Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 13 September 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The round of Treasury bond auctions conducted yesterday saw yields increase, reflecting the recent upward trajectory observed in the secondary market and the continual increasing trend at primary auctions. However, the results were significantly below market expectations amid the prevailing Presidential election related uncertainty. As such, the outcome showed robust resilience against headwinds the market has been facing.

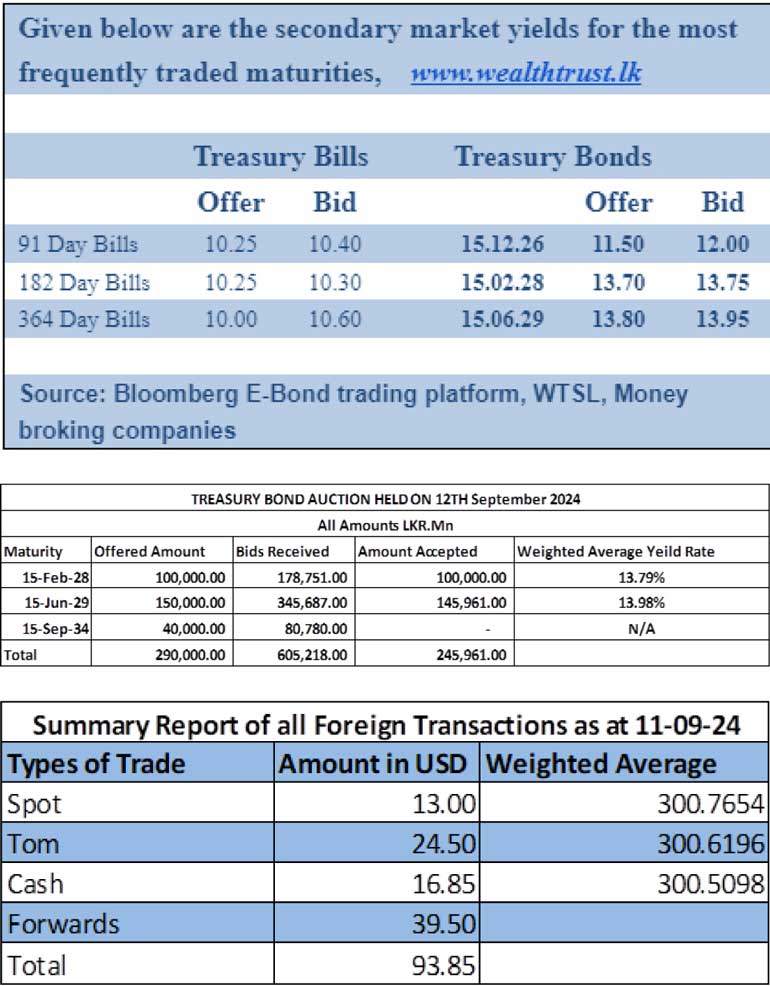

The 15.02.28 maturity was issued at the weighted average yield of 13.79% and raised the entire amount on offer. Meanwhile, the 15.06.2029 maturity bond was issued at a weighted average yield of 13.98%, however only managed to raise Rs. 145.961 billion out of the Rs. 150.00 billion offered. The relatively longer tenor 15.09.34 maturity saw all bids rejected.

In conclusion, the auction overall raised 81.81% or Rs. 245.96 billion against a total offered amount of Rs. 290.00 billion.

The Secondary bond market saw limited activity yesterday. However, following the release of the auction outcome the market saw a slight rally with yields declining below weighted average yield levels. Accordingly, The auction maturities: 15.02.28 and 15.06.29 traded down from 13.80% to 13.75% (below the weighted average) and the rate of 13.98% (showcasing market demand at the weighted average level). The total secondary market Treasury bond/bill transacted volume for 11 September was Rs. 52.06 billion.

In money markets, The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight reverse repo auctions for Rs. 20.00 billion at the weighted average rate of 8.54%. The net liquidity surplus stood at Rs. 85.51 billion yesterday as an amount of Rs. 106.62 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.25% as against an amount of Rs. 1.11 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 9.25%.

The weighted average rates on overnight call money and Repo stood at 8.56% and 8.72% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 301.50/301.70 as against its previous day’s closing level of Rs. 301.00/301.30.

The total USD/LKR traded volume for 11 September was $ 93.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)