Monday Mar 09, 2026

Monday Mar 09, 2026

Tuesday, 10 March 2020 01:17 - - {{hitsCtrl.values.hits}}

Acuity Stockbrokers Research has said the impact of COVID-19 on Sri Lanka and global markets is likely to be larger than anticipated.

Following are highlights of its findings.

Pandemic worries rise as COVID-19 cases increase sharply outside China

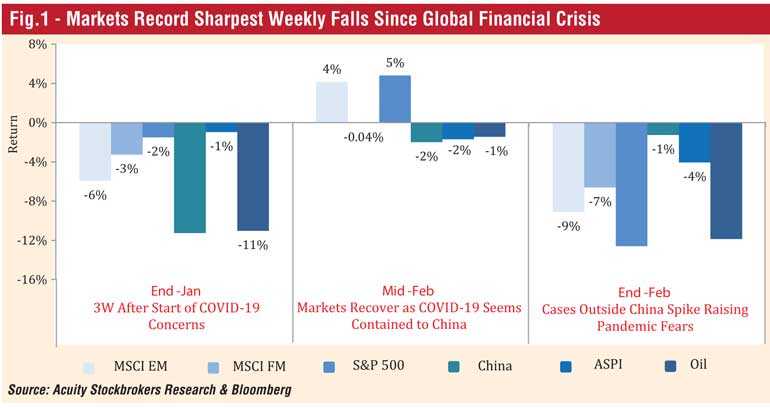

Renewed fears over COVID-19 becoming a global pandemic have wreaked havoc on global stock markets over the last two weeks.

Markets (which were previously optimistic that COVID-19 would be contained to China) have plunged as new infections outside China (particularly in South Korea, Italy and Iran) have accelerated.

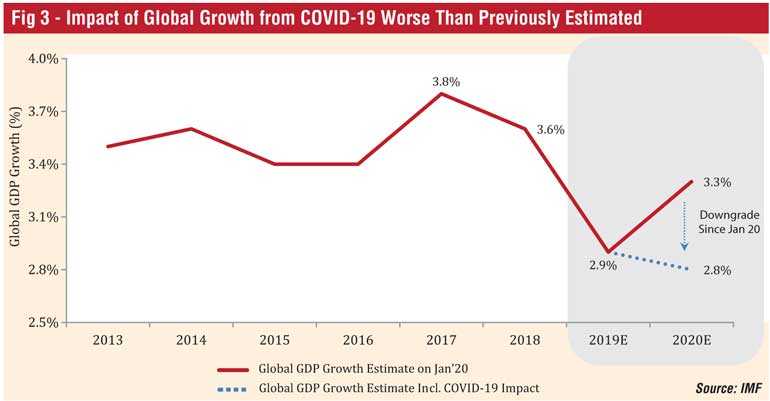

Investors fear that the rapidly spreading outbreak could slow the global economy even further and potentially result in global GDP growth recording its worst year since the Great Recession of 2009.

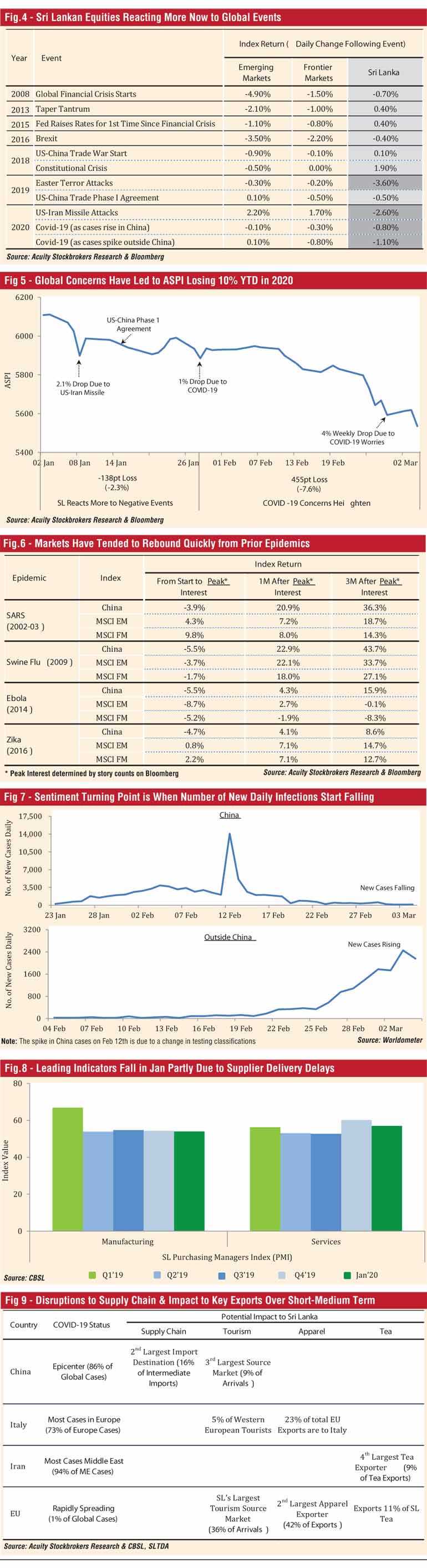

SL equities reacting more to global events

Interestingly, Sri Lankan equities (which have historically been less moved by global events) have reacted strongly to this year’s global events.

The ASPI registered its largest daily fall since the Easter terror attacks following the US-Iran missile attacks in January 2020.

The ASPI has lost 7.6% since late January when COVID-19 was spreading rapidly in China.

History shows that impact of pandemics are sharp but short-lived

Markets and Commodities have tended to rebound quickly from prior instances of epidemics. The sentiment turning point is typically when the number of daily new cases begins to decline. But will this be the case for COVID-19?

China plays a far more crucial role now in global supply chains and the global economy.

This implies that the global economic dislocations caused by the virus could be more long-lasting.

This may limit the efficacy of global central banks lowering rates to address the impact of the virus, particularly in G7 economies where rates are already low.

Potential impact on SL from COVID-19

Sentiment has already taken a hit, while tourism and supply chain disruptions have already begun to impact the Services and Industry sectors.

While it is too early to quantify the overall impact, Sri Lanka’s ties to the epidemic’s hotspots highlight the potential fallout from COVID-19.