Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 29 June 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The all-time high offered volume of Rs. 150 billion at yesterday’s bond auctions saw Rs. 142.25 billion or 94.83% in total taken up at its first and second phases of the auctioned three maturities.

The all-time high offered volume of Rs. 150 billion at yesterday’s bond auctions saw Rs. 142.25 billion or 94.83% in total taken up at its first and second phases of the auctioned three maturities.

The weighted average of the 3-year maturity of 01.06.2025 was seen leaping to 23.77% against its pre-auction rate of 21.00/25 while the 5-year maturity of 15.01.2028 recorded a weighted average of 21.18% against its pre-auction rate of 20.50/00. The newly issued 9-year maturity of 15.05.2031 fetched a weighted average of 20.74%.

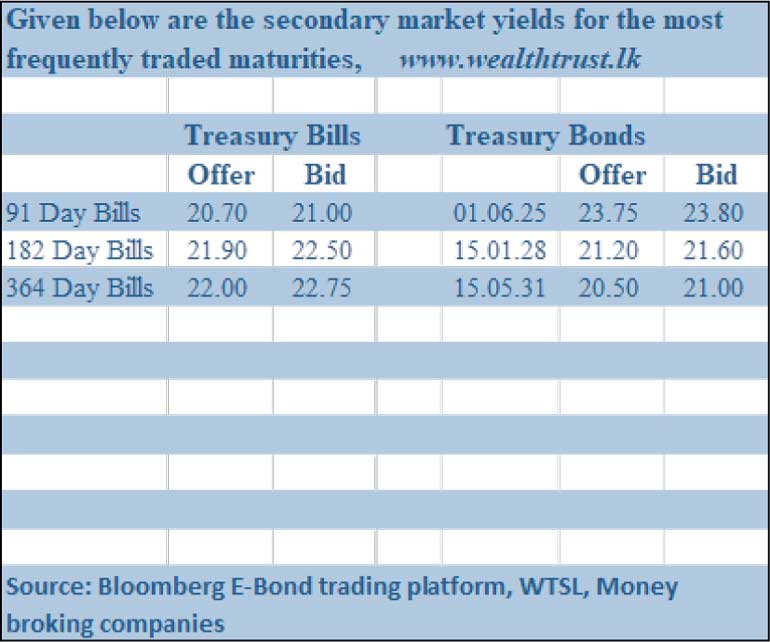

The phase 2 of the auction was opened for the 2025 maturity while a direct issuance window of 20% of the offered amount on the 2028 and 2031 maturities will be opened until close of business of the day prior to settlement (i.e. 4 p.m. on 30.06.2022). In the secondary bond market, subsequent to the release of the auction results, the auctioned maturities of 01.06.25 and 15.01.28 were seen changing hands at levels of 23.90% to 23.75% and 21.50% respectively.

Today’s bill auction will have on offer Rs. 77.5 billion, consisting of Rs. 37.5 billion on the 91 day maturity and Rs. 20 billion each on the 182 day and the 364 day maturities.

At last week’s auction, the weighted average rates on the three maturities remained steady at 20.73%, 21.90% and 22.04% respectively. However, the total accepted amount at the auctions dipped to a low of 33% of its total offered amount while a further amount of Rs. 1.21 billion was raised at its Phase II of the three maturities.

The total secondary market Treasury bond/bill transacted volume for 27 June was Rs. 4.34 billion.

In money markets, the net liquidity deficit was registered at Rs. 491.85 billion yesterday while the weighted average rates on overnight Call money and REPO stood at 14.50% each. An amount of Rs. 226.05 billion was deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 13.50% while an amount of Rs. 717.90 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 14.50%.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 60 billion by way of a 61 day Reverse Repo auction at a weighted average rate of 22.02%, valued today.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts appreciated to Rs. 359.90 yesterday against its previous day’s Rs. 360.30.

The total USD/LKR traded volume for 27 June was $ 6.90 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)