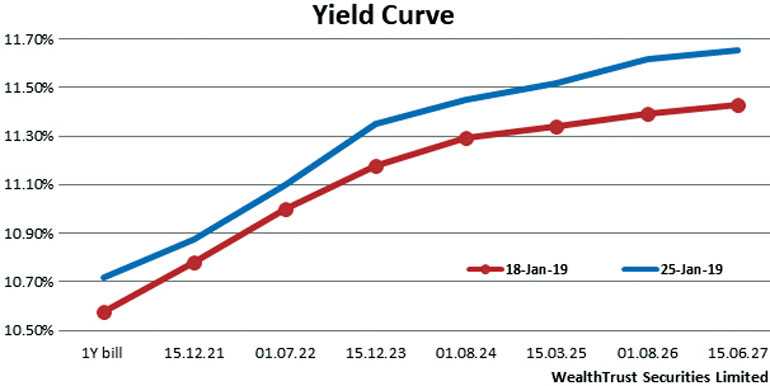

Nevertheless, the secondary market bond yields increased during the week ending 25 January, driven by selling interest from local market participants.

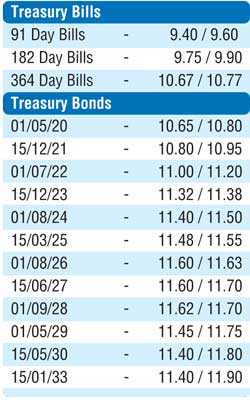

The liquid maturities of 15.12.23, 15.03.25, two 2026s (01.06.26 and 01.08.26) and 01.09.28 saw its yields increase to weekly highs of 11.37%, 11.53%, 11.50%, 11.60% and 11.67% respectively towards the end of the week against its previous weeks closing levels of 11.16/19, 11/30/37, 11.38/42, 11.35/38 and 11.42/48.

This was despite the 364 day bill weighted average at the weekly bill auction decreasing for a fifth consecutive week to 10.70%.

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 7.03 billion.

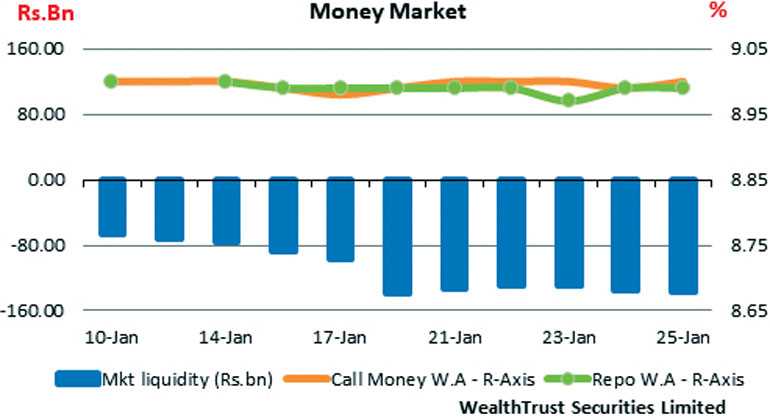

The overnight call money and repo rates averaged at 8.99% and 9.00% respectively for the week as the OMO (Open Market Operation) Department of Central Bank continued to inject liquidity during the week on an overnight basis at weighted average of 9.00%.

The overnight call money and repo rates averaged at 8.99% and 9.00% respectively for the week as the OMO (Open Market Operation) Department of Central Bank continued to inject liquidity during the week on an overnight basis at weighted average of 9.00%.

The liquidity was also infused by way of auctions for outright purchase of Treasury bills, where an amount of Rs. 6 billion was injected in total at weighted average yields ranging from 9.50% to 9.65% for periods of 115 to 129 days.

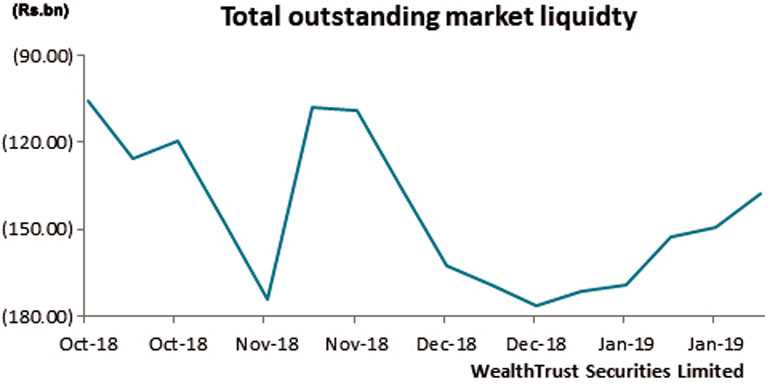

The average net overnight liquidity shortfall in the system stood at Rs. 133.12 billion for the week while the total outstanding market liquidity shortfall improved further to Rs. 137.74 billion.

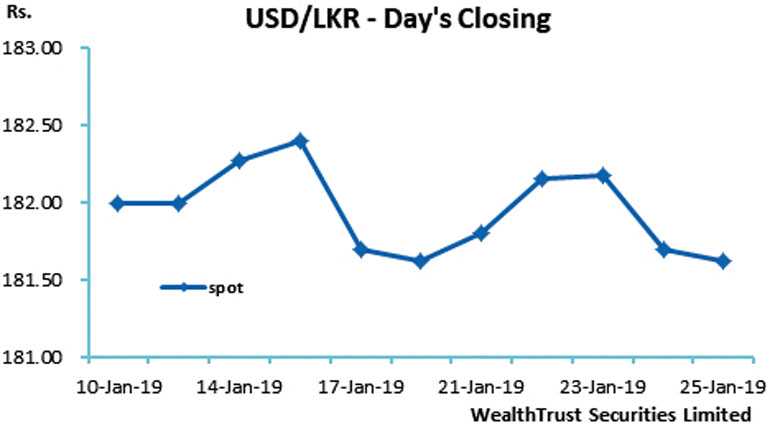

Rupee closes mostly unchanged

The USD/LKR rate on spot contracts depreciated during the early part of the week to a low of Rs. 182.36 against its previous weeks closing levels of Rs. 181.60/65 due to importer demand. However, it was seen appreciating once again towards the later part of the week to close the week at levels of Rs. 181.60/65 on the back of selling interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 92.08 million.

Some of the forward dollar rates that prevailed in the market were one month – 182.65/75; three months – 184.45/75; and six months – 187.45/75.