Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 7 February 2022 00:00 - - {{hitsCtrl.values.hits}}

The general insurance (GI) industry plays a pivotal role in driving financial and economic growth both locally and globally. Over the past year, with the continuing economic volatility, companies paid more heed to reducing the risks of uncertainty and enormous losses. While the GI sector is instrumental in reducing such risk, it simultaneously encourages companies to take on new investment and innovation opportunities, thereby resulting in healthy market competition as well as sustenance of communities.

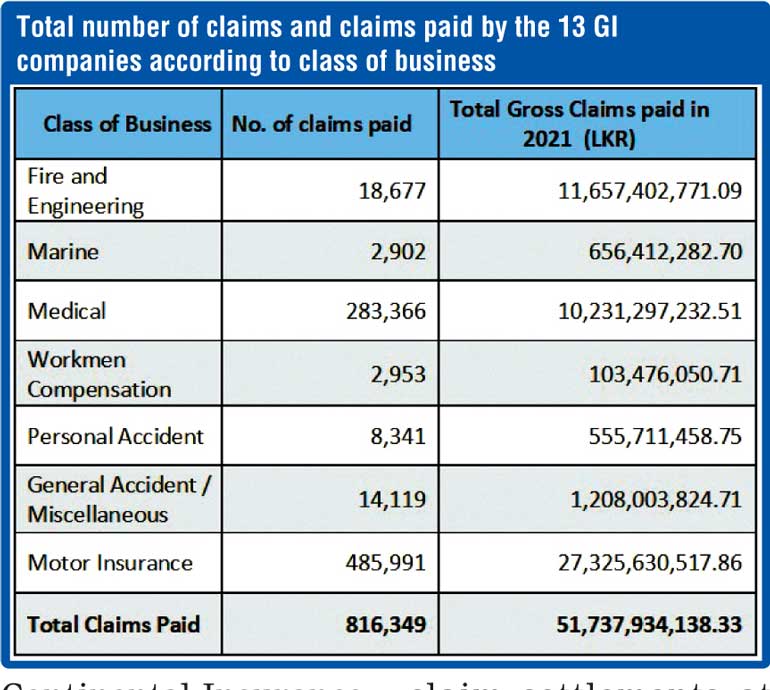

In Sri Lanka, the GI claim settlements of 13 insurance companies falling under the purview of the Insurance Association of Sri Lanka (IASL) stood at over Rs. 51 billion for the financial year (FY) 2021, where a total of 816,349 claims were settled during the same period.

Accordingly, the 13 general insurance companies are Sanasa General Insurance Company Ltd., People’s Insurance PLC, Fairfirst Insurance Ltd., Ceylinco General Insurance Ltd., HNB General Insurance Ltd., Co-operative Insurance Company Ltd., MBSL Insurance Company Ltd., Amana Takaful PLC, LOLC General Insurance Ltd., Sri Lanka Insurance Corporation Ltd., Orient Insurance Ltd., Allianz Insurance Lanka Ltd., and Continental Insurance Lanka Ltd.

These GI claim settlements were made across seven classes of business – namely, fire and engineering, marine, medical, workmen compensation, personal accident, general accident/miscellaneous, and motor insurance. Out of this, the category of motor insurance recorded the highest amount of claim settlements at over Rs. 27 billion. The total claims paid stood at Rs. 51,737,934,138.33.

IASL President Iftikar Ahamed said: “The general insurance industry has coped and performed exceptionally well despite a challenging economy. Claim settlement has been crucial especially due to the pandemic and subsequent hardships faced by people, where the insurance sector has stood with their policyholders, and the customer-centric attitude adopted by these general insurance companies has played a vital role in quick claim disbursement and strengthened relationships.”

Established in 1989, IASL upholds general insurance best practices and represents the industry in Sri Lanka. Currently encompassing 29 registered life and general insurance companies in the country, IASL is the foremost insurance industry body in the country, whose key objectives are to promote and drive insurance growth and penetration by inculcating professionalism in the insurance industry and harmonising the overall goals and objectives of all industry participants.