Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 24 July 2024 00:20 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The highly anticipated Fourth Monetary Policy Review announcement for the year 2024 is due at 7:30 a.m. today (24 July).

The highly anticipated Fourth Monetary Policy Review announcement for the year 2024 is due at 7:30 a.m. today (24 July).

For context, at the previous meeting on 28 May, the Central Bank of Sri Lanka (CBSL) maintained the Standing Deposit Facility Rate (SDFR) at 8.50% and the Standing Lending Facility Rate (SLFR) at 9.50%. As such, the CBSL was seen taking a pause on its monetary easing cycle, which has seen a cumulative reduction of 700 basis points since June 2023.

This announcement will be followed by today’s weekly Treasury bill auction, where a total amount of Rs. 160 billion is on offer, an increase of Rs. 50 billion over its previous week. This will consist of Rs. 45 billion each on the 91-day and 182-day maturities and Rs. 70 billion on the 364-day maturity.

For context, last Wednesday’s Treasury bill auction saw full subscription of the Rs. 110 billion offered, with bids exceeding the offer by 2.8 times. This marked the second consecutive week of declining weighted average rates, with a notable decrease last week. The 91-day yield dropped by 36 basis points to 9.55%, the 182-day fell by 32 basis points to 9.78%, and the 364-day decreased by 14 basis points to 10.07%. An additional Rs. 11 billion, the maximum amount on offer, was raised at the second phase.

The secondary bond market yesterday exhibited mixed sentiment as yields decreased during the early part of the day on the back of renewed buying interest, and thereafter increased towards the latter part of the day backed by fresh selling interest.

Interestingly, the short tenor 01.06.25 saw significant demand as its yield was seen decreasing to an intraday low 10.00% against its opening high of 10.15%. The 01.06.26 maturity was seen transacting at a low of 10.30% as well. However, the yield on the 01.05.28 and 01.07.28 maturities were seen hitting intraday highs of 11.85% each towards the latter part of the day against its opening lows of 11.80% each. The 15.02.28, 15.03.28, and 15.09.29 maturities were witnessed trading at the rates of 11.80%, 11.75%, and 12.05% respectively.

Meanwhile, the secondary Treasury bill market continued to see strong buying interest ahead of the upcoming T-bill auction, with sizeable volumes transacted. Accordingly, October/November 2024 (close to three months) maturities were seen at the rate of 9.30%. Meanwhile, January 2024 maturities (close to six months) changed hands at the level of 9.50% and June/July maturities (close to one year) were seen trading within the range of 9.95% to 9.88%.

The total secondary market Treasury bond/bill transacted volume for 22 July was Rs. 9.65 billion.

In money markets, the weighted average rate on overnight call money was at 8.76% and repo was at 8.89%.

The net liquidity surplus stood at Rs. 52.63 billion yesterday as an amount of Rs. 125.13 billion was deposited at the Central Bank’s SDFR of 8.50% as against an amount of Rs. 2.50 billion withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate).

The DOD (Domestic Operations Department) of the CBSL injected liquidity by way of an overnight and seven-day term reverse repo auction for Rs. 20 billion and Rs. 50 billion at the weighted average rates of 8.66% and 9.03% respectively.

Forex Market

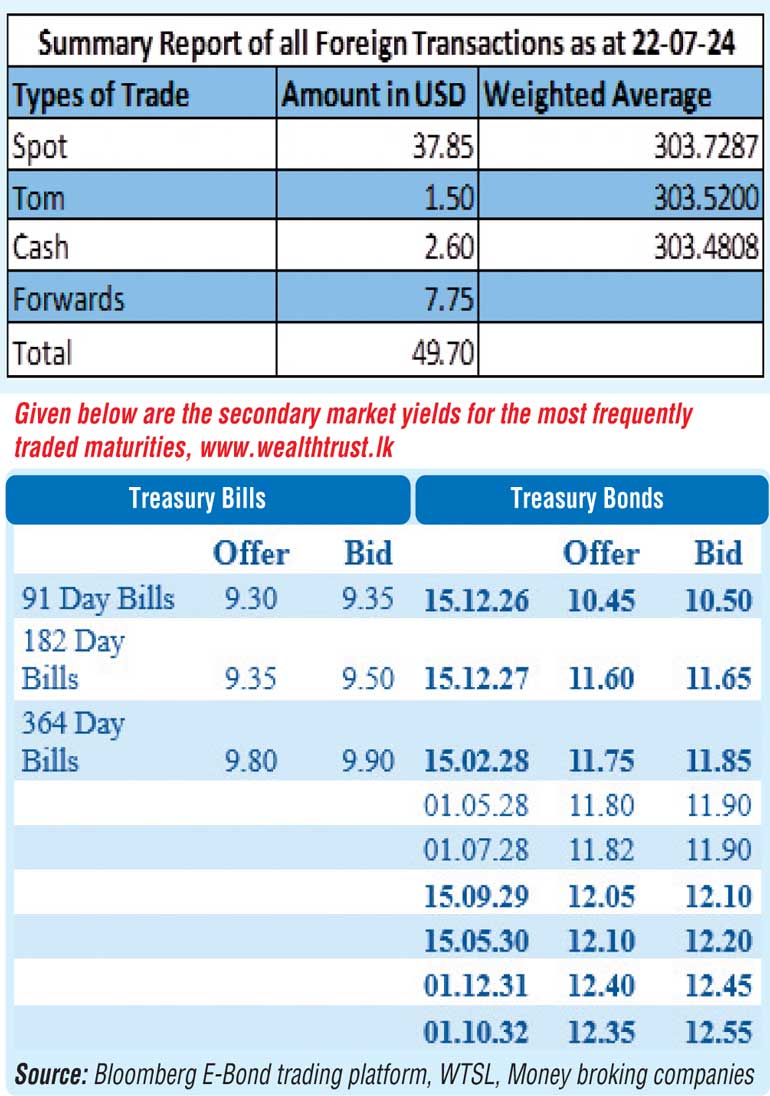

In the Forex market, the USD/LKR rate on spot contracts appreciated marginally to close trading yesterday at Rs.303.70/303.80 against its previous day’s closing level of Rs. 304.00/324.20.

The total USD/LKR traded volume for 22 July was $ 49.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)