Sunday Apr 20, 2025

Sunday Apr 20, 2025

Monday, 20 December 2021 05:30 - - {{hitsCtrl.values.hits}}

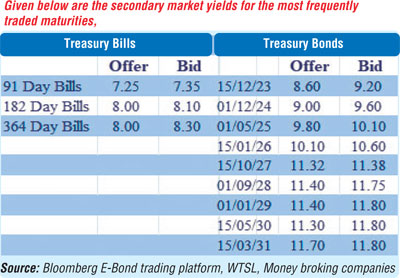

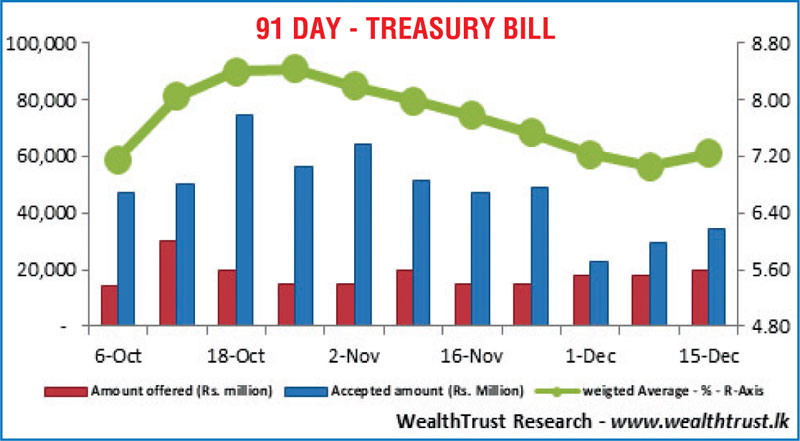

The secondary bond market yields increased while activity moderated during the week ending 17 December, mainly due to the rise in weighted average rates of the 91-day and 182-day maturities for the first time six weeks at its weekly Treasury bill auction.

The secondary bond market yields increased while activity moderated during the week ending 17 December, mainly due to the rise in weighted average rates of the 91-day and 182-day maturities for the first time six weeks at its weekly Treasury bill auction.

Furthermore, at the start of the week, the outcome of the Treasury bond auctions saw its weighted averages come in higher than its pre-auction secondary market rate.

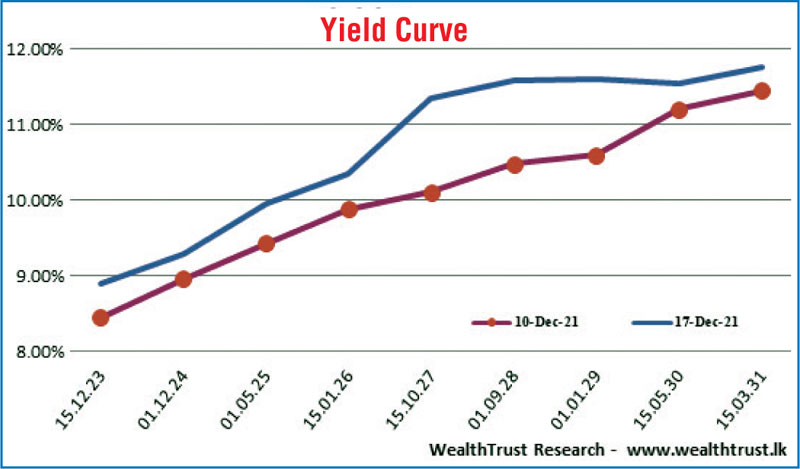

The overall yield curve witnessed a shift upward with yields on the maturities of 15.03.25 and 15.10.27 increasing to intraweek highs of 9.70% and 11.36% respectively against its weekly lows of 9.40% and 11.10%. In addition, maturities of 01.01.29 and 15.03.31 traded at levels of 11.30% and 11.60% to 11.66% respectively as well.

In secondary bills, December 2021 to February 2022 maturities changed hands at levels of 6.75% to 7.15%. The foreign holding in rupee bonds remained mostly unchanged at Rs. 1.75 billion for the week ending 15 December, while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 25.62 billion.

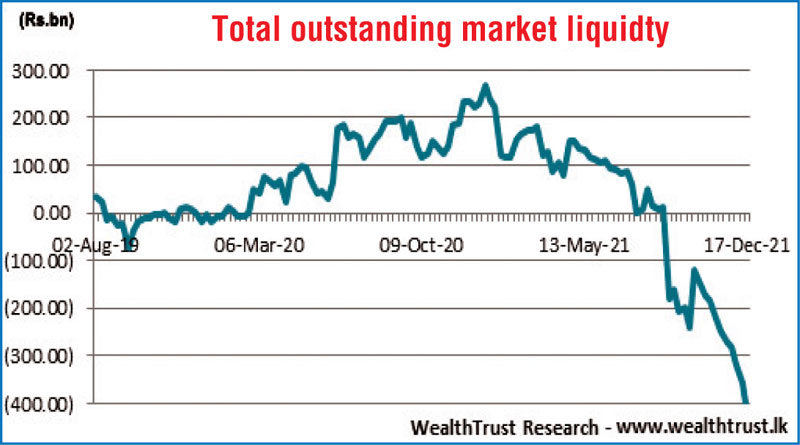

In money markets, a historically high volume of Rs. 429.08 billion was accessed from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6% during the week while the total outstanding liquidity deficit continued its increasing trend to hit Rs. 421.67 billion by the end of the week against its previous week’s Rs. 358.89 billion.

The weighted average rates on call money and repo remained mostly unchanged at 5.92% and 5.98% respectively for the week.

In this backdrop, the Domestic Operations Department (DOD) of Central Bank was seen draining out liquidity during the week by way of overnight to seven-day repo auctions at weighted average yields ranging from 5.98% to 5.99%, while an average of Rs. 69.25 billion was deposited throughout the week at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 5%. However, no bids were received for the Rs. 10 billion outright sale of Treasury bills for durations of 70 days to 105 days.

The CBSL’s holding of Gov. Securities was registered at Rs. 1,372.55 billion against the previous week’s Rs. 1,392.38 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at levels of Rs. 202.80 to Rs.203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 42.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.