Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 15 July 2020 00:00 - - {{hitsCtrl.values.hits}}

IFC, a member of the World Bank Group, will support Commercial Bank of Ceylon (ComBank), Sri Lanka’s largest commercial bank, to develop more specially-designed products and services for women, as part of a move to help boost access to finance for women, especially those who own Small- and Medium-sized Businesses (SMEs).

|

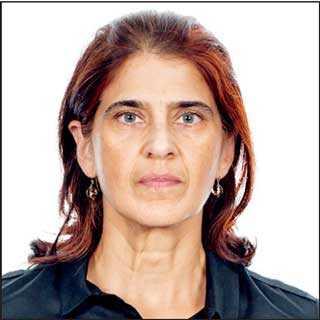

IFC Asia and Pacific Regional Director for Financial Institutions Group Rosy Khanna |

|

ComBank Managing Director/Chief Executive Officer S. Renganathan |

The advisory assistance to ComBank is part of IFC’s Banking on Women (BOW) program, which is supported by the Government of Australia under the IFC-DFAT Women in Work program.

Sri Lankan women are recognised as highly entrepreneurial, owning nearly a quarter of the micro, small and medium sized enterprises in the country. Most are micro-sized enterprises, with the number of women owned business falling drastically as the business size increases. While over 80% of women have an account at a financial institution, only 17% have borrowed money.

“Whilst the ComBank has identified the significant contribution made by female entrepreneurs to the economy of the country and has led many initiatives to improve their access to finance, we look forward to this partnership further enhancing the value propositions extended to female led businesses, broadening their horizons instead of limiting their potential,” said ComBank Managing Director/Chief Executive Officer S. Renganathan.

With a longstanding partnership since 2003, the latest IFC-ComBank engagement is aimed at help narrowing the financing gap in the country. With around one million SMEs – more than 14% of which are women-owned – small businesses are a significant engine of job creation in Sri Lanka, providing a livelihood for nearly 2.25 million people and contributing to 52% of the country’s GDP. However, over 30% of SMEs have unmet financing needs, with a financing gap estimated at $ 13.7 billion.

“This engagement becomes even more critical as the world faces an unprecedented crisis straining public health system and constraining economic activity,” said IFC Asia and the Pacific Regional Director for Financial Institutions Group Rosy Khanna.

“Therefore, it becomes even more vital that we scale up access to finance for women and women-led small and medium sized enterprises, who will bear the brunt of this ensuing liquidity crisis. As we renew our 50-year partnership in Sri Lanka this year, we also hope that this will send a strong signal to other financial institutions in the market on the significance of increased and improved access to financial services as a means of bridging a critical gap in the country.”

The move is in line with IFC’s country strategy for Sri Lanka which includes a focus on the need to deepen financial inclusion by expanding access for SMEs and women.

In June, IFC invested $100 million in ComBank – a $50 million loan as part of IFC’s $8 billion global COVID-19 fast track financing facility, and another $50 million through a private placement of new equity shares. Both investments will help ComBank sustain its operations and support the economic recovery process.