Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 10 July 2023 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The overall bill and bond yield curve witnessed a considerable downward parallel shift during the week ending 7 July reversing an upward movement witnessed over the previous week. This outcome in the secondary bond market was mainly attributed to the announced framework and parliamentary approval of the Domestic Debt Optimisation (DDO) and a sizable downward movement in weighted averages at the weekly Treasury bill auction.

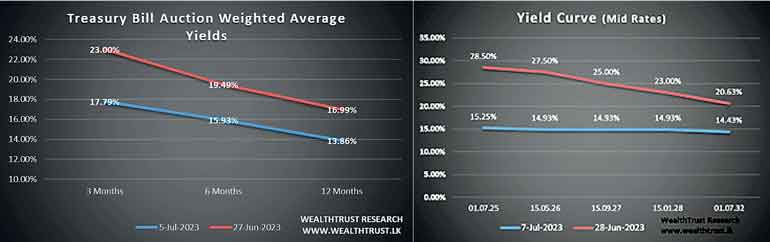

At the auction, weighted average rates decreased sharply across the board by 521, 356 and 313 basis points respectively to 17.79%, 15.93% and 13.86% on the 91-day, 182-day and 364-day maturities while the total offered amount of Rs.140 billion was fully subscribed at the 1st phase of the auction. A further amount of Rs.35 billion was raised at its phase II.

The Central Bank of Sri Lanka continued relaxing its monetary policy at its announcement on 6 July. The 200-basis points slash saw the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) fall to 11.00% and 12.00% respectively.

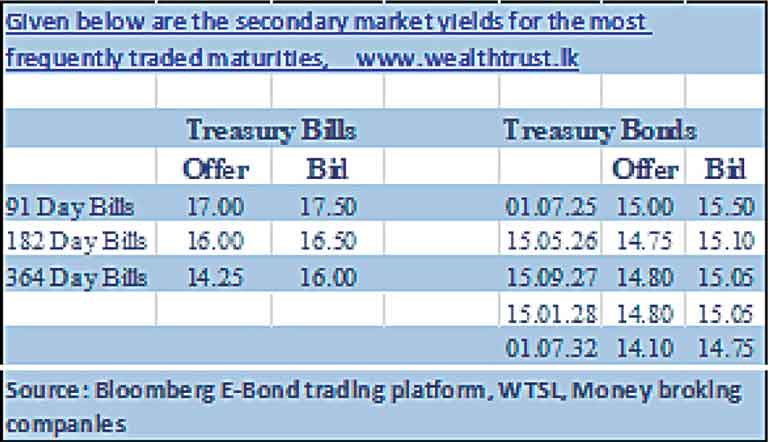

In the secondary market for bonds, the liquid maturities of 01.07.25, 15.05.26, 01.05.27, 15.09.27, 15.01.28 and 01.07.2032 hit lows of 13.75%, 14.00%, 13.75%, 13.50%, and 12.00% respectively against its previous weeks closing levels of 28.25/28.75, 27.00/28.00, 24.50/25.50 each, 22.00/24.00 and 20.25/21.00. However, profit taking saw yields edge up once again to weekly highs of 15.45%, 15.15%, 15.00%, 15.25%, 15.01% and 14.70 respectively on the said maturities. The significant downward movement in yields saw it hit levels last seen in March 2022.

Foreign holding in LKR bonds was seen reducing for the second consecutive week to record an outflow of Rs.1.85 billion for the week ending 6 July.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs.56.74 billion.

In money markets, the base rate change led to a drop in overnight call money and repo rates to 11.94% and 12.00% respectively for the last two trading days of the week against its 13.82% and 13.97% for the first two days of the week.

The total outstanding liquidity deficit decreased to Rs. 303.44 billion by the end of the week against its previous week’s deficit of Rs.317.65 billion while the Central Bank of Sri Lanka’s (CBSL) holding of Gov. Security’s increased to Rs.2,542.76 billion against its previous weeks of Rs.2,456.56 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse repo auctions.

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week at Rs.312.00/313.00 against its previous week›s closing level of Rs.306.50/308.00.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 74.37 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)